Bearish Cup And Handle: The Ultimate Trading Pattern You Need To Know

Trading can be a wild ride, and if you're diving into the world of chart patterns, you've probably heard of the bearish cup and handle. This pattern is like the holy grail for traders looking to spot potential downturns in the market. But what exactly is it? How does it work? And more importantly, how can you use it to make smarter trading decisions? Grab your favorite drink, because we're about to break it down in a way that even your grandma could understand.

Let's face it, the stock market isn't exactly predictable. Sometimes it feels like a rollercoaster with no safety bars. That's where technical analysis comes in. The bearish cup and handle is one of those chart patterns that can help you anticipate when a stock might be ready to take a nosedive. It's not just about guessing—it's about reading the signs.

Now, before we dive deep into the nitty-gritty, let's establish something important. This pattern isn't just for seasoned traders. Even if you're new to the game, understanding the bearish cup and handle can give you a leg up. So, whether you're trading stocks, forex, or cryptocurrencies, this pattern could be your secret weapon.

- Hdhub4uearth Your Ultimate Destination For Highquality Entertainment

- Marie Temara Leaked The Truth Behind The Controversy

What is Bearish Cup and Handle?

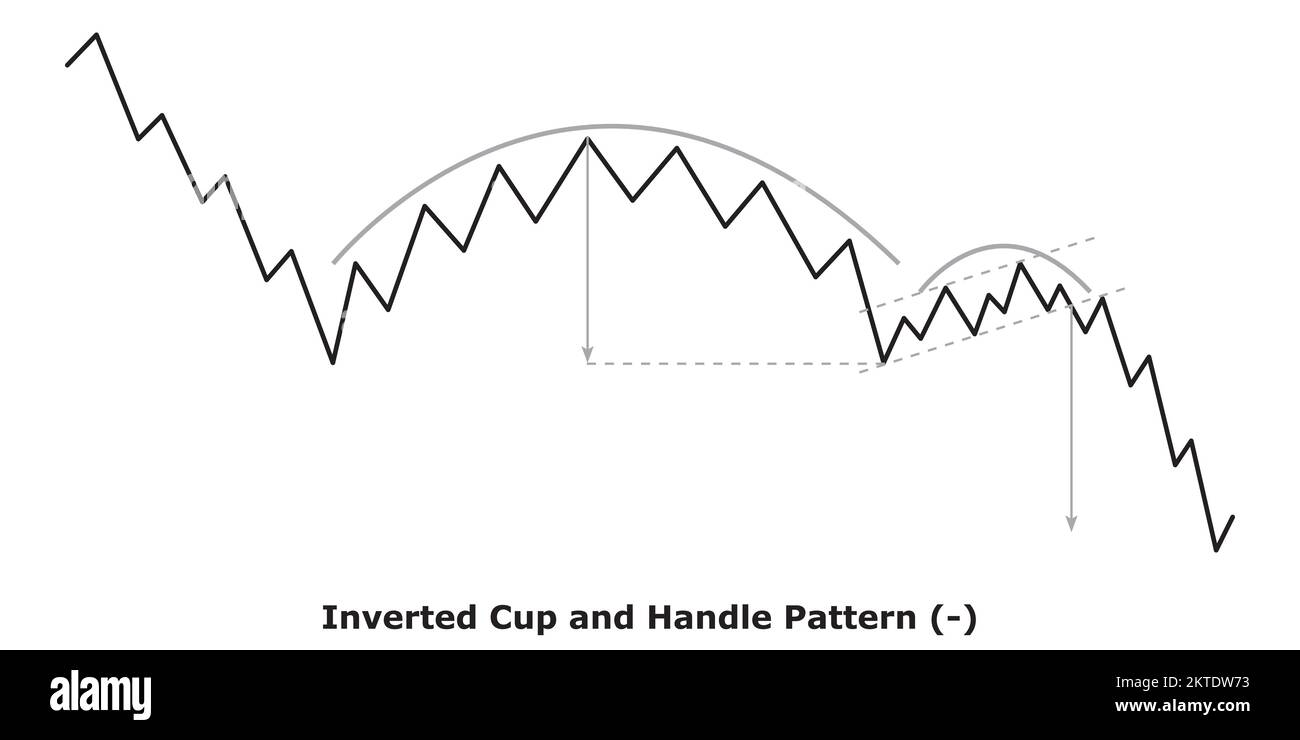

The bearish cup and handle is essentially a reversal pattern that traders use to predict when an upward trend is about to turn into a downward trend. Imagine a cup with a handle on the right side. The "cup" part is a U-shaped pattern, and the "handle" is a small pullback after the cup completes. It's like when you're holding a coffee mug, but instead of drinking coffee, you're spotting market opportunities.

This pattern usually forms after a stock or asset has been in an uptrend. It suggests that the momentum is shifting, and sellers are starting to take control. But here's the kicker—it's not just about seeing the pattern; it's about understanding what it means for your trades.

Why Should You Care About This Pattern?

Well, here's the thing: if you're trading without recognizing chart patterns, you're basically flying blind. The bearish cup and handle gives you a heads-up that the market sentiment might be changing. It's like having a weather forecast for the stock market. You can prepare for the storm before it hits.

- Hdhub4u 18 Everything You Need To Know About This Adult Content Platform

- Browse Kid And His Mom Video Original A Deep Dive Into The Phenomenon

For example, if you see this pattern forming, you might want to consider closing your long positions or even going short. It's all about staying ahead of the curve and making informed decisions. And trust me, in the world of trading, being informed can mean the difference between profit and loss.

How Does Bearish Cup and Handle Form?

