Spinning Tops Candlestick: The Ultimate Guide To Unlocking Market Secrets

Hey there, fellow traders and market enthusiasts! Ever heard of spinning tops candlestick patterns? Yeah, I’m talking about those little wiggly lines that can tell you a whole lot about what’s happening in the markets. But don’t let their simplicity fool ya. These patterns pack a punch when it comes to revealing market sentiment and potential price movements. In this article, we’re diving deep into the world of spinning tops, breaking them down in a way that even a beginner can grasp. So, buckle up and let’s get started!

Now, you might be wondering, "What’s so special about spinning tops?" Well, my friend, these little guys are like the whisperers of the market. They don’t scream "BUY" or "SELL" like some other patterns, but they do give you a heads-up when the market is in a state of indecision. And trust me, knowing when the market’s unsure can be just as valuable as knowing when it’s confident.

Before we dive into the nitty-gritty, let’s set the stage. This article isn’t just about spinning tops; it’s about understanding how they fit into the bigger picture of technical analysis. By the end of this read, you’ll have a solid grasp of what spinning tops are, how to identify them, and most importantly, how to use them to your advantage. Let’s roll!

- Gina Wap The Queen Of Urban Rhythms And Bold Lyrics

- Jade Castrinos Meth The Untold Story You Need To Know

What Are Spinning Tops Candlestick Patterns?

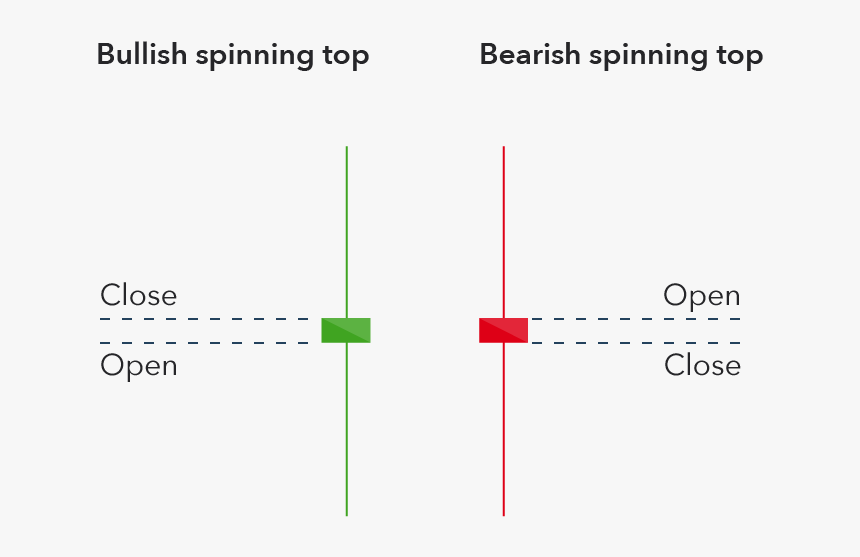

Spinning tops are these candlestick patterns that kinda look like little spinning tops, hence the name. They’ve got short bodies with long wicks or shadows, both on the top and bottom. Think of them as the market’s way of saying, "I’m not sure which way to go." These patterns usually pop up when buyers and sellers are equally matched, leading to a bit of a standoff in the market.

Here’s the deal: spinning tops can occur in any market, whether it’s stocks, forex, or cryptocurrencies. They’re like the universal language of indecision. But here’s the kicker – they don’t always mean the same thing. The context matters, big time. For instance, a spinning top after a long uptrend might suggest that the bullish momentum is losing steam, while in a downtrend, it could indicate that sellers are getting tired.

Let’s break it down further. A spinning top has four main parts: the open, high, low, and close. The body is usually small, which means the difference between the open and close prices is minimal. The long wicks show that prices moved quite a bit during the period, but they eventually closed near where they started. It’s like a tug-of-war where neither side wins.

- Faith Ordway Nude A Comprehensive And Respectful Discussion

- Rachel Pizzolato Onlyfans The Ultimate Guide To Her Rise Content And Impact

How to Identify Spinning Tops

Alright, let’s get practical. Identifying spinning tops isn’t rocket science, but it does require a keen eye. Here’s what you’re looking for:

- A small real body – this means the difference between the open and close is tiny.

- Long upper and lower wicks – these indicate that prices moved significantly in both directions during the period.

- No clear direction – the open and close are close together, showing that neither buyers nor sellers had a dominant influence.

Now, here’s a pro tip: always check the context. A spinning top in isolation doesn’t mean much. But when you see it after a strong trend, it can signal a potential reversal or consolidation. It’s like reading a book – you gotta understand the chapter it’s in to get the full story.

Why Are Spinning Tops Important in Trading?

Let’s talk about why spinning tops matter. In the world of trading, indecision can be just as powerful as certainty. When the market’s unsure, it often leads to big moves one way or the other. Spinning tops act as warning signs, telling you to buckle up because something might be about to happen.

