How Can I Learn The Stock Market? A Beginner’s Guide To Mastering The Game

So, you’re probably sitting there scrolling through your socials, and you see someone flexing about their stock market gains. Like, “I just made $10k in two weeks!” You’re thinking, “Wait, what? How does that even work?” If you’ve ever wondered how can I learn the stock market, you’re not alone. Tons of people are jumping into this world right now, but it’s not as easy as just throwing money at a screen. Let’s break it down for ya.

Learning the stock market isn’t about getting rich overnight. It’s about understanding the rules of the game, knowing what you’re doing, and being smart with your cash. Whether you’re looking to grow your savings, build wealth for the future, or just want to dip your toes in, this guide will walk you through everything you need to know. Think of it like a treasure map for your financial journey.

But hey, before we dive deep, let’s make one thing clear: the stock market isn’t some magical place where money grows on trees. It’s a complex system that requires knowledge, patience, and a little bit of strategy. So, if you’re ready to level up your financial game, buckle up, because we’re about to take you on a ride!

- Ullu Uncut The Hottest Buzzword In Entertainment Thats Got Everyone Talking

- Lara Rose Leaked The Truth Behind The Headlines

Why Should You Care About the Stock Market?

Alright, let’s get real. Why even bother learning the stock market? Well, here’s the deal: the stock market is one of the most powerful tools for building wealth over time. Unlike stashing cash under your mattress or letting it sit in a savings account with tiny interest rates, investing in stocks can help your money grow exponentially. And who doesn’t want that, right?

But it’s not just about making money. Understanding the stock market gives you control over your financial future. Instead of leaving everything to chance, you can actively manage your investments and make informed decisions. Plus, in today’s economy, having some knowledge about stocks can give you a serious edge. It’s like having a superpower in your financial toolkit.

Key Benefits of Learning the Stock Market

- Wealth Accumulation: Stocks have historically outperformed other asset classes, meaning they can help you grow your wealth faster.

- Hedge Against Inflation: Over time, inflation eats away at the value of your money. Stocks can help offset this by providing returns that beat inflation rates.

- Passive Income: Many stocks pay dividends, which means you can earn money just by owning shares. Think of it as your money working for you while you sleep.

- Financial Independence: By learning how to invest wisely, you can build a portfolio that supports your lifestyle and helps you achieve financial freedom.

What Exactly is the Stock Market?

Let’s start with the basics. The stock market is essentially a marketplace where people buy and sell shares of publicly traded companies. When you buy a stock, you’re buying a tiny piece of ownership in that company. For example, if you buy one share of Apple stock, you technically own a small fraction of Apple Inc. Cool, right?

- Layla Jenner Ethnicity A Deep Dive Into Her Roots And Identity

- Amanda Cerny Onlyfans The Ultimate Guide To Her Success And Impact

But here’s the thing: the stock market isn’t just about buying and selling stocks. It’s a dynamic system influenced by a ton of factors, including economic conditions, company performance, and even global events. Understanding how all these pieces fit together is key to becoming a successful investor.

How Does the Stock Market Work?

Here’s a quick breakdown: Companies issue stocks to raise money for things like expansion, research, and development. Investors like you buy these stocks, hoping the company will perform well and the stock price will go up. When that happens, you can sell your shares for a profit. Simple, right?

Of course, there’s always risk involved. Stock prices can go down as well as up, and sometimes companies fail completely. That’s why it’s important to do your research and diversify your investments. You don’t want all your eggs in one basket, ya feel me?

How Can I Learn the Stock Market?

Now, let’s get to the heart of the matter: how can I learn the stock market? The good news is, there are tons of resources out there to help you get started. From online courses to books to mentorship programs, the options are endless. But where do you even begin?

First things first: start with the basics. Learn about key concepts like stocks, bonds, ETFs, and mutual funds. Understand how the market operates and what drives stock prices. Once you’ve got a solid foundation, you can dive deeper into more advanced strategies.