Now that we've established what it is, let's talk about how it forms. The process is pretty straightforward, but it requires some patience and observation. First, you'll see an initial decline in price, followed by a consolidation period that forms the "cup." Then, there's a small pullback, which is the "handle." Finally, the price breaks below the support level, confirming the pattern.

It's important to note that the cup part should ideally be symmetrical. If it's too steep or too shallow, it might not be a reliable signal. Think of it like a perfect bowl—neither too deep nor too shallow. The handle, on the other hand, should be a smaller move, typically not exceeding 1/3 of the cup's height.

Key Characteristics of the Pattern

- Cup Shape: The U-shaped part of the pattern should be smooth and symmetrical.

- Handle: The handle is a smaller pullback that often forms after the cup is complete.

- Volume: Pay attention to trading volume. Ideally, you'll see lower volume during the formation of the cup and handle, followed by higher volume when the price breaks below the support line.

Volume is like the heartbeat of the market. If you don't see the right volume patterns, the signal might not be as strong. So, always keep an eye on it.

Why Does Bearish Cup and Handle Work?

Okay, so we know what it is and how it forms, but why does it work? The answer lies in market psychology. When a stock is in an uptrend, traders are often holding onto their positions, hoping for higher prices. But eventually, momentum slows down, and sellers start to dominate. The bearish cup and handle captures this shift in sentiment.

During the cup phase, traders who were previously bullish start to rethink their positions. Some might sell, causing the price to dip. Then, during the handle phase, there's a small rally as some traders jump back in, thinking the dip is temporary. But ultimately, the bears win out, and the price breaks below support.

Market Psychology and the Bearish Cup and Handle

Understanding market psychology is crucial. Traders are human, and humans have emotions. Fear and greed drive the market, and the bearish cup and handle is a reflection of these emotions. When traders start to panic or lose confidence, you'll see this pattern emerge.

For example, let's say a company releases disappointing earnings. Initially, traders might hold onto their positions, hoping for a rebound. But as more bad news comes out, they start to sell. The cup and handle pattern captures this transition from hope to despair.

How to Spot a Bearish Cup and Handle

Spotting this pattern isn't rocket science, but it does require some practice. Here's a quick guide to help you identify it:

- Look for an uptrend that's starting to lose momentum.

- Check for a U-shaped consolidation period, followed by a small pullback.

- Watch for a breakdown below the support line, ideally with increased volume.

Remember, not every U-shaped pattern is a bearish cup and handle. You need to confirm it with the handle and the breakdown. It's like solving a puzzle—you need all the pieces to fit.

