Swing Trade Vs Scalping: Which Trading Strategy Is Right For You?

Let's cut straight to the chase, folks. If you're diving into the world of trading, you've probably stumbled upon two popular strategies that traders swear by – swing trading and scalping. These methods are like the peanut butter and jelly of the trading world, but not everyone enjoys the same sandwich. So, what's the deal with swing trade vs scalping? Stick around because we're about to break it down in a way that even your grandma could understand.

Think of trading like a game of chess. Each move you make can either land you in the winner's circle or leave you scratching your head. Swing trading and scalping are two distinct approaches to this game, each with its own set of rules, risks, and rewards. One focuses on short-term gains, while the other plays the long game. But which one should you choose? That’s the million-dollar question we’re here to answer.

Before we dive deeper, let’s get one thing straight: there’s no one-size-fits-all solution in trading. What works for one trader might not work for another. But by the time you finish reading this, you’ll have a clearer picture of which strategy aligns with your trading personality, goals, and risk tolerance. Now, buckle up because we’re about to take you on a wild ride through the world of swing trading and scalping!

- Xxmx The Ultimate Guide To Unlocking The Power Of Xxmx

- Mckinley Richardsonleaks The Untold Story Behind The Viral Sensation

What is Swing Trading?

Alright, let’s start with the big dog on the block – swing trading. Imagine you're a surfer waiting for the perfect wave. Swing trading is all about catching those waves – the price movements – in the financial markets. Instead of trying to ride every single ripple, swing traders focus on bigger, more predictable price swings that typically last anywhere from a few days to a few weeks.

Here's the deal: swing traders rely heavily on technical analysis, chart patterns, and indicators to identify potential entry and exit points. They’re not in it for the quick buck; instead, they aim to capitalize on the natural ebb and flow of market trends. Think of it as a slow-cooker approach to trading – it might take a bit longer, but the results are often more satisfying.

Key Characteristics of Swing Trading

- Timeframe: Swing trades typically last anywhere from 2 to 7 days, sometimes even longer.

- Market Focus: Swing traders prefer liquid markets with clear trends, making stocks, forex, and indices popular choices.

- Tools of the Trade: Moving averages, RSI, MACD, and Fibonacci retracements are just a few of the tools in a swing trader’s arsenal.

- Risk Management: Swing traders use stop-loss orders to protect their trades from unexpected market moves.

Now, here’s the kicker – swing trading requires patience. You’re not chasing every little price movement; you’re waiting for the right moment to strike. It’s like fishing – sometimes you need to sit quietly by the lake for hours before you catch that big fish.

- Sadie Mckenna Nude Unveiling The Truth And Setting The Record Straight

- Camilla Araujo The Rising Star Redefining Brazilian Beauty

What is Scalping?

Let’s switch gears and talk about the adrenaline junkie of the trading world – scalping. If swing trading is the slow-cooker, scalping is the microwave. Scalpers thrive on speed and precision, aiming to make small but frequent profits by exploiting tiny price movements in the market.

Scalping is all about quick wins. These traders don’t care about long-term trends or big price swings. Instead, they focus on capturing just a few pips (price interest points) at a time. It’s like picking up loose change off the street – individually, the gains might seem small, but over time, they add up.

Key Characteristics of Scalping

- Timeframe: Scalping trades usually last from a few seconds to a few minutes, rarely exceeding an hour.

- Market Focus: Scalpers prefer highly volatile markets with tight spreads, making forex and cryptocurrencies popular choices.

- Tools of the Trade: Scalpers rely on real-time data, tick charts, and high-frequency indicators to make split-second decisions.

- Risk Management: Scalpers use tight stop-losses and position sizing to minimize risk on each trade.

Scalping is not for the faint of heart. It demands constant attention, lightning-fast reflexes, and a solid understanding of market dynamics. If you’re the type who gets bored easily, this might just be your jam. But be warned – it’s a high-stakes game that can be both rewarding and risky.

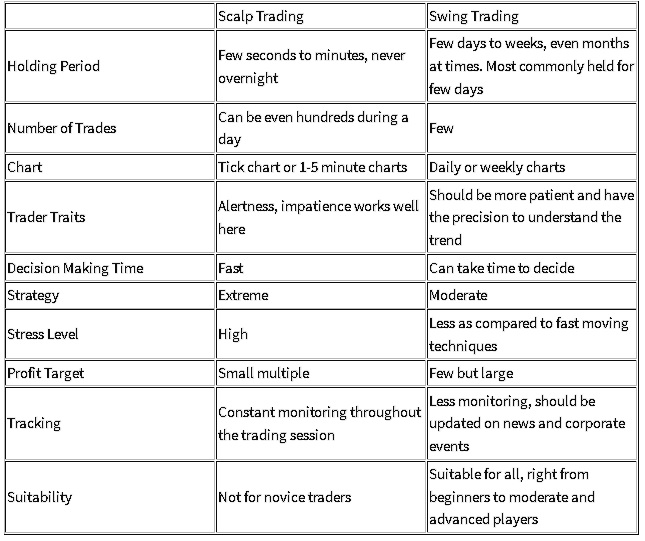

Swing Trade vs Scalping: The Key Differences

Now that we’ve introduced both strategies, let’s break down the key differences between swing trading and scalping. Think of this as the ultimate showdown – which one will come out on top? Here’s a quick rundown:

1. Timeframe

Swing traders play the long game, holding positions for days or even weeks. Scalpers, on the other hand, are all about the quick buck, often closing trades within minutes. It’s like comparing a marathon runner to a sprinter – both require skill, but the approach is entirely different.