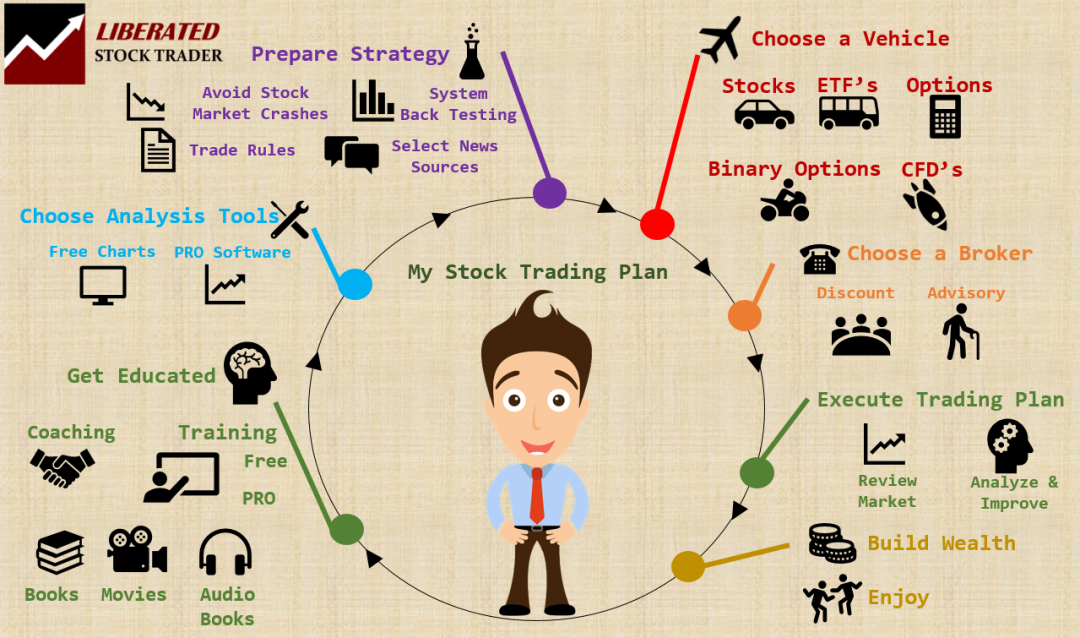

Step-by-Step Guide to Learning the Stock Market

- Read Books: There are some amazing books out there that can teach you everything you need to know. Some popular ones include “The Intelligent Investor” by Benjamin Graham and “A Random Walk Down Wall Street” by Burton Malkiel.

- Take Online Courses: Platforms like Coursera, Udemy, and Investopedia Academy offer courses specifically designed for beginners. These courses often include quizzes, assignments, and interactive tools to help you learn faster.

- Follow Financial News: Stay up-to-date with the latest market trends by following reputable news outlets like Bloomberg, CNBC, and The Wall Street Journal. This will help you understand how current events impact the stock market.

- Practice with a Demo Account: Many brokerage platforms offer demo accounts where you can practice trading with virtual money. It’s a great way to test out different strategies without risking your hard-earned cash.

- Join Investment Clubs: Connecting with other investors can be incredibly valuable. Investment clubs provide a supportive community where you can share ideas, ask questions, and learn from others.

Understanding Key Stock Market Concepts

Before you dive headfirst into the stock market, it’s important to understand some key concepts. These are the building blocks of investing, and mastering them will give you a solid foundation for success.

1. Stocks vs. Bonds

Stocks and bonds are two of the most common types of investments. Stocks represent ownership in a company, while bonds are essentially loans you give to a company or government. Stocks tend to be riskier but offer higher potential returns, while bonds are generally safer but provide lower returns.

2. Diversification

Diversification is all about spreading your investments across different asset classes, sectors, and geographies. This reduces your risk because if one investment performs poorly, others may perform well. Think of it like spreading your bets across multiple horses in a race.

