The Real Difference Between A Shareholder And A Stakeholder You Need To Know

Ever wondered what sets a shareholder apart from a stakeholder? If you’re scratching your head trying to figure out the nuances, you’re not alone. The difference between a shareholder and a stakeholder is more than just a play on words—it’s a fundamental distinction that can shape how businesses operate and prioritize their goals. Whether you're an entrepreneur, investor, or simply curious about the business world, understanding these roles is key to navigating the corporate jungle.

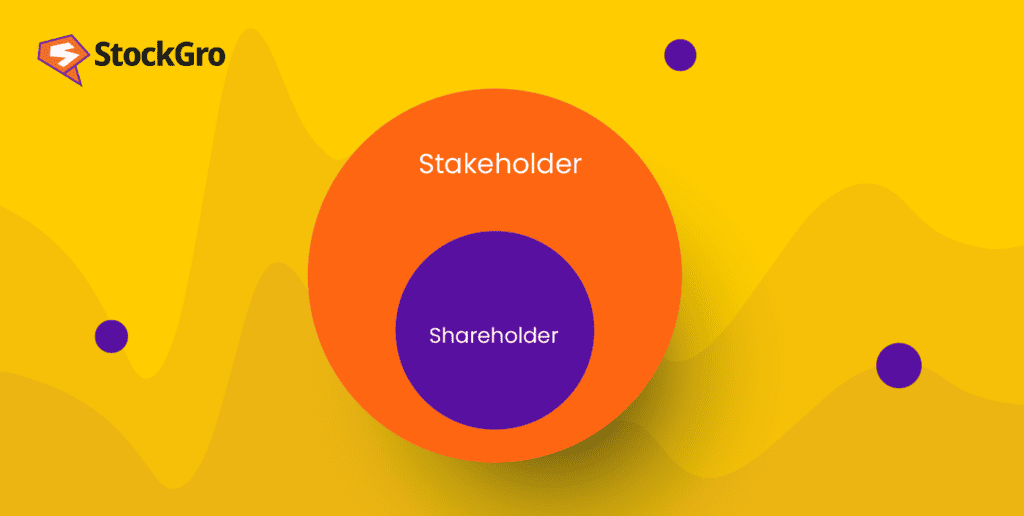

Let’s break it down in a way that’s easy to digest. While both shareholders and stakeholders have vested interests in a company, their roles, rights, and responsibilities differ significantly. Think of it like this: shareholders are like the investors who put their money on the line, while stakeholders are the broader group of people who have a stake—pun intended—in the company's success or failure.

This article dives deep into the nitty-gritty of what makes shareholders and stakeholders tick. By the end, you’ll have a crystal-clear understanding of their differences, why they matter, and how they influence business decisions. So buckle up and let’s get started!