Tools to Help You Spot the Pattern

There are plenty of tools available to help you spot this pattern. Charting platforms like TradingView, MetaTrader, and Thinkorswim all offer features that can make your life easier. You can draw trendlines, add indicators, and even set up alerts for when the pattern forms.

But here's a pro tip: don't rely solely on tools. You still need to develop your own intuition. The market is unpredictable, and no tool can replace experience and knowledge.

When Should You Trade Bearish Cup and Handle?

Timing is everything in trading, and the bearish cup and handle is no exception. Ideally, you should wait for the pattern to fully form before taking action. This means waiting for the handle to complete and the price to break below the support line.

Once the breakdown occurs, you can consider entering a short position or closing your long positions. But remember, no pattern is foolproof. Always use stop-loss orders to protect yourself from unexpected moves.

Risk Management Tips

Managing risk is crucial. Even if you spot a perfect bearish cup and handle, things can still go wrong. Here are a few tips to help you manage risk:

- Set a stop-loss just above the handle's high.

- Use position sizing to limit your exposure.

- Monitor the market closely after entering a trade.

Risk management is like wearing a seatbelt—it might not seem important until something goes wrong. Always prioritize safety over greed.

Real-World Examples of Bearish Cup and Handle

Talking about patterns is one thing, but seeing them in action is another. Let's look at a few real-world examples to see how the bearish cup and handle has played out in the past.

One classic example is Apple's stock in 2019. After a strong uptrend, the stock formed a perfect bearish cup and handle pattern. Traders who spotted it were able to short the stock just before it dropped significantly. It's a textbook example of how this pattern can be used to make profitable trades.

Lessons from Past Patterns

History doesn't always repeat itself, but it often rhymes. By studying past examples, you can learn what to look for and what to avoid. For instance, in the Apple example, volume played a crucial role. The breakdown occurred on high volume, confirming the pattern's validity.

Another lesson is that not all patterns lead to big moves. Sometimes, the market can be choppy, and the pattern might not play out as expected. That's why it's important to have a plan and stick to it.

Common Mistakes to Avoid

Even the best traders make mistakes, but you can avoid some common pitfalls by being aware of them. Here are a few mistakes to watch out for:

- Jumping the gun and entering a trade too early.

- Ignoring volume patterns and relying solely on price action.

- Not having a clear exit strategy.

Mistakes are part of the learning process, but they can be costly. Always take the time to analyze the pattern thoroughly before making any decisions.

How to Improve Your Pattern Recognition

Pattern recognition is a skill that takes time to develop. The more you practice, the better you'll get. Here are a few tips to help you improve:

- Study historical charts to see how patterns have played out in the past.

- Practice identifying patterns on demo accounts before trading live.

- Keep a trading journal to track your successes and mistakes.

Improving your pattern recognition is like sharpening a tool. The sharper it is, the better you'll be at spotting opportunities.

Conclusion: Mastering the Bearish Cup and Handle

In conclusion, the bearish cup and handle is a powerful pattern that every trader should know. It can help you anticipate downturns and make smarter trading decisions. But remember, no pattern is perfect. Always use it in conjunction with other tools and strategies.

So, what's next? Start practicing! Look for this pattern on your favorite charts and see how it plays out. And don't forget to share your experiences in the comments. The more we learn from each other, the better traders we become.

Table of Contents:

- What is Bearish Cup and Handle?

- How Does Bearish Cup and Handle Form?

- Why Does Bearish Cup and Handle Work?

- How to Spot a Bearish Cup and Handle

- When Should You Trade Bearish Cup and Handle?

- Real-World Examples of Bearish Cup and Handle

- Common Mistakes to Avoid

Happy trading, and remember—stay sharp, stay informed, and most importantly, stay safe!

- Maine Cabin Masters Death The Untold Story Behind The Tragedy

- Ullu Uncut The Hottest Buzzword In Entertainment Thats Got Everyone Talking

bearish cup and handle for by vikrampsdba7 — TradingView

Trading The Bullish & Bearish ‘Cup and Handle’ Pattern Forex Academy

Inverted Cup and Handle Pattern Bearish () White & Black Bearish