3. Risk vs. Reward

In investing, there’s always a trade-off between risk and reward. High-risk investments have the potential for higher returns, but they also come with a greater chance of loss. Low-risk investments, on the other hand, offer more stability but lower returns. It’s up to you to decide how much risk you’re willing to take.

Common Mistakes to Avoid as a Beginner

As a beginner, it’s easy to make mistakes when learning the stock market. But don’t worry—everyone makes them at first. The key is to learn from your mistakes and avoid repeating them. Here are some common pitfalls to watch out for:

- Emotional Trading: Letting your emotions drive your investment decisions can be disastrous. Stick to a solid strategy and avoid making impulsive moves based on fear or greed.

- Overtrading: Trading too frequently can eat into your profits due to fees and taxes. Try to focus on long-term investments instead of constantly buying and selling.

- Ignoring Fees: Brokerage fees and management fees can add up quickly. Make sure you understand all the costs associated with your investments and choose low-cost options whenever possible.

- Chasing Hot Stocks: Just because a stock is trending doesn’t mean it’s a good investment. Always do your research and analyze the fundamentals before jumping in.

Tools and Resources for Learning the Stock Market

There are tons of tools and resources available to help you learn the stock market. From apps to podcasts to YouTube channels, the possibilities are endless. Here are a few of our favorites:

1. Stock Market Apps

Apps like Robinhood, Acorns, and Stash make it easy to start investing with just a few taps on your phone. They offer user-friendly interfaces, educational content, and even gamified features to keep you engaged.

2. Podcasts

Podcasts are a great way to learn on the go. Some popular stock market podcasts include “The Investors Podcast,” “Marketplace,” and “The Clark Howard Show.” These shows cover a wide range of topics and feature interviews with industry experts.

3. YouTube Channels

YouTube is a treasure trove of free educational content. Channels like Graham Stephan, Ben Felix, and The Financial Diet offer in-depth tutorials, market analysis, and investment tips for beginners.

Building a Solid Investment Strategy

Once you’ve learned the basics, it’s time to start building your investment strategy. This is where you’ll decide how to allocate your money, what types of investments to focus on, and how much risk you’re willing to take. Here are a few tips to help you get started:

1. Set Clear Goals

Before you start investing, it’s important to define your goals. Are you saving for retirement, buying a house, or building wealth for the long term? Your goals will dictate your investment strategy and help you stay focused.

2. Start Small

Don’t feel like you need to invest a ton of money right away. Start small and gradually increase your contributions as you become more comfortable. This will help you build confidence and avoid taking on too much risk too soon.

3. Reinvest Your Dividends

If you invest in dividend-paying stocks, consider reinvesting those dividends back into the market. This allows you to compound your returns over time and grow your portfolio faster.

Conclusion: Take Action and Keep Learning

Alright, that’s the lowdown on how can I learn the stock market. As you can see, there’s a lot to consider, but with the right mindset and resources, anyone can master the game. Remember, the stock market isn’t about getting rich quick—it’s about building wealth over time through smart, informed decisions.

So, what’s next? Start by educating yourself, setting clear goals, and building a solid investment strategy. And most importantly, stay consistent and keep learning. The more you know, the better equipped you’ll be to navigate the ups and downs of the market.

Now, it’s your turn. Share your thoughts in the comments below. What’s one thing you’ve learned about the stock market that you didn’t know before? And don’t forget to share this article with your friends—knowledge is power, after all!

Table of Contents

- Why Should You Care About the Stock Market?

- What Exactly is the Stock Market?

- How Can I Learn the Stock Market?

- Understanding Key Stock Market Concepts

- Common Mistakes to Avoid as a Beginner

- Tools and Resources for Learning the Stock Market

- Building a Solid Investment Strategy

- Conclusion: Take Action and Keep Learning

- Emilianos Wand The Magical Story Behind La Varita De Emiliano

- Paige Bueckers Nude Clearing The Misunderstandings And Focusing On Her Incredible Journey

How Can I Learn The Stock Market?

Learn Stock Market How to Understand Stock Market in India?

Learn About Stock Market