Point Figure Charting: The Ultimate Guide For Mastering Price Action

Point figure charting is not just another trading technique; it's a game-changer for anyone serious about mastering price action. This ancient charting method has stood the test of time and continues to provide traders with valuable insights into market behavior. Unlike modern charting methods, point figure charts focus solely on price movements, eliminating the noise of time and volume to reveal the true essence of market trends.

You might be wondering, "Why should I care about point figure charting?" Well, imagine having a crystal-clear view of market reversals, support and resistance levels, and potential breakout points without getting distracted by unnecessary details. That's exactly what point figure charting offers. It's like having a secret weapon in your trading arsenal that helps you make smarter decisions.

Now, before we dive deep into the world of point figure charting, let me tell you something interesting. This method dates back to the late 19th century and was originally used by floor traders in the stock exchanges. Back then, they didn't have fancy computers or software. They relied on pen and paper to track price movements, and point figure charting was their go-to tool. Today, with the help of technology, we can implement this powerful technique more efficiently than ever.

- Why Was Girl Meets Farm Cancelled The Inside Scoop Youve Been Waiting For

- Morgan Vera Onlyfans The Ultimate Guide To Her Journey Content And Success

What Exactly is Point Figure Charting?

Point figure charting is a unique charting method that uses X's and O's to represent price movements. It's different from traditional bar or candlestick charts because it doesn't consider time or volume. Instead, it focuses solely on price changes, making it an excellent tool for identifying key market levels and trends.

Here's how it works: When the price moves up by a certain predefined amount, we plot an X. When the price moves down by the same amount, we plot an O. This creates a visual representation of price action that helps traders identify patterns and make informed decisions.

One of the biggest advantages of point figure charting is its ability to filter out market noise. By ignoring minor price fluctuations and focusing only on significant moves, traders can better understand the true direction of the market. This makes point figure charting particularly useful for long-term traders who want to avoid getting caught up in short-term volatility.

- Unveiling The Truth About Mmsdose A Comprehensive Guide

- Kaitlyn Krems Nude Separating Facts From Fiction

Why Point Figure Charting Matters in Today's Market

In today's fast-paced trading world, having a reliable method to analyze price action is crucial. Point figure charting provides traders with a clear and concise way to interpret market movements without getting overwhelmed by excessive data. Here are a few reasons why point figure charting matters:

- It eliminates time-based biases, allowing traders to focus on price.

- It helps identify key support and resistance levels with precision.

- It simplifies complex price movements into easy-to-understand patterns.

- It works across all asset classes, from stocks to forex and commodities.

Think about it this way: in a world filled with distractions, point figure charting acts as a filter that helps you focus on what truly matters – price action. It's like having a pair of noise-canceling headphones for your trading strategy.

How to Read a Point Figure Chart

Reading a point figure chart might seem intimidating at first, but once you get the hang of it, it becomes second nature. Here's a step-by-step guide to help you understand how to read a point figure chart:

Understanding the X's and O's

As mentioned earlier, X's represent upward price movements, while O's represent downward price movements. The transition from X's to O's (or vice versa) indicates a reversal in price direction. This makes it easy to spot trend changes and potential entry or exit points.

Identifying Key Levels

Point figure charts are excellent for identifying support and resistance levels. These levels are represented by clusters of X's or O's that act as barriers for price movement. Traders can use these levels to set stop-loss orders or take-profit targets.

Spotting Patterns

Just like candlestick charts have patterns like doji or hammer, point figure charts have their own set of patterns. Some common patterns include double tops, double bottoms, and triangles. Recognizing these patterns can give traders valuable insights into future price movements.

The Benefits of Using Point Figure Charting

Now that you understand the basics of point figure charting, let's talk about its benefits. Here are a few reasons why traders love this method:

- Clarity: Point figure charts provide a clear and uncluttered view of price action, making it easier to spot trends and reversals.

- Flexibility: This method works across all timeframes and asset classes, giving traders the freedom to apply it to their preferred markets.

- Accuracy: By focusing solely on price, point figure charting reduces the chances of false signals, leading to more accurate trading decisions.

- Historical Insights: Point figure charts allow traders to analyze historical data with precision, helping them identify recurring patterns and trends.

