Master The Art Of Options Day Trading: A Comprehensive Course Guide

Ever wondered how to dive into the world of options day trading? If you're on the hunt for an options day trading course that can transform your trading skills, you're in the right place. This isn't just another article—it's your ultimate guide to unlocking the secrets of day trading with options. Whether you're a beginner or looking to sharpen your expertise, this guide has got you covered. So, grab a coffee, get comfy, and let's dive in!

Day trading with options is no joke. It’s like entering a high-stakes game where knowledge is your weapon, and strategy is your shield. But don’t worry, we’ve got your back. This article isn’t just about throwing random tips at you; it’s a well-researched, step-by-step journey to help you navigate the complexities of options day trading.

By the end of this guide, you’ll have a solid understanding of what makes an effective options day trading course, the tools you need, and how to avoid common pitfalls. Think of it as your personal cheat sheet to trading success. Ready? Let’s get started!

- Best Remoteiot Vpc Ssh Raspberry Pi Free Your Ultimate Guide

- Vegamovies Archive Your Ultimate Destination For Streaming Movies

Why an Options Day Trading Course Matters

Let’s face it—trading options without proper knowledge is like wandering into a maze blindfolded. An options day trading course is your map, your compass, and your guide all rolled into one. But why exactly does it matter? Well, let me break it down for ya:

- It gives you a structured approach to learning, which is crucial in such a fast-paced environment.

- You’ll gain access to expert insights and strategies that can take years to develop on your own.

- It helps you avoid costly mistakes by teaching you the dos and don’ts of options trading.

And let’s not forget, the right course can boost your confidence. You’ll feel more prepared to tackle the market head-on, knowing you’ve got the skills to back you up. So, yeah, it’s kinda a big deal.

What to Look for in an Options Day Trading Course

Not all courses are created equal, my friend. When you’re shopping around for an options day trading course, there are a few key things you need to keep an eye out for. Here’s the lowdown:

- Lara Rose Leak The Untold Story Behind The Viral Sensation

- Buscar Kid And His Mom A Heartwarming Story Thats Captured Hearts Around The Globe

Expertise and Reputation

First things first, check out who’s behind the course. Are they legit? Do they have a solid track record in options trading? You want someone who’s not just talking the talk but has walked the walk. Think of it like hiring a personal trainer—if they’ve never lifted a weight, would you trust them to guide you?

Comprehensive Curriculum

A good options day trading course should cover the basics and then some. Look for one that dives deep into:

- Understanding options contracts

- Identifying market trends

- Developing trading strategies

- Risk management techniques

And don’t forget, practical examples and case studies are a must. Theory’s great, but you need real-world scenarios to truly grasp the concepts.

Interactive Learning

Learning doesn’t have to be boring, right? An awesome options day trading course will offer interactive elements like quizzes, simulations, and live trading sessions. These tools help reinforce what you’ve learned and make the whole process more engaging.

Top Options Day Trading Courses to Consider

Now that you know what to look for, let’s talk about some of the top options day trading courses out there. Spoiler alert—they’re not all created equal. Here’s a quick rundown:

Course A: The Ultimate Options Trading Bootcamp

This one’s a favorite among traders. It boasts a comprehensive curriculum, expert instructors, and a ton of interactive features. Plus, it’s got a killer reputation in the trading community. If you’re serious about leveling up your skills, this could be the one for you.

Course B: Day Trading Mastery

Another solid choice, this course focuses heavily on risk management and strategy development. It’s perfect for traders who want to build a strong foundation before diving into the market. The instructors are legit pros, and the course materials are top-notch.

Course C: Options Trading Simplified

If you’re looking for something a bit more beginner-friendly, this one’s worth checking out. It breaks down complex concepts into easy-to-understand chunks, making it ideal for newbies. Plus, it’s pretty affordable compared to some of the other options out there.

Understanding the Basics of Options Trading

Before you jump into an options day trading course, it’s crucial to have a solid understanding of the basics. Think of it like building a house—you need a strong foundation to support the structure. Here’s what you need to know:

What Are Options?

In simple terms, options give you the right, but not the obligation, to buy or sell a stock at a specific price within a certain timeframe. They’re like a contract between two parties, and they can be used for speculation or hedging.

Types of Options

There are two main types of options:

- Call Options: Give you the right to buy a stock at a set price.

- Put Options: Give you the right to sell a stock at a set price.

Understanding the difference between these two is key to making informed trading decisions.

Key Terminology

Let’s not forget the lingo. Here are a few terms you’ll encounter in any options day trading course:

- Premium: The price you pay for the option.

- Strike Price: The price at which you can buy or sell the underlying asset.

- Expiration Date: The deadline by which the option must be exercised.

Getting familiar with these terms will make your learning journey smoother and more enjoyable.

Developing a Winning Trading Strategy

Having a solid strategy is like having a game plan in sports. Without it, you’re just winging it, and that’s a recipe for disaster. Here’s how to develop a winning strategy:

Identify Your Goals

What do you want to achieve with your options trading? Are you looking to make quick profits, or are you more focused on long-term gains? Knowing your goals will help shape your strategy.

Analyze Market Trends

Understanding market trends is crucial. Look for patterns, keep an eye on economic indicators, and stay informed about news that could impact the market. This will help you make more informed trading decisions.

