Learn About Equity Trading: Your Ultimate Guide To Unlocking Market Potential

Hey there, future trader! Ever wondered what equity trading is all about? In today's fast-paced financial world, understanding how equity trading works can be a game-changer for your financial future. Whether you're a newbie or someone looking to level up their investment skills, this guide has got you covered. We'll dive deep into the ins and outs of equity trading, breaking down complex concepts into bite-sized pieces that even your grandma could understand.

Equity trading might sound intimidating at first, but trust me, it's not as scary as it seems. Think of it like a puzzle where each piece represents a different aspect of the market. By the end of this article, you'll have a clear picture of how everything fits together. Plus, we'll sprinkle in some fun facts and real-life examples to keep things interesting.

So, grab your favorite snack, get comfy, and let's embark on this journey to learn about equity trading. By the time you finish reading, you'll be armed with the knowledge to make informed decisions and potentially grow your wealth. Let's do this!

- Best Remoteiot Vpc Ssh Raspberry Pi Free Your Ultimate Guide

- Avery Leigh Nude A Comprehensive Look Beyond The Clickbait

Here's a quick sneak peek of what we'll cover:

- What is equity trading and why should you care?

- The basics of the stock market

- How to start trading equities like a pro

- Common pitfalls to avoid

- Tips for long-term success

Table of Contents

- What is Equity Trading?

- The Basics of the Stock Market

- How to Start Trading Equities

- Choosing the Right Broker

- Types of Orders in Equity Trading

- Risk Management in Equity Trading

- Common Mistakes to Avoid

- Long-Term Strategies for Success

- Tax Implications of Equity Trading

- Resources for Learning More

What is Equity Trading?

Alright, let's kick things off by answering the million-dollar question: what exactly is equity trading? Simply put, equity trading involves buying and selling shares of publicly listed companies on the stock market. When you buy a share, you're essentially purchasing a small piece of ownership in that company. Cool, right?

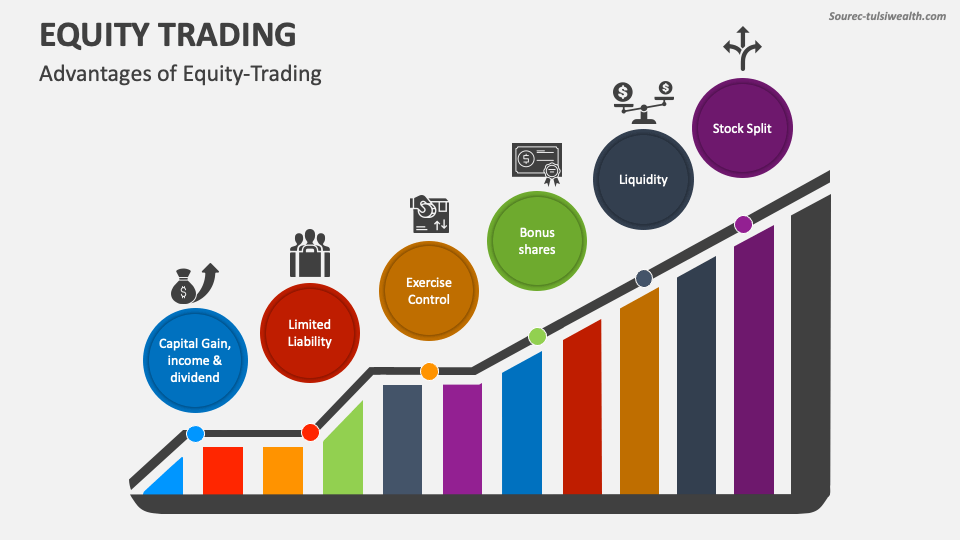

Equity trading offers several advantages, such as the potential for high returns and the ability to diversify your portfolio. However, it also comes with risks, which we'll discuss later. The key to successful equity trading lies in understanding the market, analyzing trends, and making informed decisions.

- Ximena Saenz Naked The Truth Behind The Sensation

- Ali Vitali Jeremy Diamond Split The Inside Scoop Youve Been Waiting For

Why Should You Learn About Equity Trading?

Learning about equity trading can open doors to financial independence and wealth creation. It empowers you to take control of your money and make it work for you. Plus, with the rise of online trading platforms, getting started has never been easier. Whether you're looking to supplement your income or build a retirement fund, equity trading can be a valuable tool in your financial arsenal.

The Basics of the Stock Market

Before we dive deeper into equity trading, let's take a moment to understand the stock market. Think of the stock market as a giant marketplace where buyers and sellers come together to trade shares. It operates much like any other market, but instead of goods, you're trading ownership stakes in companies.

The stock market is influenced by a variety of factors, including economic conditions, political events, and company performance. Understanding these factors can help you anticipate market movements and make smarter trades. For instance, if a company reports strong earnings, its stock price might rise. Conversely, negative news can lead to a drop in price.

Key Players in the Stock Market

- Investors: People like you and me who buy and sell stocks.

- Brokers: Middlemen who facilitate trades between buyers and sellers.

- Exchanges: Platforms where stocks are bought and sold, such as the NYSE and NASDAQ.

- Regulators: Organizations like the SEC that ensure fair trading practices.

How to Start Trading Equities

Ready to take the plunge into equity trading? Here's a step-by-step guide to help you get started:

- Set clear financial goals: Determine what you hope to achieve through equity trading.

- Learn the basics: Educate yourself about the stock market and trading strategies.

- Choose a broker: Find a reliable broker that suits your needs.

- Open a trading account: Sign up for an account and fund it with your initial investment.

- Start small: Begin with a small portfolio and gradually expand as you gain experience.