These benefits make point figure charting an invaluable tool for both novice and experienced traders alike.

Common Mistakes to Avoid in Point Figure Charting

While point figure charting is a powerful technique, it's not without its challenges. Here are some common mistakes traders make when using this method:

- Overcomplicating the chart by using too many boxes or reversals.

- Ignoring the importance of setting the right box size and reversal amount.

- Trying to force patterns where none exist, leading to poor trading decisions.

- Not considering the broader market context when analyzing point figure charts.

Avoiding these mistakes can significantly improve your trading performance and help you make the most of point figure charting.

Setting Up Your Point Figure Chart

Before you start using point figure charting, you need to set up your chart properly. Here are the key parameters you need to consider:

Box Size

The box size determines the minimum price movement required to plot an X or O. Choosing the right box size is crucial because it affects the level of detail in your chart. A smaller box size provides more detail but can lead to clutter, while a larger box size simplifies the chart but may miss important price movements.

Reversal Amount

The reversal amount specifies how many boxes a price must move in the opposite direction before a reversal is plotted. A common reversal amount is three boxes, but this can be adjusted based on your trading style and market conditions.

Chart Orientation

Point figure charts can be plotted horizontally or vertically. Horizontal charts are more traditional, while vertical charts are gaining popularity due to their better use of screen space.

Combining Point Figure Charting with Other Techniques

While point figure charting is a powerful standalone tool, it can be even more effective when combined with other trading techniques. Here are a few ways to enhance your point figure charting strategy:

Using Indicators

Indicators like moving averages or RSI can complement point figure charts by providing additional context and confirming signals.

Integrating Fundamental Analysis

Combining point figure charting with fundamental analysis can give traders a more comprehensive view of the market, helping them make well-informed decisions.

Applying Risk Management

No trading strategy is complete without proper risk management. Use point figure charts to set stop-loss orders and take-profit targets, ensuring you protect your capital while maximizing your gains.

Real-World Examples of Point Figure Charting

Let's look at a few real-world examples of how point figure charting can be applied in different markets:

Stock Market

In the stock market, point figure charts can help identify key levels where major price reversals are likely to occur. For example, a cluster of X's near a previous high might indicate a potential breakout, while a cluster of O's near a previous low might signal a possible breakdown.