For instance, imagine you’re trading a stock that’s been on a steady uptrend for weeks. Suddenly, you see a spinning top. This could mean that the buyers are losing steam, and the sellers might be getting ready to take over. Or, in a downtrend, it could signal that the sellers are exhausted, and a potential rally is on the horizon. Either way, spinning tops are like little market detectives, giving you clues about what’s brewing beneath the surface.

Spinning Tops Candlestick: The Psychology Behind It

Now, let’s dive into the psychology of spinning tops. Markets are driven by human emotions, and spinning tops are a reflection of that. When you see a spinning top, it means that during that period, buyers and sellers were equally matched. Neither side could gain the upper hand, leading to a stalemate.

Think about it like a game of chess. Both players make their moves, but neither can checkmate the other. In the market, this often leads to a period of consolidation, where prices move sideways as traders wait for new information or catalysts to break the deadlock. And when that happens, you better believe it’s going to be a big move!

Spinning Tops vs. Doji: What’s the Difference?

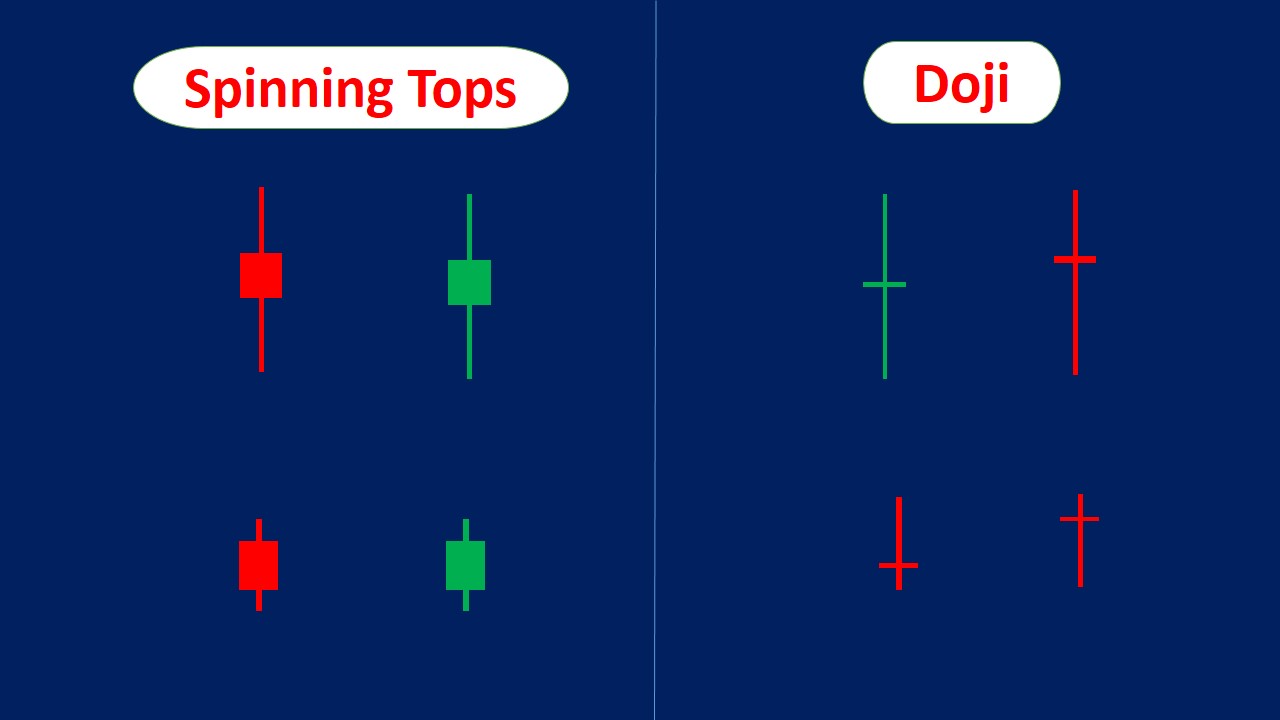

A lot of traders confuse spinning tops with doji patterns. While they both indicate indecision, there’s a key difference. A doji has an even smaller body, often with the open and close prices being exactly the same or very close. Spinning tops, on the other hand, have slightly larger bodies, showing that there was some movement, but not enough to make a decisive move.

Here’s a quick comparison:

- Doji: Extremely small body, often with equal open and close prices.

- Spinning Tops: Small body, but with more movement during the period.

So, while both patterns indicate indecision, spinning tops suggest a bit more activity in the market. It’s like the difference between a whisper and a quiet conversation – both are soft, but one’s got a little more going on.

