Bullish Rectangle Pattern: The Secret Weapon For Traders

So here's the deal, folks. If you're into trading or even just curious about how the markets work, you've probably heard of the bullish rectangle pattern. This little gem is like a treasure map for traders, giving hints about where prices might go next. It's not just some random shape on a chart; it's a powerful signal that can help you make smarter decisions. So, buckle up, because we're diving deep into this pattern and uncovering its secrets.

Now, I know what you're thinking. "Another trading pattern? Really?" But trust me, this one's special. The bullish rectangle pattern is like a reliable friend in the world of trading. It doesn't scream at you like some of those flashy indicators. Instead, it quietly whispers, "Hey, pay attention. Something big might happen here." And when it speaks, experienced traders listen. So, let's break it down and see why this pattern deserves your attention.

Before we dive deeper, let's clarify something. The bullish rectangle pattern isn't just for pros. Even if you're new to trading, understanding this pattern can give you a solid edge. It's all about recognizing patterns and using them to your advantage. And hey, who doesn't want an edge in the market? Let's get started!

- Truett Hanes Height And Weight The Full Scoop Yoursquove Been Waiting For

- The Untold Story Of Richard Leete Robbins Net Worth From Humble Beginnings To Financial Success

What Exactly is a Bullish Rectangle Pattern?

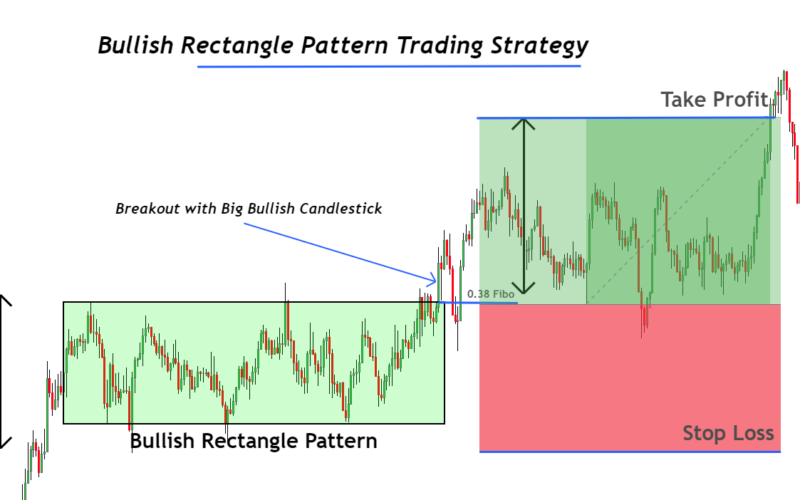

Alright, let's get technical for a second. The bullish rectangle pattern is essentially a consolidation phase on a chart. It happens when the price moves sideways between two parallel lines, creating a rectangle. But here's the kicker—this pattern often signals a potential upward breakout. Think of it as a coiled spring, ready to explode in the bullish direction.

This pattern usually forms after a strong upward trend. It's like the market taking a breather before continuing its journey north. The rectangle is formed by two horizontal lines: the resistance line at the top and the support line at the bottom. When the price breaks above the resistance line, it's a strong indication that the bulls are back in control.

Now, I know this might sound a bit textbook, but stay with me. The beauty of the bullish rectangle pattern lies in its simplicity. It doesn't require any fancy calculations or complicated indicators. You just need to spot it and understand its implications. And trust me, once you see it in action, you'll wonder how you ever traded without it.

- Charli Damelio Nude The Truth Behind The Viral Sensation

- Rachel Pizzolato Onlyfans The Ultimate Guide To Her Rise Content And Impact

Why Should You Care About This Pattern?

Here's the thing, folks. The bullish rectangle pattern isn't just another chart formation. It's a powerful tool that can significantly boost your trading strategy. Think of it as a roadmap that shows you where the market might head next. And in the world of trading, having a roadmap is like having a superpower.

First off, this pattern gives you a clear entry point. When the price breaks above the resistance line, it's like a green light telling you to jump in. But that's not all. It also helps you set realistic profit targets. By measuring the height of the rectangle, you can estimate how far the price might go after the breakout. It's like having a crystal ball that gives you a sneak peek into the future.

Plus, the bullish rectangle pattern is relatively easy to identify. Unlike some of those cryptic indicators that make your head spin, this one is straightforward. And in trading, simplicity is often the key to success. So, whether you're a seasoned trader or just starting out, this pattern is worth your attention.

How to Identify a Bullish Rectangle Pattern

Step 1: Look for a Strong Upward Trend

Let's break it down step by step. The first thing you need to do is identify a strong upward trend. This is crucial because the bullish rectangle pattern usually forms after such a trend. Think of it as the market taking a pause after a long run. If there's no prior trend, chances are it's not a bullish rectangle pattern.

Step 2: Spot the Consolidation Phase

Once you've identified the trend, look for a consolidation phase. This is where the price starts moving sideways, creating a rectangle on the chart. The key here is to spot two parallel lines: one acting as support and the other as resistance. If the price bounces between these lines multiple times, you're probably looking at a bullish rectangle pattern.

Step 3: Wait for the Breakout

The final step is waiting for the breakout. When the price breaks above the resistance line, it's a strong indication that the bulls are back in control. But here's a pro tip: wait for the price to close above the resistance line to confirm the breakout. This helps avoid false signals and keeps you on the right side of the trade.