- David And Rebecca Muir Wedding Love Story That Captured Hearts Worldwide

- Oxleak Uncovering The Hidden World Of Digital Security And Privacy

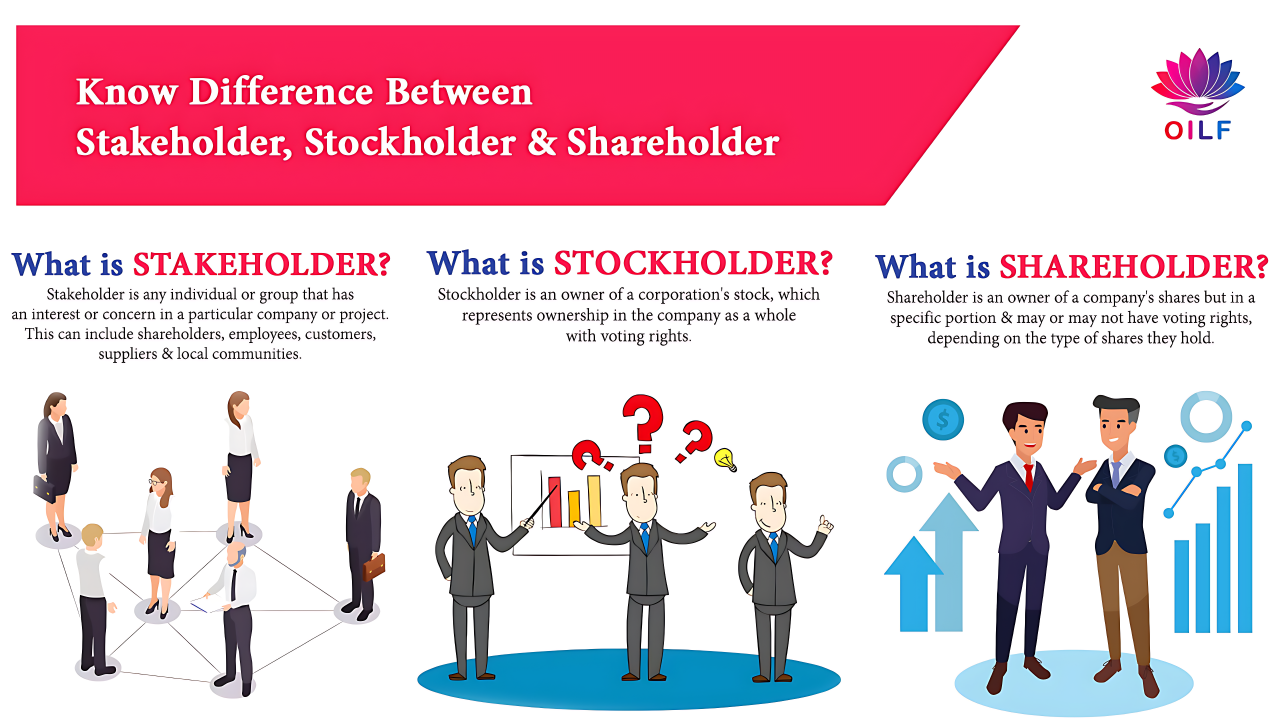

What Exactly is a Shareholder?

Alright, let’s start with the basics. A shareholder is someone who owns shares in a company. Think of them as the folks who’ve got skin in the game—literally. They’ve invested their hard-earned cash into the company by purchasing stocks, and in return, they get a piece of the pie. But here’s the kicker: their involvement usually revolves around financial returns.

Shareholders are often referred to as equity holders because they own a portion of the company’s equity. They have certain rights, like voting on major company decisions and receiving dividends if the company performs well. But here’s the thing—they’re not always involved in the day-to-day operations. Their main focus is on maximizing their investment returns.

Key Characteristics of Shareholders

Let’s highlight some key points about shareholders:

- Jameliz Benitez The Truth Behind The Controversial Search Term

- Layla Jenner Ethnicity A Deep Dive Into Her Roots And Identity

- They own shares in the company.

- They have voting rights in shareholder meetings.

- They receive dividends if the company profits.

- Their primary interest is financial gain.

Now, here’s where it gets interesting. Shareholders aren’t just limited to individuals. They can also be institutional investors, like mutual funds or pension funds, who hold large chunks of shares. These guys play a big role in shaping corporate policies and strategies.

And What About Stakeholders?

On the flip side, we’ve got stakeholders. These are the people who have an interest in the company’s performance, but not necessarily because they own shares. Think employees, customers, suppliers, local communities, and even the government. Stakeholders are the broader group of individuals and entities whose lives are impacted by the company’s actions.

Unlike shareholders, stakeholders don’t always have a direct financial stake in the company. But their involvement is crucial. For example, employees rely on the company for their livelihood, customers depend on its products or services, and communities may benefit—or suffer—from its operations. It’s a more holistic view of the company’s impact.

Types of Stakeholders

Here’s a quick breakdown of the different types of stakeholders:

- Internal Stakeholders: Employees, managers, and executives who work within the company.

- External Stakeholders: Customers, suppliers, investors, regulators, and the community at large.

See how broad that scope is? Stakeholders can come from all walks of life, and their interests can vary widely. Some may care about job security, others about product quality, and still others about environmental sustainability.

The Core Difference Between a Shareholder and a Stakeholder

Now that we’ve covered the basics, let’s get to the heart of the matter. The difference between a shareholder and a stakeholder boils down to one key factor: focus. Shareholders are primarily concerned with financial returns, while stakeholders have a vested interest in the company’s overall impact.

Here’s a simple way to think about it:

- Shareholders = Financial Gains

- Stakeholders = Broader Impact

While shareholders are focused on profits, stakeholders are often more concerned with issues like ethical practices, social responsibility, and environmental sustainability. It’s a balancing act that companies have to navigate carefully.

Financial vs. Non-Financial Interests

Let’s dive deeper into this distinction. Shareholders are all about the numbers. They want to see their stock prices rise, dividends increase, and the company’s bottom line grow. On the other hand, stakeholders are more concerned with the big picture. They want to know that the company is doing the right thing—not just for its shareholders, but for everyone involved.

For example, a customer might care more about the quality of a product than the company’s stock performance. An employee might prioritize job security over shareholder returns. And a community might be more concerned about pollution from a factory than the company’s quarterly earnings.

Why Does This Difference Matter?

You might be wondering why this distinction is so important. The truth is, understanding the difference between shareholders and stakeholders can help businesses make better decisions. It’s all about striking the right balance between profitability and responsibility.

Companies that focus solely on shareholder value risk alienating other stakeholders. For instance, cutting costs by outsourcing jobs may boost profits in the short term, but it could harm employees and local communities in the long run. On the flip side, prioritizing stakeholder interests without considering financial performance could lead to unsustainable business practices.

The Triple Bottom Line Approach

One way companies address this challenge is by adopting the triple bottom line (TBL) approach. This framework considers not just financial performance, but also social and environmental impact. By balancing these three pillars, businesses can create value for both shareholders and stakeholders.

Here’s how it works:

- Profit: Maximizing financial returns for shareholders.

- People: Ensuring fair treatment of employees, customers, and communities.

