Best Leading Indicators: The Ultimate Guide To Predicting Economic Success

Ever wonder how economists and business leaders seem to have a crystal ball when it comes to predicting the future of the economy? Well, the secret lies in the best leading indicators. These powerful tools are like the weather forecast for the financial world, helping us anticipate what’s coming next. Imagine being able to peek into the future of your business or investment opportunities—sounds pretty cool, right? But before we dive into the nitty-gritty, let’s break it down for ya. Leading indicators are basically early warning signs that give us clues about where the economy is headed. And trust me, knowing these can make all the difference in your decision-making game.

Now, you might be thinking, why should I care about leading indicators? Well, here's the deal. Whether you're a small business owner, a stock market enthusiast, or just someone trying to make smart financial decisions, understanding these indicators can help you stay ahead of the curve. They’re like the insider tips that let you know if it’s time to buckle up or if the economic skies are about to clear up. So, if you're ready to level up your financial IQ, stick around because we’re about to drop some serious knowledge.

Before we get too deep into the world of leading indicators, let’s clear up a common misconception. These aren’t just random numbers or stats thrown around by economists. They’re carefully selected metrics that have proven time and again to be reliable predictors of economic trends. Think of them as the superheroes of data, swooping in to save the day by giving us a heads-up on what’s coming next. So, buckle up because we’re about to take a deep dive into the best leading indicators that can make all the difference in your financial strategy.

- Abby Berner Nudes The Truth Behind The Clickbait And Sensationalism

- Maplestars The Ultimate Guide To Unlocking Their Charisma And Achieving Stardom

What Are the Best Leading Indicators?

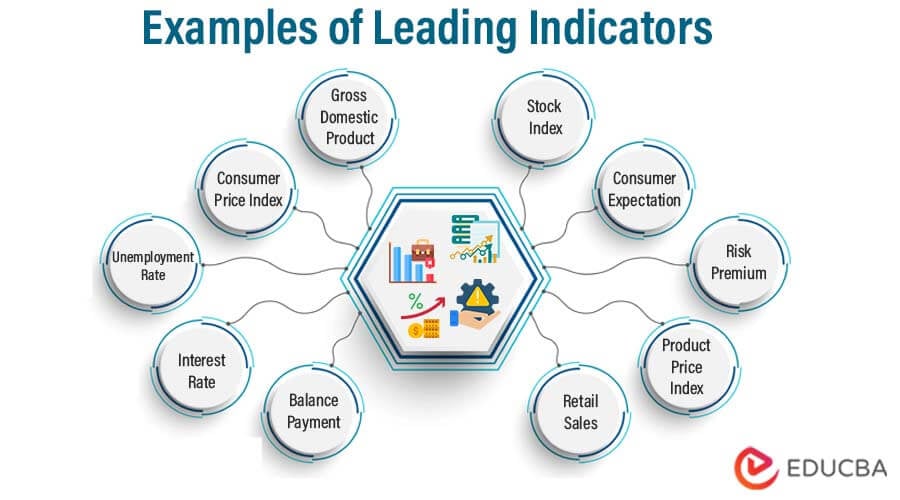

Alright, so now that we’ve got the basics down, let’s talk about the cream of the crop—the best leading indicators that every savvy investor and business owner should know. These indicators aren’t just some random numbers; they’re carefully chosen metrics that have been shown to give us a pretty accurate glimpse into the future of the economy. Here’s a quick rundown of some of the top contenders:

- Stock Market Trends: The stock market is often seen as a leading indicator because it reflects investor confidence and expectations for the future. When the market is up, it usually means people are optimistic about the economy.

- Building Permits: This one’s a bit more specific, but it’s super important. Building permits are a sign of future construction activity, which can indicate economic growth. More building usually means more jobs and more economic activity.

- Consumer Confidence Index (CCI): This measures how confident consumers are about the economy. If people feel good about their financial situation, they’re more likely to spend money, which drives economic growth.

- Manufacturing Orders: Orders for durable goods, especially big-ticket items like cars and appliances, can signal future economic activity. If companies are getting a lot of orders, it means they’ll need to ramp up production, which can boost the economy.

These indicators, among others, are the key players in the world of economic forecasting. They’re like the canaries in the coal mine, giving us early warning signs of what’s to come. So, whether you’re a seasoned pro or just starting out, knowing these indicators can help you make smarter decisions.

Why Are Leading Indicators Important?

So, why exactly do these leading indicators matter so much? Well, imagine you’re navigating a ship through stormy waters. Wouldn’t it be great to have a radar system that tells you where the rocks are before you hit them? That’s essentially what leading indicators do for the economy. They help us anticipate potential challenges and opportunities, allowing us to adjust our course accordingly.

- Drew Gulliver Onlyfans Your Ultimate Guide To The Creatorrsquos Rise And Content

- Zulma Aponte Shimkus A Rising Star In The Spotlight

1. Early Warning System

One of the main reasons leading indicators are so important is that they act as an early warning system. By monitoring these indicators, businesses and investors can prepare for potential economic downturns or take advantage of upcoming opportunities. It’s like having a weather forecast that tells you when to bring an umbrella or when it’s safe to head to the beach.

2. Strategic Planning

Leading indicators also play a crucial role in strategic planning. Whether you’re a small business owner trying to decide if it’s time to expand or an investor looking to make the next big move, these indicators can help guide your decisions. They provide valuable insights into where the economy is headed, allowing you to plan accordingly and stay ahead of the competition.

How to Use Leading Indicators Effectively

Okay, so now you know what leading indicators are and why they’re important, but how do you actually use them? Here’s where things get a little more hands-on. To get the most out of these indicators, you need to know how to interpret them and apply them to your specific situation. Here are some tips to help you use leading indicators effectively:

- Stay Informed: Keep an eye on the latest data and trends. Subscribe to economic reports and stay updated on news that could impact the indicators you’re tracking.

