Mastering The Ichimoku Trading Strategy: Your Ultimate Guide To Trading Success

Let’s talk about Ichimoku trading strategy, a powerful tool that can transform your trading game. Whether you're a seasoned trader or just starting out, understanding this strategy can be a game-changer. Imagine having a roadmap that helps you make smarter decisions in the market – that's what Ichimoku is all about.

Now, before we dive deep, let me tell you something cool. Ichimoku isn't just another trading indicator; it's like a Swiss Army knife for traders. It combines multiple elements into one chart, giving you a holistic view of price action, trends, and support/resistance levels. This makes it an essential tool for anyone serious about trading.

So, why should you care? Because mastering the Ichimoku trading strategy can give you an edge in the market. In this guide, we’ll break it down step by step, so you can understand how it works, how to use it effectively, and how to incorporate it into your trading plan. Let’s get started!

- 5movierulz Kannada Movie Your Ultimate Guide To Streaming And Downloading

- Best Remoteiot Vpc Ssh Raspberry Pi Free Your Ultimate Guide

Understanding the Basics of Ichimoku Trading Strategy

First things first, let’s talk about the basics. The Ichimoku trading strategy was developed by a Japanese journalist named Goichi Hosoda back in the 1930s. It’s designed to provide traders with a comprehensive view of the market, making it easier to identify trends, reversals, and key levels.

One of the coolest things about Ichimoku is its ability to simplify complex market data. Instead of relying on multiple indicators, you get everything in one place. This includes:

- Tenkan Sen (Conversion Line): Shows short-term trends.

- Kijun Sen (Base Line): Represents mid-term trends.

- Senkou Span A & B: Create the cloud (Kumo), which indicates potential support and resistance.

- Chikou Span (Lagging Span): Helps confirm price action by showing where the price was 26 periods ago.

These components work together to give you a clearer picture of what’s happening in the market. It’s like having a crystal ball that predicts price movements – well, almost!

- Mila Ruby Onlyfans The Untold Story You Need To Know

- Unlock The Power Of Mydesinet Your Ultimate Travel Companion

Why Ichimoku is a Game-Changer

So, why is Ichimoku so special? Unlike other indicators that focus on a single aspect of the market, Ichimoku provides a complete picture. Here’s why it’s worth your time:

- It helps identify trends more accurately.

- It highlights key support and resistance levels.

- It provides early signals for potential reversals.

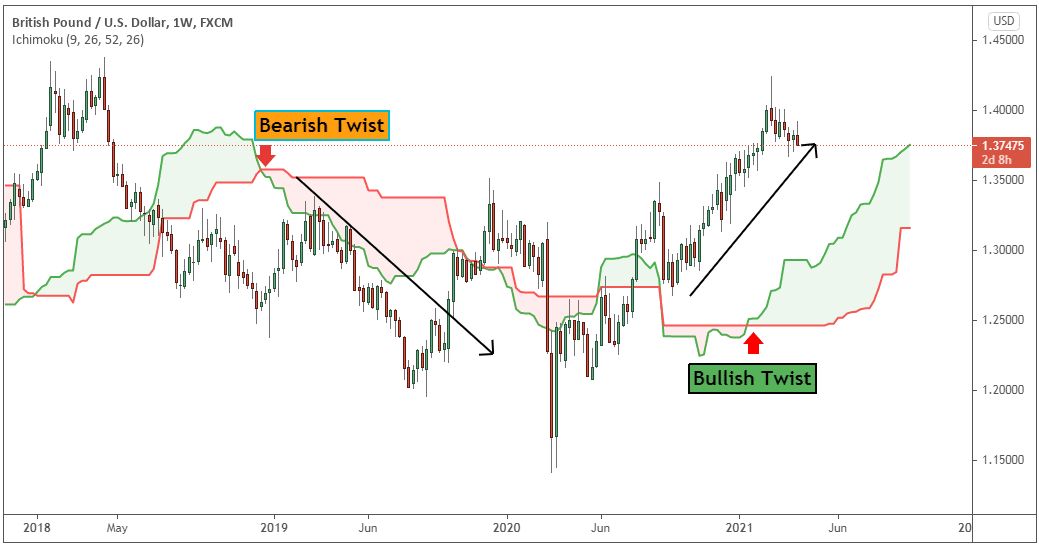

For example, when the price is above the cloud (Kumo), it indicates a bullish trend. Conversely, when it’s below the cloud, it suggests a bearish trend. Simple, right? But don’t worry, we’ll dive deeper into this later.