- Planet: Minimizing environmental impact and promoting sustainability.

It’s a win-win situation that benefits everyone involved. And in today’s world, where consumers are increasingly demanding ethical practices, this approach is more relevant than ever.

How Companies Prioritize Shareholders vs. Stakeholders

So how do companies decide where to focus their efforts? It depends on their priorities and goals. Some companies adopt a shareholder-centric approach, prioritizing profits above all else. Others take a more balanced approach, considering the needs of all stakeholders.

But here’s the thing: companies that ignore stakeholder interests do so at their own peril. In today’s interconnected world, bad press can spread like wildfire. If a company is seen as exploiting workers or harming the environment, it could face a backlash from customers, investors, and regulators alike.

Real-World Examples

Let’s look at a couple of examples to illustrate this point:

- Shareholder-Centric Example: A tech giant that prioritizes stock buybacks over employee benefits may see its stock price soar, but it risks losing top talent in the process.

- Stakeholder-Centric Example: A retail chain that invests in sustainable sourcing and fair labor practices may see slower growth, but it builds long-term trust with customers and communities.

Both approaches have their merits, but the key is finding the right balance. Companies that succeed in doing so are often the ones that thrive over the long term.

The Role of Corporate Governance

Corporate governance plays a crucial role in managing the relationship between shareholders and stakeholders. It’s the system of rules, practices, and processes that govern how a company is run. Good corporate governance ensures that the company acts in the best interests of all its stakeholders, not just its shareholders.

Here are some key principles of corporate governance:

- Transparency: Being open and honest about company practices and decisions.

- Accountability: Holding executives and board members responsible for their actions.

- Responsibility: Acting in an ethical and sustainable manner.

By adhering to these principles, companies can build trust with both shareholders and stakeholders. And in today’s competitive business landscape, trust is a priceless commodity.

How Corporate Governance Impacts Shareholders and Stakeholders

Corporate governance affects both shareholders and stakeholders in different ways. For shareholders, it ensures that their investments are managed responsibly. For stakeholders, it provides assurance that the company is operating ethically and sustainably.

For example, a company with strong corporate governance might implement policies to reduce carbon emissions, protect worker rights, and engage with local communities. These actions not only benefit stakeholders but can also enhance the company’s reputation and financial performance in the long run.

The Future of Shareholder vs. Stakeholder Focus

As we look to the future, the debate over shareholder vs. stakeholder focus is likely to continue. But one thing is clear: companies that prioritize both will have a better chance of succeeding in the long term. The business landscape is evolving, and with it, so are the expectations of investors, customers, and communities.

Here are a few trends to watch:

- Increased focus on environmental, social, and governance (ESG) factors.

- Growing demand for transparency and accountability.

- Shifting consumer preferences towards ethical and sustainable brands.

Companies that adapt to these trends will be well-positioned to thrive in the years to come. But it won’t be easy. Balancing the needs of shareholders and stakeholders requires careful planning, strategic thinking, and a commitment to doing the right thing.

Preparing for the Future

So how can companies prepare for this changing landscape? Here are a few tips:

- Engage with stakeholders to understand their needs and concerns.

- Integrate ESG factors into business strategies and decision-making processes.

- Communicate transparently about company practices and performance.

By taking these steps, companies can build stronger relationships with both shareholders and stakeholders, creating value for everyone involved.

Conclusion: The Bottom Line

So there you have it—the difference between a shareholder and a stakeholder in a nutshell. While shareholders are all about financial returns, stakeholders have a broader interest in the company’s impact. Understanding this distinction is crucial for businesses that want to succeed in today’s complex and ever-changing world.

As we’ve seen, striking the right balance between profitability and responsibility is key. Companies that prioritize both shareholders and stakeholders are more likely to build trust, create value, and achieve long-term success.

Now it’s your turn. What do you think about the shareholder vs. stakeholder debate? Do you think companies should focus more on one than the other? Leave a comment below and let’s start a conversation. And if you found this article helpful, don’t forget to share it with your friends and colleagues!

Table of Contents

- What Exactly is a Shareholder?

- Key Characteristics of Shareholders

- And What About Stakeholders?

- Types of Stakeholders

- The Core Difference Between a Shareholder and a Stakeholder

- Financial vs. Non-Financial Interests

- Why Does This Difference Matter?

- The Triple Bottom Line Approach

- How Companies Prioritize Shareholders vs. Stakeholders

- Real-World Examples

- The Role of Corporate Governance

- How Corporate Governance Impacts Shareholders and Stakeholders

- The Future of Shareholder vs. Stakeholder Focus

- Preparing for the Future

- Conclusion: The Bottom Line

- Karlye Taylor Nudes Separating Facts From Fiction And Exploring The Bigger Picture

- Damon Darpling Net Worth A Deep Dive Into The Wealth Of This Hollywood Icon

Difference between Stakeholder, Stockholder & Shareholder

Stakeholder vs shareholder Differences and types

Shareholder Vs Stakeholder What’s the difference? Simply Stakeholders