Mastering Classes In Stock Market: Your Ultimate Guide To Success

Let’s be real here, folks. The stock market can feel like a rollercoaster ride—sometimes thrilling, sometimes terrifying, but always full of opportunities. If you’re diving into the world of "classes in stock market," you’ve come to the right place. We’re about to break down everything you need to know, from the basics to the nitty-gritty details. So, grab your favorite drink, and let’s get started!

Now, you might be wondering, what exactly are these "classes in stock market"? Well, buckle up because we’re about to take you on a journey through the different types of stocks, their characteristics, and how they can impact your investment strategy. Whether you’re a newbie or a seasoned player, understanding stock classes is crucial for making informed decisions.

Here’s the deal: the stock market isn’t just one big blob of stocks. It’s divided into different classes, each with its own set of rules and benefits. By the end of this article, you’ll have a solid grasp of these classes and how they fit into your financial goals. So, let’s dive in and make some money moves!

- The Untold Story Of Richard Leete Robbins Net Worth From Humble Beginnings To Financial Success

- Gina Wap The Queen Of Urban Rhythms And Bold Lyrics

Why Understanding Classes in Stock Market Matters

Let’s face it, folks. The stock market can be a jungle, and without the right knowledge, you’re just another tourist wandering around lost. Understanding "classes in stock market" is like having a map to navigate this complex world. It helps you identify which stocks align with your investment goals and risk tolerance.

Think of it this way: different stock classes are like different teams in a game. Some teams play offense, some play defense, and some are all-around powerhouses. Knowing which team to root for can make all the difference in your portfolio’s performance.

Here’s the kicker: understanding stock classes isn’t just about knowing the names. It’s about understanding what each class represents, how it behaves, and how it can impact your financial future. So, whether you’re looking to grow your wealth or protect your assets, having a clear understanding of stock classes is essential.

- Maine Cabin Masters Death The Untold Story Behind The Tragedy

- Karlye Taylor Nudes Separating Facts From Fiction And Exploring The Bigger Picture

Breaking Down the Different Classes in Stock Market

Alright, let’s get into the meat and potatoes. The stock market is divided into several classes, each with its own unique features. Here’s a quick rundown:

- Common Stock: Think of this as the bread and butter of the stock market. Common stockholders have voting rights and can participate in company decisions. Plus, they get a slice of the profits in the form of dividends.

- Preferred Stock: Now, this is where things get interesting. Preferred stockholders don’t have voting rights, but they get priority when it comes to dividend payouts. Think of them as the VIPs of the stock market.

- Growth Stocks: These are the high-flyers of the stock world. Companies with growth stocks are expected to grow at an above-average rate compared to the market.

- Value Stocks: On the flip side, we have value stocks. These are stocks that are undervalued by the market, making them a potential bargain for savvy investors.

Each class has its own set of pros and cons, and understanding them can help you build a diversified portfolio that aligns with your financial goals.

Common Stock: The Backbone of the Market

Let’s talk about common stock. This is the most widely traded class of stock, and for good reason. Common stockholders have voting rights, which means they get a say in major company decisions, like electing the board of directors. Plus, they can benefit from capital appreciation and dividend payments.

But here’s the catch: common stockholders are last in line when it comes to asset distribution. If the company goes belly-up, they might not get anything back. That’s why it’s important to do your homework and invest in companies with strong fundamentals.

Preferred Stock: The VIPs of the Stock Market

Preferred stockholders might not have voting rights, but they get some pretty sweet perks. For starters, they get priority when it comes to dividend payments. This means they’re more likely to receive a steady income stream, even if the company isn’t performing well.

However, preferred stockholders don’t benefit as much from capital appreciation. If the company takes off, their stock value might not increase as much as common stock. It’s a trade-off, but one that can be worth it for income-focused investors.

How to Choose the Right Classes in Stock Market

Choosing the right stock classes can feel overwhelming, especially if you’re new to the game. But don’t worry, we’ve got your back. Here are some tips to help you make the right choices:

- Define Your Goals: Are you looking for growth, income, or capital preservation? Your goals will dictate which stock classes are right for you.

- Assess Your Risk Tolerance: Some stock classes are riskier than others. Make sure you’re comfortable with the level of risk involved before making any investments.

- Do Your Research: Don’t just rely on hearsay. Dive into the company’s financials, management team, and industry trends to make informed decisions.

Remember, there’s no one-size-fits-all solution when it comes to stock classes. What works for one investor might not work for another. It’s all about finding the right balance for your unique situation.

Investing in Classes in Stock Market: Tips and Tricks

Now that you know the different classes in stock market, let’s talk about how to invest in them. Here are some tips to help you get started:

- Start Small: Don’t put all your eggs in one basket. Start with a small investment and gradually increase as you gain confidence.

- Diversify Your Portfolio: Spreading your investments across different stock classes can help mitigate risk and increase potential returns.

