Negative P/E Ratio Meaning: What It Really Tells You About A Company

Ever wondered why some stocks have a negative P/E ratio and what that means for your investment? If you're diving into the world of finance, understanding the negative P/E ratio meaning is crucial. This figure can be a red flag or a hidden gem, depending on how you interpret it. So, let's break it down and uncover the secrets behind this mysterious number.

Investing in the stock market isn’t just about picking stocks that look good on paper. It’s about understanding the numbers behind those stocks, and one of the most important numbers is the P/E ratio—or price-to-earnings ratio. But what happens when that number turns negative? Does it mean the company is doomed, or is there more to the story?

This article will guide you through everything you need to know about negative P/E ratios. We’ll cover the basics, dive into the details, and help you understand how this metric fits into your investment strategy. So, buckle up and let’s get started!

- Sophia Rain Xxx A Comprehensive Look At The Rising Star

- Exploring The World Of Diva Flawless Nudes Unveiling Secrets Behind The Scenes

What is a P/E Ratio?

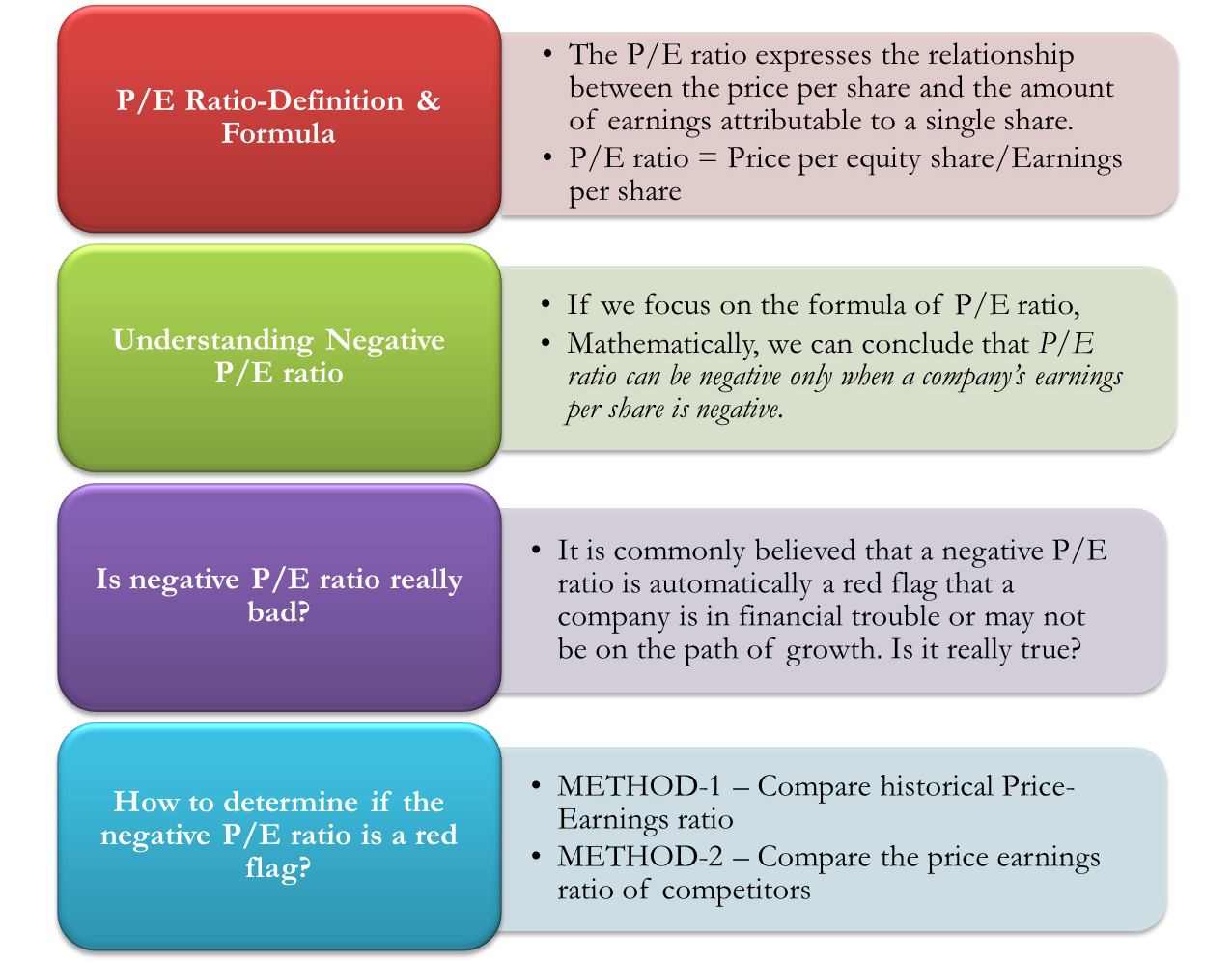

Before we dive into the negative side of things, let’s first understand what a P/E ratio is. The P/E ratio is essentially a way to measure how much investors are willing to pay for each dollar of a company's earnings. It’s calculated by dividing the current market price per share by the company's earnings per share (EPS). A lower P/E ratio might indicate that a stock is undervalued, while a higher one could mean it’s overvalued.

Why is the P/E Ratio Important?

The P/E ratio is a key indicator for investors because it helps them gauge the value of a stock. It provides insight into how the market perceives a company’s future growth potential. For instance, a high P/E ratio might suggest that investors expect significant growth, while a low P/E ratio could indicate that the market has low expectations for the company.

What Does a Negative P/E Ratio Mean?