2. Market Focus

Swing traders prefer stable, trending markets where they can ride the wave. Scalpers, however, thrive in volatile markets where prices fluctuate rapidly. It’s like choosing between a calm lake and a raging river – each has its own set of challenges and rewards.

3. Risk Management

Both strategies require solid risk management, but the approach differs. Swing traders use wider stop-losses to account for market noise, while scalpers rely on tight stop-losses to protect their small profits. It’s like wearing a life jacket – both keep you afloat, but one is designed for deep water while the other is for shallow streams.

4. Tools and Techniques

Swing traders rely on technical indicators and chart patterns to identify potential trades. Scalpers, on the other hand, use real-time data and high-frequency indicators to make split-second decisions. Think of it as choosing between a telescope and a microscope – both help you see clearly, but at different scales.

Which Strategy is Right for You?

Here’s the million-dollar question – which strategy should you choose? The answer depends on your trading personality, goals, and risk tolerance. Let’s break it down:

Are You a Patient Planner?

If you’re the type who enjoys analyzing charts, waiting for the right moment to strike, and letting your trades breathe, swing trading might be your cup of tea. It’s perfect for traders who prefer a more hands-off approach and don’t mind waiting a few days for their profits to materialize.

Or a Quick-Trigger Action Junkie?

On the flip side, if you thrive on adrenaline, enjoy the thrill of fast-paced trading, and don’t mind staring at your screen for hours, scalping could be your calling. It’s ideal for traders who want to make quick profits and don’t mind the added stress that comes with it.

Ultimately, the right strategy is the one that aligns with your trading style and goals. Don’t be afraid to experiment and find what works best for you. Remember, trading is a journey, not a destination.

The Pros and Cons of Swing Trading

Every strategy has its pros and cons, and swing trading is no exception. Let’s take a closer look:

Pros

- Less Time Commitment: Swing trading allows you to manage your trades without being glued to your screen 24/7.

- Potential for Larger Profits: By riding the waves, swing traders can capture significant price movements over time.

- Lower Stress Levels: With wider stop-losses and longer timeframes, swing trading can be less nerve-wracking than scalping.

Cons

- Market Risk: Holding positions for longer periods exposes you to unexpected market events and volatility.

- Opportunity Cost: While you’re waiting for your trades to mature, you might miss out on other profitable opportunities.

- Emotional Challenges: Watching your trades fluctuate can be emotionally taxing, especially during periods of market uncertainty.

The Pros and Cons of Scalping

Now let’s talk about the pros and cons of scalping. Here’s what you need to know:

Pros

- Quick Profits: Scalping allows you to make small but frequent profits, which can add up over time.

- Immediate Feedback: With trades lasting just a few minutes, you get instant feedback on your strategy’s effectiveness.

- High Frequency: Scalpers can execute dozens of trades in a single day, maximizing their earning potential.

Cons

- High Stress Levels: Constantly monitoring the market and making split-second decisions can be mentally exhausting.

- Transaction Costs: Frequent trading can lead to higher brokerage fees and commissions, eating into your profits.

- Risk of Burnout: The fast-paced nature of scalping can lead to burnout if you’re not careful.

How to Get Started with Swing Trading

Ready to dip your toes into the world of swing trading? Here’s a step-by-step guide to help you get started:

1. Educate Yourself

Knowledge is power, and swing trading is no exception. Start by learning the basics of technical analysis, chart patterns, and market trends. There are plenty of free resources available online, including videos, blogs, and forums.

2. Choose the Right Tools

Invest in a reliable trading platform that offers the tools you need for swing trading, such as moving averages, RSI, and MACD. Some popular platforms include TradingView, MetaTrader, and Thinkorswim.

3. Start Small

Don’t jump in headfirst – start with a small account and practice your strategy on paper trades before risking real money. This will help you fine-tune your approach and build confidence.

How to Get Started with Scalping

If scalping sounds more like your speed, here’s how to get started:

1. Master the Basics

Scalping requires a solid understanding of market dynamics, including volatility, liquidity, and spread. Take the time to learn these concepts before diving in.

2. Pick the Right Market

Scalpers thrive in highly liquid markets with tight spreads, such as forex and cryptocurrencies. Choose a market that aligns with your trading style and goals.

3. Develop a Strategy

Scalping requires a well-defined strategy that accounts for entry and exit points, risk management, and position sizing. Practice your strategy on a demo account before going live.

Conclusion

So, there you have it – the lowdown on swing trade vs scalping. Both strategies have their own strengths and weaknesses, and the right choice depends on your trading personality, goals, and risk tolerance. Whether you’re a patient planner or a quick-trigger action junkie, there’s a strategy out there that’s perfect for you.

Remember, trading is a journey, not a destination. Don’t be afraid to experiment, learn from your mistakes, and adapt your strategy as needed. And most importantly, have fun! After all, trading is not just about making money – it’s about the thrill of the chase and the satisfaction of mastering the art.

Now, it’s your turn. Which strategy resonates with you more – swing trading or scalping? Leave a comment below and let us know. And if you found this article helpful, don’t forget to share it with your fellow traders. Happy trading, folks!

Table of Contents

- What is Swing Trading?

- Key Characteristics of Swing Trading

- What is Scalping?

- Key Characteristics of Scalping

- Swing Trade vs Scalping: The Key Differences

- Which Strategy is Right for You?

- The Pros and Cons of Swing Trading

- The Pros and Cons of Scalping

- Girlylana Onlyfans The Phenomenon You Need To Know About

- Jennette Mccurdy Nude Facts Myths And The Real Story Behind The Headlines

Scalping vs Swing Trading A Comparison

Swing & Position Trading Scalping vs Swing Trading Trade2Win Forums

Scalping vs. Swing Trading What Is Best and Why? InvestGrail