Remember, patience and discipline are key when starting out. Don't rush into big trades until you're confident in your abilities.

Setting Up Your Trading Account

When setting up your trading account, look for features like low fees, user-friendly interfaces, and access to research tools. Some popular brokers include TD Ameritrade, E*TRADE, and Robinhood. Each has its own strengths, so do your homework before committing.

Choosing the Right Broker

Selecting the right broker is crucial for your trading success. A good broker should offer competitive pricing, reliable customer support, and a wide range of investment options. Additionally, consider the broker's platform features, such as charting tools and real-time data.

Here are some factors to consider when choosing a broker:

- Commission fees: Look for brokers with low or no commission fees.

- Account minimums: Some brokers require a minimum deposit, so choose one that fits your budget.

- Research tools: Access to quality research can enhance your trading decisions.

- Mobile app: A user-friendly mobile app can make trading on the go a breeze.

Popular Brokers for Equity Trading

Some of the top brokers for equity trading include:

- Charles Schwab

- Fidelity Investments

- Interactive Brokers

- Webull

Each of these brokers has its own strengths, so take the time to compare them and find the best fit for your trading style.

Types of Orders in Equity Trading

Understanding the different types of orders is essential for successful equity trading. Here's a quick rundown of the most common ones:

- Market Order: Executes a trade at the current market price.

- Limit Order: Sets a maximum price you're willing to pay or a minimum price you're willing to accept.

- Stop Order: Triggers a trade when the stock reaches a specified price.

- Stop-Limit Order: Combines a stop order with a limit order for more control.

Choosing the right order type depends on your trading goals and risk tolerance. For example, if you want to ensure your trade executes quickly, a market order might be the way to go. On the other hand, if you're concerned about price fluctuations, a limit order could be more appropriate.

Risk Management in Equity Trading

Risk management is a critical component of equity trading. No one likes losing money, so it's important to have strategies in place to minimize potential losses. One effective method is setting stop-loss orders, which automatically sell a stock when it reaches a certain price. This helps protect your capital and prevents emotional decision-making.

Another key aspect of risk management is diversification. Instead of putting all your eggs in one basket, spread your investments across different sectors and asset classes. This reduces the impact of a single stock's poor performance on your overall portfolio.

Common Risk Management Techniques

- Position sizing: Determine the appropriate amount to invest in each stock.

- Portfolio rebalancing: Regularly adjust your portfolio to maintain your desired asset allocation.

- Hedging: Use options or other financial instruments to offset potential losses.

Common Mistakes to Avoid

Even the most experienced traders make mistakes from time to time. However, by being aware of common pitfalls, you can avoid costly errors and improve your trading performance. Here are a few to watch out for:

- Emotional trading: Letting emotions like fear or greed drive your decisions.

- Overtrading: Making too many trades without a solid strategy.

- Ignoring fundamentals: Focusing solely on technical indicators while neglecting company performance.

- Chasing trends: Buying stocks simply because they're popular without doing proper research.

By staying disciplined and sticking to your trading plan, you can sidestep these traps and increase your chances of success.

Long-Term Strategies for Success

If you're in it for the long haul, there are several strategies you can employ to maximize your returns. One popular approach is dollar-cost averaging, where you invest a fixed amount of money at regular intervals, regardless of market conditions. This helps smooth out the effects of market volatility.

Another effective strategy is dividend investing, where you focus on companies that pay regular dividends. These payments can provide a steady stream of income and help grow your wealth over time.

Building a Long-Term Portfolio

When building a long-term portfolio, consider factors like growth potential, dividend yield, and risk tolerance. Diversify your holdings across various sectors and geographic regions to reduce exposure to any one market. Regularly review and adjust your portfolio to ensure it aligns with your evolving financial goals.

Tax Implications of Equity Trading

Don't forget about taxes when it comes to equity trading. Depending on your country of residence, you may be subject to capital gains taxes on your profits. Understanding these tax implications can help you plan your trades more effectively and minimize your tax liability.

Some strategies to consider include tax-loss harvesting, where you sell losing positions to offset gains, and holding stocks for more than a year to qualify for long-term capital gains rates. Consulting with a tax professional can provide valuable insights tailored to your specific situation.

Resources for Learning More

There's always more to learn when it comes to equity trading. Fortunately, there are plenty of resources available to help you deepen your knowledge. Online courses, webinars, and books can provide valuable insights and practical tips. Additionally, joining trading communities or forums can connect you with like-minded individuals and expose you to different perspectives.

Some recommended resources include:

- Investopedia: A comprehensive source for financial education.

- Coursera: Offers courses on finance and investing from top universities.

- TradingView: A platform for charting and analyzing market trends.

By continuously learning and adapting, you can stay ahead of the curve and achieve long-term success in equity trading.

Conclusion

And there you have it, folks! A comprehensive guide to learning about equity trading. From understanding the basics of the stock market to mastering risk management and long-term strategies, you're now equipped with the knowledge to navigate the world of equity trading with confidence.

Remember, success in equity trading doesn't happen overnight. It requires dedication, discipline, and a willingness to learn from both successes and failures. So, keep honing your skills, stay informed, and most importantly, have fun along the way!

Now it's your turn. Share your thoughts in the comments below or check out our other articles for more insights into the world of finance. Happy trading, and may your portfolio grow as big as your dreams!

- Unlock The Power Of Mydesinet Your Ultimate Travel Companion

- Indian Hot Web Series A Spicy Journey Into The World Of Streaming Entertainment

Equity Trading by Company and Instrument 2008 PDF Stocks Market

Anyone can a successful trader. Practice every day, you'll

Equity Trading PowerPoint and Google Slides Template PPT Slides