Set Risk Management Rules

Risk management is non-negotiable. Set clear limits on how much you’re willing to lose on a single trade, and stick to them. It’s better to walk away with a small loss than to risk everything in one go.

Common Mistakes to Avoid in Options Day Trading

Even the best traders make mistakes. The key is learning from them and not repeating them. Here are a few common pitfalls to watch out for:

Overtrading

It’s tempting to jump into every trade that looks promising, but overtrading can be disastrous. Stick to your strategy and avoid the temptation to chase quick profits.

Ignoring Stop Losses

Stop losses are your safety net. Ignoring them is like driving without a seatbelt—risky business. Always set stop losses and have an exit plan for every trade.

Underestimating the Market

The market’s unpredictable, and underestimating it can cost you big time. Stay informed, stay alert, and never assume you’ve got it all figured out.

Tools and Resources for Successful Options Day Trading

Having the right tools is like having the right gear for a sport. They can make all the difference. Here are a few must-haves:

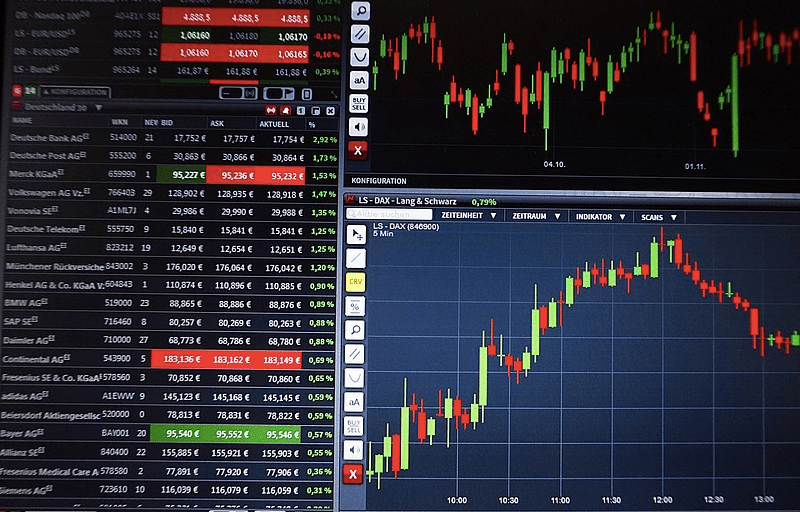

Trading Platforms

Choose a reliable trading platform that suits your needs. Look for features like real-time data, customizable charts, and easy-to-use interfaces. Some popular options include Thinkorswim, TD Ameritrade, and E*TRADE.

Charting Software

Charting software helps you visualize market trends and identify patterns. Tools like TradingView and MetaTrader are great options for both beginners and seasoned traders.

News and Analysis

Stay informed with the latest news and analysis. Websites like Bloomberg, Reuters, and CNBC are excellent resources for staying up-to-date on market developments.

Success Stories: Real-Traders, Real-Results

Hearing about success stories can be a huge motivator. Let’s take a look at a few traders who’ve crushed it in the options day trading world:

Trader A: From Rookie to Pro

Trader A started with a small account and no experience. After enrolling in an options day trading course, they developed a solid strategy and turned their small account into a six-figure portfolio. Discipline and consistency were key to their success.

Trader B: Mastering Risk Management

Trader B was all about risk management. They set strict rules for themselves and stuck to them no matter what. This approach helped them avoid major losses and steadily grow their account over time.

Future Trends in Options Day Trading

Like any industry, options trading is constantly evolving. Here are a few trends to watch out for:

Increased Use of AI and Machine Learning

AI and machine learning are revolutionizing the way traders analyze data and make decisions. Expect to see more courses incorporating these technologies in the near future.

Focus on Sustainability

As investors become more conscious of their environmental impact, sustainable trading practices are gaining traction. Look for courses that emphasize ethical trading and responsible investing.

Conclusion: Take the Leap and Start Your Options Day Trading Journey

So, there you have it—a comprehensive guide to options day trading courses. By now, you should have a clear idea of what to look for in a course, the basics of options trading, and how to develop a winning strategy. Remember, success in options trading isn’t about getting lucky—it’s about being informed, disciplined, and strategic.

Now it’s your turn to take action. Enroll in a course, start practicing, and don’t be afraid to make mistakes along the way. Every great trader started as a beginner, and with the right tools and mindset, you can achieve greatness too. So, what are you waiting for? Let’s make it happen!

Table of Contents

Master the Art of Options Day Trading: A Comprehensive Course Guide

Why an Options Day Trading Course Matters

What to Look for in an Options Day Trading Course

Top Options Day Trading Courses to Consider

Understanding the Basics of Options Trading

Developing a Winning Trading Strategy

Common Mistakes to Avoid in Options Day Trading

Tools and Resources for Successful Options Day Trading

Success Stories: Real-Traders, Real-Results

Future Trends in Options Day Trading

Conclusion: Take the Leap and Start Your Options Day Trading Journey

- Hdhub4uearth Your Ultimate Destination For Highquality Entertainment

- Anna Malygon Onlyfans The Untold Story Behind Her Rise To Fame

TRADING COURSE's PDF Day Trading Option (Finance)

Day Trading Options Rules, Strategy and Brokers for intraday options

Courses Theme Options Trading