- Combine Indicators: Don’t rely on just one indicator. Use a combination of indicators to get a more complete picture of the economic landscape.

- Set Benchmarks: Establish benchmarks for each indicator so you can easily spot trends and changes over time. This will help you identify when it’s time to take action.

- Be Proactive: Use the insights you gain from leading indicators to make proactive decisions. Whether it’s adjusting your investment strategy or planning for expansion, being proactive can give you a competitive edge.

By following these tips, you can harness the power of leading indicators to make informed decisions that can drive your business or investment portfolio to success.

Top 5 Best Leading Indicators for Economic Forecasting

Now, let’s narrow it down to the top 5 best leading indicators that are most commonly used for economic forecasting. These indicators have stood the test of time and are widely regarded as some of the most reliable predictors of economic trends. Here they are:

1. Initial Jobless Claims

Initial jobless claims are a weekly report that shows how many people have filed for unemployment benefits for the first time. This indicator is a great early warning sign of economic trouble because a sudden increase in jobless claims can signal an impending economic downturn.

2. Purchasing Managers’ Index (PMI)

The PMI measures the level of activity in the manufacturing and service sectors. It’s a great indicator of economic health because it reflects the confidence of business leaders. A PMI above 50 indicates expansion, while a PMI below 50 indicates contraction.

3. Money Supply (M2)

The money supply, specifically M2, measures the total amount of money in circulation. An increase in the money supply can stimulate economic growth, while a decrease can lead to a slowdown. This indicator is closely watched by economists and policymakers.

4. Stock Market Indexes

As we mentioned earlier, stock market indexes are often seen as leading indicators because they reflect investor confidence. While they’re not a perfect predictor, they can provide valuable insights into the overall sentiment of the market.

5. Consumer Confidence Index (CCI)

The CCI measures how confident consumers are about the economy. It’s a great indicator of future consumer spending, which is a major driver of economic growth. When consumer confidence is high, people are more likely to spend money, which can boost the economy.

Common Misconceptions About Leading Indicators

There are a few common misconceptions about leading indicators that can trip people up if they’re not careful. Let’s clear up a couple of these myths so you can use leading indicators more effectively:

- They’re Always Accurate: While leading indicators are generally reliable, they’re not foolproof. Economic forecasting is not an exact science, and there are always variables that can throw things off. It’s important to use leading indicators as part of a broader analysis rather than relying on them exclusively.

- They Work the Same for Everyone: Different indicators may be more or less relevant depending on your specific situation. For example, a small business owner might find building permits more relevant than a stock market investor. Tailor your use of leading indicators to your specific needs and goals.

By being aware of these misconceptions, you can avoid common pitfalls and make better use of leading indicators in your decision-making process.

Real-World Applications of Leading Indicators

So, how do leading indicators play out in the real world? Let’s look at a couple of examples to see how they’ve been used effectively:

Case Study: The 2008 Financial Crisis

Leading up to the 2008 financial crisis, several leading indicators were flashing warning signs. Initial jobless claims were on the rise, and the PMI was showing signs of contraction. Unfortunately, many people ignored these warnings until it was too late. This highlights the importance of paying attention to leading indicators and taking action when necessary.

Case Study: Tech Boom of the Late 90s

On the flip side, leading indicators were instrumental in predicting the tech boom of the late 90s. Stock market indexes were soaring, and consumer confidence was high. Businesses that recognized these signs and invested in technology early were able to capitalize on the boom and achieve tremendous success.

Challenges in Using Leading Indicators

While leading indicators are incredibly useful, they do come with some challenges. Here are a few things to keep in mind:

- Data Lag: Some indicators have a data lag, meaning the information isn’t available in real-time. This can make it difficult to respond quickly to changes in the economic landscape.

- Complexity: Understanding and interpreting leading indicators can be complex, especially for those without a background in economics. It’s important to seek out reliable sources and, if necessary, consult with experts to ensure you’re using the indicators effectively.

Despite these challenges, the benefits of using leading indicators far outweigh the drawbacks. With a little effort and the right resources, anyone can learn to use these powerful tools to their advantage.

Conclusion: The Power of Leading Indicators

So, there you have it—the lowdown on the best leading indicators and how they can help you predict economic success. By understanding and using these indicators effectively, you can make smarter decisions that can drive your business or investment portfolio to new heights. Remember, the key is to stay informed, combine indicators for a more complete picture, and be proactive in your approach.

Now, it’s your turn. Take what you’ve learned and start incorporating leading indicators into your decision-making process. And don’t forget to share this article with your friends and colleagues so they can benefit from the knowledge too. Together, we can all become smarter, more informed players in the world of economics. So, what are you waiting for? Dive in and start predicting the future!

Table of Contents

- Best Leading Indicators: The Ultimate Guide to Predicting Economic Success

- What Are the Best Leading Indicators?

- Why Are Leading Indicators Important?

- How to Use Leading Indicators Effectively

- Top 5 Best Leading Indicators for Economic Forecasting

- Common Misconceptions About Leading Indicators

- Real-World Applications of Leading Indicators

- Challenges in Using Leading Indicators

- Conclusion: The Power of Leading Indicators

- Breckie Hill Erome The Ultimate Guide To This Rising Star

- Unblocked Games Your Ultimate Guide To Fun And Entertainment

Examples of Leading Indicators PDF Occupational Safety And Health

47 Leading Indicators You Can Use PDF Financial Markets Technical

Leading Indicators Meaning, Examples, Benefits and How it Works?