Understanding Market Context with Spinning Tops

Alright, here’s where things get interesting. Spinning tops don’t exist in a vacuum. Their meaning changes depending on the market context. Let’s break it down:

Spinning Tops in an Uptrend

When you see a spinning top after a strong uptrend, it might be a sign that the bullish momentum is weakening. Buyers are still trying to push prices higher, but sellers are putting up a fight. This could lead to a reversal or a period of consolidation. It’s like a runner who’s been sprinting for miles – they might need a breather before continuing.

Spinning Tops in a Downtrend

On the flip side, a spinning top in a downtrend could mean that the sellers are getting tired. Buyers might be stepping in, trying to push prices higher. This could signal a potential reversal or a pause in the downtrend. It’s like a seesaw that’s been tilted one way for too long – eventually, it’s gonna level out or tip the other way.

Spinning Tops Candlestick: Real-World Examples

Talking about spinning tops is one thing, but seeing them in action is another. Let’s look at a couple of real-world examples to see how these patterns play out in the market.

Example 1: Apple Inc. Stock

In 2022, Apple Inc. (AAPL) saw a spinning top after a strong uptrend. The stock had been climbing steadily for weeks, but then a spinning top appeared. Over the next few days, the stock consolidated, and eventually, it broke lower, signaling a potential reversal. Traders who spotted that spinning top were able to adjust their positions accordingly.

Example 2: Bitcoin

Bitcoin is notorious for its volatility, and spinning tops can be especially useful in this market. In 2021, Bitcoin saw a spinning top after a sharp decline. This pattern suggested that sellers were losing steam, and sure enough, the price rallied shortly after. Traders who recognized the spinning top were able to capitalize on the potential reversal.

How to Trade Spinning Tops Candlestick Patterns

Alright, now that you know what spinning tops are and how they work, let’s talk about how to trade them. Here’s a step-by-step guide:

- Identify the spinning top: Look for a small body with long wicks.

- Check the context: Is it in an uptrend, downtrend, or consolidation?

- Wait for confirmation: Spinning tops are indecision patterns, so you’ll need additional signals to confirm the direction.

- Set your entry and exit points: Once you have confirmation, set your stops and limits accordingly.

Here’s the thing: spinning tops are just one piece of the puzzle. They’re not a guaranteed buy or sell signal, but they can be a valuable indicator when combined with other tools like moving averages, RSI, or support and resistance levels.

Spinning Tops Candlestick: Common Mistakes to Avoid

Even the best traders make mistakes, and spinning tops can be tricky. Here are some common errors to avoid:

- Taking action too soon: Spinning tops are indecision patterns, so jumping the gun can lead to losses.

- Ignoring context: Always consider the bigger picture. A spinning top in isolation means nothing.

- Overtrading: Don’t trade every spinning top you see. Wait for the right setup and confirmation.

Remember, trading is a marathon, not a sprint. Patience and discipline are key to success.

Spinning Tops Candlestick: Advanced Strategies

For those of you who want to take your spinning tops game to the next level, here are some advanced strategies:

Combining with Fibonacci Retracements

Fibonacci retracements can be a powerful tool when used with spinning tops. For example, if you see a spinning top near a Fibonacci level, it could indicate a potential reversal or consolidation. This combination can give you a higher probability of success.

Using Volume Analysis

Volume is another key factor to consider. If a spinning top occurs on low volume, it might just be noise. But if it happens on high volume, it could be a sign of a significant shift in market sentiment.

Conclusion: Mastering Spinning Tops Candlestick Patterns

And there you have it, folks! Spinning tops might seem simple at first glance, but they’re packed with insights about market sentiment and potential price movements. By understanding what they are, how to identify them, and how to trade them, you can add a powerful tool to your trading arsenal.

Here’s a quick recap:

- Spinning tops indicate market indecision.

- They’re most effective when combined with context and other indicators.

- Always wait for confirmation before taking action.

Now, it’s your turn. Take what you’ve learned and apply it to your trading. And don’t forget to share your thoughts and experiences in the comments below. Happy trading, and may the spinning tops be ever in your favor!

Table of Contents:

- What Are Spinning Tops Candlestick Patterns?

- How to Identify Spinning Tops

- Why Are Spinning Tops Important in Trading?

- Spinning Tops vs. Doji: What’s the Difference?

- Understanding Market Context with Spinning Tops

- Spinning Tops Candlestick: Real-World Examples

- How to Trade Spinning Tops Candlestick Patterns

- Spinning Tops Candlestick: Common Mistakes to Avoid

- Spinning Tops Candlestick: Advanced Strategies

- Conclusion: Mastering Spinning Tops Candlestick Patterns

- Subhashree Sahu Xxx Debunking Myths And Exploring The Truth

- Faith Ordway Nude A Comprehensive And Respectful Discussion

Spinning top candlestick pattern. Spinning top Bullish candlestick

Spinning Tops Candlestick, HD Png Download kindpng

Spinning Top Candlestick Patterns (Strategies & Examples)