- Stay Informed: The stock market is constantly changing. Stay up-to-date with the latest news and trends to make timely investment decisions.

Investing in the stock market can be a rewarding experience, but it requires patience and discipline. Don’t let short-term fluctuations sway your long-term strategy.

Growth Stocks: Riding the Wave

Growth stocks can be exciting, but they come with their own set of challenges. Here’s how to invest in them:

- Look for Innovation: Companies with innovative products or services are more likely to succeed in the long run.

- Check the Management: A strong management team can make all the difference in a company’s success.

- Monitor Performance Metrics: Keep an eye on key performance indicators like revenue growth and profit margins.

Growth stocks can be volatile, but they also offer the potential for significant returns. Just make sure you’re prepared for the ride.

Value Stocks: Finding Hidden Gems

Value stocks might not be as glamorous as growth stocks, but they can be just as rewarding. Here’s how to find them:

- Use Fundamental Analysis: Look for companies with strong fundamentals but low stock prices.

- Watch for Market Corrections: Market downturns can create opportunities to buy undervalued stocks at a discount.

- Be Patient: Value stocks might take time to appreciate, so be prepared to hold onto them for the long haul.

Value investing requires a keen eye and a lot of patience, but it can pay off big time if done right.

Common Mistakes to Avoid When Investing in Classes in Stock Market

Even the best investors make mistakes, but you can avoid some common pitfalls by keeping these tips in mind:

- Chasing Hot Tips: Don’t invest based on rumors or hearsay. Do your own research and make informed decisions.

- Ignoring Diversification: Putting all your money into one stock class can be risky. Spread your investments to minimize risk.

- Letting Emotions Drive Decisions: The stock market can be emotional, but it’s important to stay rational and stick to your strategy.

Mistakes happen, but learning from them can make you a better investor. Keep these tips in mind, and you’ll be well on your way to success.

Data and Statistics: The Numbers Behind Classes in Stock Market

Let’s talk numbers. According to a study by Investopedia, common stocks have historically outperformed other asset classes over the long term. Preferred stocks, on the other hand, offer a steady income stream, with an average dividend yield of around 5-6%.

Growth stocks tend to outperform value stocks during bull markets, but value stocks often shine during market corrections. This highlights the importance of diversifying your portfolio to balance risk and reward.

Conclusion: Your Journey in Classes in Stock Market

Well, there you have it, folks. A comprehensive guide to understanding "classes in stock market." From common stock to preferred stock, growth stocks to value stocks, each class has its own set of characteristics and benefits. By understanding these classes, you can build a diversified portfolio that aligns with your financial goals.

Remember, investing in the stock market requires patience, discipline, and a willingness to learn. Don’t be afraid to make mistakes, but learn from them and adjust your strategy accordingly. And most importantly, have fun! The stock market can be a wild ride, but it’s also an incredible opportunity to grow your wealth.

So, what are you waiting for? Dive into the world of stock classes and start making some money moves. And don’t forget to share this article with your friends and family. Knowledge is power, and the more people know, the better off we all are!

Table of Contents

- Why Understanding Classes in Stock Market Matters

- Breaking Down the Different Classes in Stock Market

- Common Stock: The Backbone of the Market

- Preferred Stock: The VIPs of the Stock Market

- How to Choose the Right Classes in Stock Market

- Investing in Classes in Stock Market: Tips and Tricks

- Growth Stocks: Riding the Wave

- Value Stocks: Finding Hidden Gems

- Common Mistakes to Avoid When Investing in Classes in Stock Market

- Data and Statistics: The Numbers Behind Classes in Stock Market

- Kaitlyn Krems Onlyfans A Deep Dive Into Her Journey Content And Success

- Pineapplebrat Nude A Deep Dive Into The Viral Sensation Facts And Myths

Grow Rich with Stock Market Classes

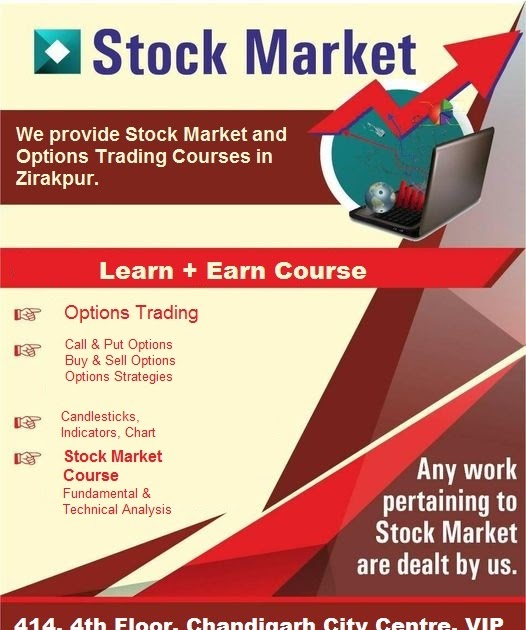

Stock Market Courses STOCK MARKET CLASSES

Pin on Stock market training