Setting Up Your Ichimoku Trading Strategy

Now that you understand the basics, let’s talk about setting up your Ichimoku chart. Most trading platforms, including MetaTrader and TradingView, have Ichimoku built-in. All you need to do is add it to your chart, and you’re good to go.

Here’s a quick guide to setting it up:

- Open your trading platform.

- Go to the indicator section and search for “Ichimoku.”

- Select it and apply it to your chart.

Once it’s set up, you’ll see the various components displayed on your chart. The cloud (Kumo) will be the most prominent feature, with the Tenkan and Kijun lines overlaying the price action. It might look a bit overwhelming at first, but trust me, it gets easier with practice.

Tweaking the Settings for Better Results

While the default settings work well for most traders, you can tweak them to suit your trading style. For example:

- Short-term traders might reduce the periods for Tenkan and Kijun to 7 and 14, respectively.

- Long-term traders might increase them to 21 and 50.

Experiment with different settings to see what works best for you. Remember, there’s no one-size-fits-all solution in trading – it’s all about finding what suits your strategy.

Interpreting Ichimoku Signals

Alright, let’s get into the nitty-gritty of interpreting Ichimoku signals. This is where the magic happens. Here are some key things to look out for:

- Crossover Signals: When the Tenkan crosses above the Kijun, it’s a bullish signal. Conversely, when it crosses below, it’s bearish.

- Cloud Position: As mentioned earlier, the position of the price relative to the cloud indicates the trend direction.

- Chikou Span: If the Chikou Span is above the price, it confirms a bullish trend. If it’s below, it confirms a bearish trend.

These signals, when combined, can provide powerful insights into market movements. For instance, if you see a bullish crossover and the price is above the cloud, with the Chikou Span confirming the trend, you’ve got a strong buy signal.

Combining Ichimoku with Other Indicators

While Ichimoku is powerful on its own, combining it with other indicators can enhance its effectiveness. Here are a few ideas:

- Use RSI to confirm overbought/oversold conditions.

- Combine it with MACD for additional momentum signals.

- Pair it with Fibonacci retracements to identify key levels.

By layering these tools, you can create a robust trading strategy that gives you more confidence in your decisions. It’s like having a team of analysts working for you!

Common Mistakes to Avoid

Before we move on, let’s talk about some common mistakes traders make when using the Ichimoku trading strategy. Avoiding these pitfalls can save you a lot of headaches:

- Over-reliance on Signals: While Ichimoku provides great insights, it’s not foolproof. Always use it in conjunction with other tools.

- Ignoring Context: Market conditions can affect how Ichimoku signals play out. Always consider the broader context.

- Not Practicing Enough: Like any skill, mastering Ichimoku takes practice. Use demo accounts to test your strategies without risking real money.

Remember, trading is a journey, not a destination. Keep learning, keep practicing, and keep improving.

How to Stay Disciplined with Ichimoku

Discipline is key in trading. Here are some tips to help you stay on track:

- Create a trading plan and stick to it.

- Set clear entry and exit rules based on Ichimoku signals.

- Review your trades regularly to identify areas for improvement.

By staying disciplined, you’ll increase your chances of success. It’s like building a solid foundation for your trading house – the stronger the foundation, the more likely it is to withstand market storms.