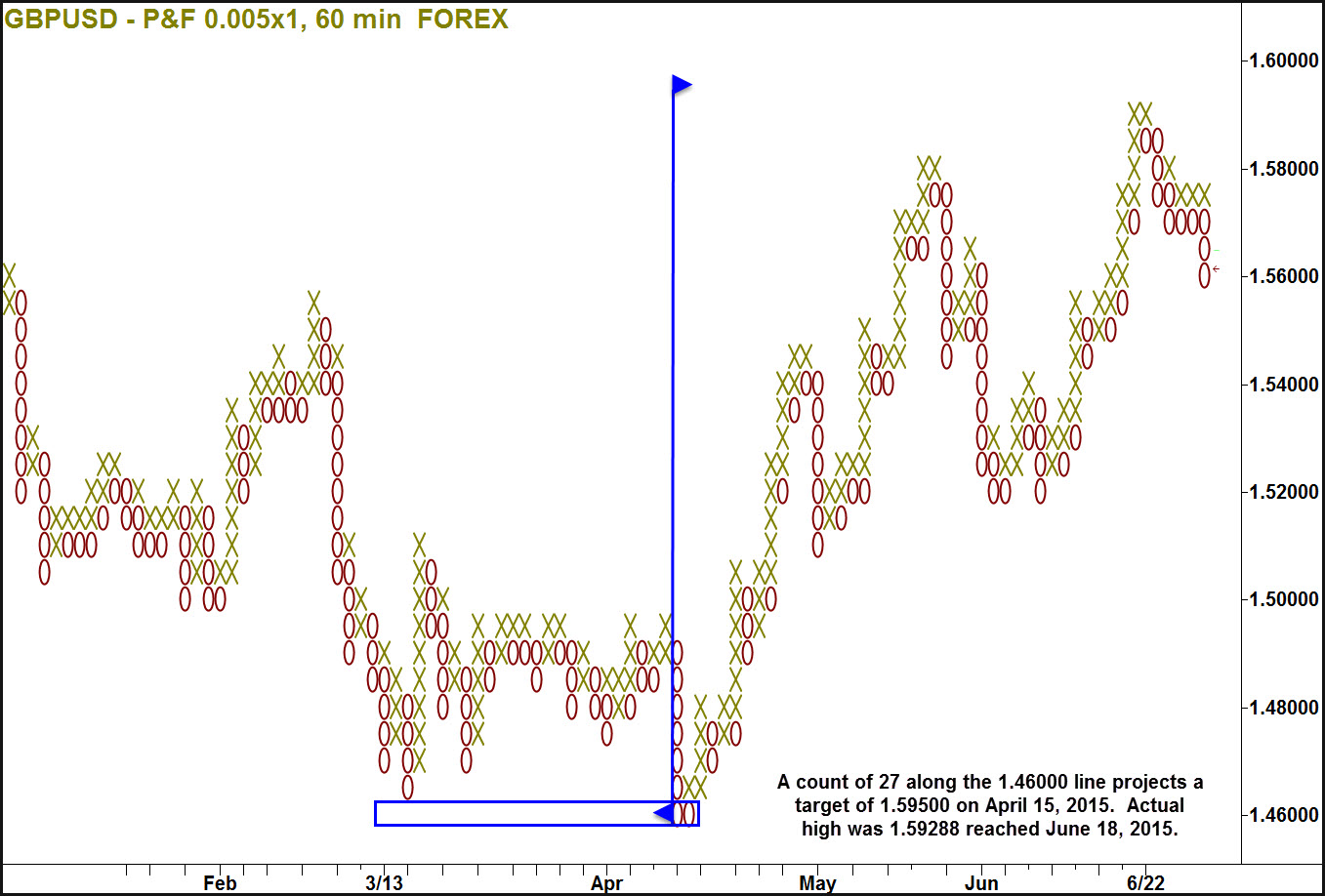

Forex Market

In the forex market, point figure charts are particularly useful for identifying long-term trends and major currency pair movements. Traders can use these charts to spot key support and resistance levels, helping them make informed decisions about when to enter or exit trades.

Commodity Market

In the commodity market, point figure charts can provide valuable insights into price patterns and trends. For example, a triangle pattern on a point figure chart might indicate a potential breakout in the near future.

Tips for Mastering Point Figure Charting

Here are a few tips to help you master point figure charting:

- Practice regularly to develop a keen eye for patterns and trends.

- Experiment with different box sizes and reversal amounts to find what works best for you.

- Stay patient and disciplined, avoiding the temptation to overtrade based on minor price movements.

- Continuously educate yourself by reading books, attending webinars, and joining trading communities.

Remember, mastering point figure charting is a journey, not a destination. The more you practice and refine your skills, the better you'll become at using this powerful technique.

Conclusion

Point figure charting is a timeless method that offers traders a unique perspective on price action. By focusing solely on price movements, it helps eliminate market noise and provides valuable insights into trends and reversals. Whether you're a beginner or an experienced trader, incorporating point figure charting into your strategy can significantly enhance your trading performance.

So, what are you waiting for? Start exploring the world of point figure charting today and take your trading to the next level. And don't forget to share your experiences and insights with the community. The more we learn from each other, the better we become as traders.

Call to Action: Leave a comment below sharing your thoughts on point figure charting or ask any questions you might have. I'd love to hear from you and help you on your trading journey!

Table of Contents

- What Exactly is Point Figure Charting?

- Why Point Figure Charting Matters in Today's Market

- How to Read a Point Figure Chart

- The Benefits of Using Point Figure Charting

- Common Mistakes to Avoid in Point Figure Charting

- Setting Up Your Point Figure Chart

- Combining Point Figure Charting with Other Techniques

- Real-World Examples of Point Figure Charting

- Tips for Mastering Point Figure Charting

- Conclusion

- Unveiling The Truth Understanding Sandra Blust Nudes

- Browse Kid And His Mom Video Original A Deep Dive Into The Phenomenon

Thomas DorseyPoint and Figure ChartingEn PDF Stocks Investor

Point and Figure Charts PDF Stocks Prices

Point & Figure Charting Trade Mindfully