A negative P/E ratio occurs when a company reports negative earnings, meaning it has lost money over a specific period. This can happen for a variety of reasons, such as one-time expenses, restructuring costs, or simply poor financial performance. When a company’s earnings are negative, the P/E ratio becomes negative as well.

- Amanda Cerny Onlyfans The Ultimate Guide To Her Success And Impact

- Subhashree Sahu Xxx Debunking Myths And Exploring The Truth

Why Would a Company Have Negative Earnings?

- **Economic Downturns**: During tough economic times, companies may struggle to generate profits.

- **High Costs**: Some companies invest heavily in research and development, which can lead to short-term losses.

- **Market Competition**: Intense competition can lead to price wars, reducing profitability.

- **Strategic Decisions**: Companies might choose to expand rapidly, incurring losses in the short term for long-term gains.

Is a Negative P/E Ratio Always Bad?

Not necessarily. While a negative P/E ratio can be a warning sign, it’s not always a death sentence for a company. Some companies, especially in high-growth industries like technology, may report negative earnings as they focus on expanding their market share. These companies might not be profitable yet, but they could have a bright future ahead.

When Can a Negative P/E Ratio Be a Good Thing?

- **Growth Potential**: If a company is investing heavily in its future, a negative P/E ratio might be a sign of aggressive growth strategies.

- **Industry Norms**: In certain industries, it’s common for companies to operate at a loss initially before turning a profit.

- **Temporary Setbacks**: Sometimes, a negative P/E ratio is the result of a one-time event that won’t impact the company’s long-term viability.

How to Interpret a Negative P/E Ratio

Interpreting a negative P/E ratio requires a deeper dive into the company’s financial statements. It’s important to look beyond just the ratio and consider other factors such as revenue growth, cash flow, and overall financial health. Here are a few things to keep in mind:

Key Factors to Consider

- **Revenue Growth**: Is the company generating increasing revenue despite its losses?

- **Cash Flow**: Does the company have strong cash flow to sustain its operations?

- **Debt Levels**: How much debt does the company have, and can it manage it effectively?

- **Management Strategy**: Is the company’s leadership taking steps to turn things around?

Examples of Companies with Negative P/E Ratios

Let’s take a look at some real-world examples of companies with negative P/E ratios. These examples can help illustrate how a negative P/E ratio doesn’t always mean a company is in trouble.

Tesla: A Case Study

Tesla, the electric car giant, has had its fair share of negative P/E ratios over the years. However, investors have continued to flock to the stock because of its massive growth potential. Despite reporting losses in some quarters, Tesla has consistently shown strong revenue growth and innovative product development. This has kept investors optimistic about its future.

How to Use Negative P/E Ratios in Your Investment Strategy

Using negative P/E ratios effectively requires a strategic approach. Here are a few tips to help you incorporate this metric into your investment decisions:

Strategic Tips

- **Do Your Homework**: Always dig deeper into a company’s financials before making any investment decisions.

- **Look for Patterns**: Analyze historical data to identify trends and patterns in the company’s performance.

- **Consider the Industry**: Some industries naturally have higher or lower P/E ratios, so it’s important to compare apples to apples.

- **Stay Informed**: Keep up with the latest news and developments in the company and its industry.

Common Misconceptions About Negative P/E Ratios

There are several misconceptions about negative P/E ratios that can lead investors astray. Let’s debunk a few of these myths:

Myth vs. Reality

- **Myth**: A negative P/E ratio always means a company is failing.

- **Reality**: A negative P/E ratio can indicate a company is investing in its future growth.

- **Myth**: Companies with negative P/E ratios are bad investments.

- **Reality**: Some of the most successful companies started with negative P/E ratios.

Expert Insights on Negative P/E Ratios

To get a better understanding of negative P/E ratios, we spoke with financial experts who shared their insights. One expert noted, “A negative P/E ratio isn’t necessarily a bad thing. It’s important to look at the bigger picture and understand the company’s overall financial health.”

Data and Statistics

According to a study by the Financial Times, companies with negative P/E ratios have outperformed the market in certain sectors over the past decade. This suggests that investors who are willing to take a chance on these companies can reap significant rewards.

Final Thoughts on Negative P/E Ratio Meaning

In conclusion, the negative P/E ratio meaning isn’t as straightforward as it might seem. While it can be a red flag, it can also be a sign of a company’s potential for growth. The key is to look beyond the ratio and consider all the factors that contribute to a company’s financial health.

So, the next time you come across a stock with a negative P/E ratio, don’t dismiss it outright. Instead, take the time to do your research and see if it might be a hidden gem waiting to shine. And remember, investing is all about taking calculated risks. Keep learning, stay informed, and most importantly, trust your instincts.

Feel free to leave a comment below sharing your thoughts on negative P/E ratios or ask any questions you might have. Don’t forget to share this article with your fellow investors, and check out our other articles for more insights into the world of finance.

Table of Contents

- What is a P/E Ratio?

- Why is the P/E Ratio Important?

- What Does a Negative P/E Ratio Mean?

- Why Would a Company Have Negative Earnings?

- Is a Negative P/E Ratio Always Bad?

- When Can a Negative P/E Ratio Be a Good Thing?

- How to Interpret a Negative P/E Ratio

- Examples of Companies with Negative P/E Ratios

- How to Use Negative P/E Ratios in Your Investment Strategy

- Common Misconceptions About Negative P/E Ratios

- Expert Insights on Negative P/E Ratios

- Jailyne Ojeda Nude Unveiling The Truth Behind The Controversy

- Why Divaflawless Onlyfans Is Taking The Internet By Storm

Negative P/E Ratio Really a Red Flag?

Negative P/E Ratio Definition and What It Shows Stock Analysis

Negative P/E Ratio Definition and What It Shows Stock Analysis