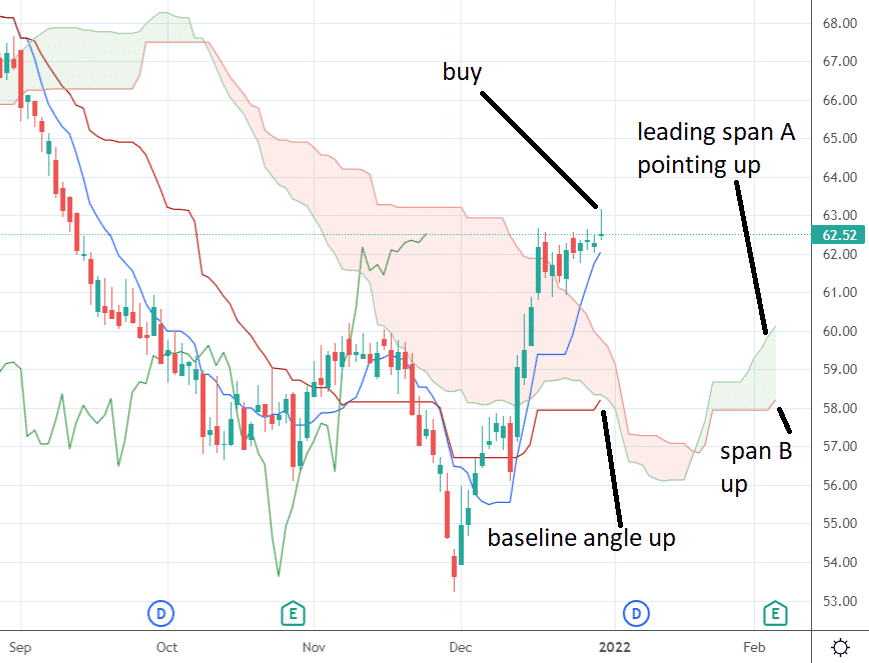

Real-Life Examples of Ichimoku in Action

Let’s look at some real-life examples to see Ichimoku in action. These case studies will give you a better understanding of how the strategy works in different market conditions.

Case Study 1: Bullish Trend

Imagine you’re trading a stock that’s been in a steady uptrend. The price is above the cloud, the Tenkan is above the Kijun, and the Chikou Span confirms the trend. This is a classic buy signal. You enter the trade, set your stop-loss below the cloud, and let the trend carry you to profits.

Case Study 2: Bearish Reversal

Now, consider a scenario where the price is below the cloud, the Tenkan crosses below the Kijun, and the Chikou Span confirms the reversal. This is a strong sell signal. You short the stock, set your stop-loss above the cloud, and ride the downtrend.

These examples show how Ichimoku can help you make informed decisions in various market conditions. It’s all about reading the signals and acting accordingly.

Tips for Beginners

If you’re new to Ichimoku, here are some tips to help you get started:

- Start with a demo account to get comfortable with the indicator.

- Focus on understanding each component before trying to use them all together.

- Practice identifying trends and reversals using historical data.

Remember, learning Ichimoku is a process. Don’t rush it – take your time to understand each element and how they work together.

Building Confidence as a Trader

Confidence comes from knowledge and experience. Here’s how you can build yours:

- Read books and articles about Ichimoku trading.

- Join online communities to learn from other traders.

- Keep a trading journal to track your progress.

By continuously learning and improving, you’ll become more confident in your abilities. And confidence, my friend, is the key to success in trading.

Advanced Techniques for Ichimoku Trading

Once you’ve mastered the basics, it’s time to level up your game. Here are some advanced techniques to consider:

- Use Ichimoku to identify breakout opportunities.

- Combine it with machine learning algorithms for predictive analysis.

- Experiment with custom settings to create personalized strategies.

These techniques can take your trading to the next level, but remember – they require a solid understanding of the basics. Don’t rush into them until you’re ready.

Staying Ahead of the Curve

The markets are constantly evolving, and so should your strategies. Here’s how to stay ahead:

- Keep up with market news and trends.

- Test new strategies in a demo environment before going live.

- Network with other traders to share ideas and insights.

By staying informed and adaptable, you’ll be better equipped to handle whatever the markets throw at you.

Conclusion: Your Path to Trading Success

We’ve covered a lot of ground in this guide, from the basics of Ichimoku trading strategy to advanced techniques. Remember, mastering Ichimoku is a journey, not a destination. It requires patience, practice, and perseverance.

Here’s a quick recap of what we’ve learned:

- Ichimoku provides a comprehensive view of the market, helping you identify trends, reversals, and key levels.

- Setting up and interpreting Ichimoku signals is easier than it seems – with practice, you’ll get the hang of it.

- Combining Ichimoku with other indicators can enhance its effectiveness.

- Avoid common mistakes and stay disciplined to increase your chances of success.

Now, it’s your turn to take action. Start practicing, experimenting, and refining your strategy. And don’t forget to share your experiences with the community – we’re all in this together!

So, what are you waiting for? Dive in and start mastering the Ichimoku trading strategy today. Your trading success awaits!

Table of Contents

- Understanding the Basics of Ichimoku Trading Strategy

- Setting Up Your Ichimoku Trading Strategy

- Interpreting Ichimoku Signals

- Common Mistakes to Avoid

- Real-Life Examples of Ichimoku in Action

- Tips for Beginners

- Advanced Techniques for Ichimoku Trading

- Conclusion: Your Path to Trading Success

- Why Was Girl Meets Farm Cancelled The Inside Scoop Youve Been Waiting For

- Jade Castrinos Meth The Untold Story You Need To Know

Ichimoku Strategies PDF Market Trend Financial Markets

ichimoku trading strategy Options Trading IQ

Best Ichimoku Cloud Strategy Accelerate Profits In 5 Steps