Understanding the Psychology Behind the Pattern

Now, let's talk about the psychology behind the bullish rectangle pattern. This is where things get interesting. The pattern reflects the battle between buyers and sellers. During the consolidation phase, the buyers and sellers are evenly matched, causing the price to move sideways. But when the buyers gain the upper hand, the price breaks above the resistance line, signaling the start of a new upward trend.

Understanding this psychology can help you anticipate market movements. It's like reading the market's mind. When you see the price bouncing between the support and resistance lines, you know there's a battle going on. And when the price finally breaks out, it's like the market saying, "Alright, the bulls have won this round."

Plus, the bullish rectangle pattern often attracts more buyers as it nears the resistance line. This is because traders start anticipating a breakout, creating a self-fulfilling prophecy. It's like a snowball effect, where the more people expect a breakout, the more likely it is to happen.

Real-Life Examples of Bullish Rectangle Patterns

Example 1: Apple Inc.

Let's take a look at a real-life example. Back in 2020, Apple Inc. formed a perfect bullish rectangle pattern. After a strong upward trend, the price consolidated between $110 and $120. Traders who spotted this pattern and waited for the breakout above $120 were rewarded with a significant upward move. The price eventually reached $135, giving a nice profit to those who acted on the signal.

Example 2: Tesla Inc.

Another great example is Tesla Inc. In 2021, Tesla's stock price formed a bullish rectangle pattern between $600 and $700. When the price broke above $700, it signaled the start of a new upward trend. Traders who acted on this signal saw the price climb to over $800 in just a few weeks. It's like the market saying, "Thanks for paying attention. Here's your reward."

Common Mistakes to Avoid

Now, let's talk about some common mistakes traders make with the bullish rectangle pattern. First off, don't jump the gun. Just because the price touches the resistance line doesn't mean it's going to break out. Wait for a proper close above the line to confirm the signal. Patience is key in trading.

Another mistake is ignoring the volume. A breakout without significant volume is often a false signal. Think of volume as the fuel that powers the breakout. If there's no fuel, the breakout might not go very far. So, always check the volume when analyzing this pattern.

And finally, don't forget to set a stop-loss. Even with the best patterns, things can go wrong. A stop-loss protects you from big losses if the market doesn't behave as expected. It's like wearing a seatbelt—it might seem unnecessary until you really need it.

Advanced Techniques for Using the Pattern

Combining with Other Indicators

For those of you who want to take things to the next level, consider combining the bullish rectangle pattern with other indicators. For example, you can use moving averages to confirm the breakout. If the price breaks above the resistance line and the moving averages also signal an upward trend, you have a stronger signal.

Using Fibonacci Retracement

Another advanced technique is using Fibonacci retracement levels. By measuring the height of the rectangle and applying Fibonacci levels, you can set more accurate profit targets. This adds an extra layer of precision to your trading strategy, helping you maximize your gains.

Daftar Isi

What Exactly is a Bullish Rectangle Pattern?

Why Should You Care About This Pattern?

How to Identify a Bullish Rectangle Pattern

Understanding the Psychology Behind the Pattern

Real-Life Examples of Bullish Rectangle Patterns

Advanced Techniques for Using the Pattern

Benefits of Mastering the Bullish Rectangle Pattern

The Future of Trading with Patterns

Benefits of Mastering the Bullish Rectangle Pattern

Mastering the bullish rectangle pattern can significantly enhance your trading skills. It gives you a clear edge in the market, helping you make smarter decisions. Whether you're a day trader or a long-term investor, understanding this pattern can improve your profitability.

Plus, the pattern is versatile. It works across different timeframes and asset classes. Whether you're trading stocks, forex, or cryptocurrencies, the bullish rectangle pattern can be a valuable tool in your arsenal. And let's face it, having multiple tools at your disposal is always a good thing.

And here's the best part. The more you use this pattern, the better you get at spotting it. It's like developing a sixth sense for market movements. So, the sooner you start practicing, the sooner you'll see results.

The Future of Trading with Patterns

As technology advances, the role of patterns like the bullish rectangle is becoming even more important. With the rise of algorithmic trading and machine learning, patterns are being analyzed at unprecedented speeds. But don't worry, humans still have the edge when it comes to interpreting these patterns.

The future of trading is all about combining technology with human intuition. While algorithms can process vast amounts of data, they can't replace the human touch. And patterns like the bullish rectangle are where human intuition shines. So, whether you're trading with a computer or by hand, understanding these patterns will always give you an advantage.

Conclusion

So, there you have it, folks. The bullish rectangle pattern is more than just a chart formation. It's a powerful tool that can help you navigate the markets with confidence. By understanding its mechanics, psychology, and applications, you can significantly improve your trading performance.

Remember, the key to success with this pattern is patience and discipline. Don't rush into trades, and always confirm your signals with other indicators. And most importantly, practice makes perfect. The more you use this pattern, the better you'll get at spotting it.

Now, it's your turn. Take what you've learned and start applying it to your trading. And don't forget to share your experiences with us. Whether you've had success or faced challenges, we'd love to hear about it. So, drop a comment below and let's keep the conversation going!

- The Untold Story Of Richard Leete Robbins Net Worth From Humble Beginnings To Financial Success

- Anna Malygon Leak The Untold Story You Need To Know

![What is Bullish Rectangle Pattern? [Video] Trading charts, Forex](https://i.pinimg.com/736x/c0/2a/e7/c02ae742a78a25f3deba2b3644b37f20.jpg)

What is Bullish Rectangle Pattern? [Video] Trading charts, Forex

Bullish Rectangle Pattern Full Trading Guide ForexBee

Chart Pattern Series (10/12) Bullish Rectangle Pattern