Bearish Cup And Handle Pattern: The Ultimate Guide For Smart Traders

Let's talk about the bearish cup and handle pattern, shall we? If you're diving into the world of trading, this technical analysis tool is a game-changer. Imagine it like a roadmap that helps you predict when stocks or markets are about to tank. But here's the deal: not everyone gets it right. That's why we're breaking it down step by step so you can master it like a pro. This pattern is no joke—it's one of the most reliable indicators for spotting downward trends, but you gotta know what you're doing.

Now, before we dive deep into the nitty-gritty, let’s set the scene. The bearish cup and handle pattern is like the dark knight of chart patterns—it signals a bearish market ahead. It’s not just for stock trading; it works wonders in forex, crypto, and other financial markets too. If you’re serious about trading, understanding this pattern is essential. It’s not just about making money—it’s about protecting your hard-earned cash.

Here’s the kicker: if you ignore this pattern, you might end up on the wrong side of a trade. And trust me, nobody wants that. So buckle up because we’re about to take you on a journey through the ins and outs of the bearish cup and handle pattern. By the end of this, you’ll have the tools and knowledge to spot it, analyze it, and trade it like a seasoned pro.

- Penelope Menchaca Onlyfans The Rise Of A Digital Sensation

- Lara Rose Onlyfans The Ultimate Guide To Her Journey Content And Impact

Let’s get started with a quick overview of what’s coming up:

- What is the Bearish Cup and Handle Pattern?

- How to Identify the Bearish Cup and Handle Pattern

- Key Components of the Bearish Cup and Handle

- Examples of the Pattern in Action

- Developing a Trading Strategy with Bearish Cup and Handle

- Common Mistakes to Avoid

- Tips for Beginners

- The Psychology Behind This Pattern

- Impact on Different Markets

- Conclusion and Next Steps

What is the Bearish Cup and Handle Pattern?

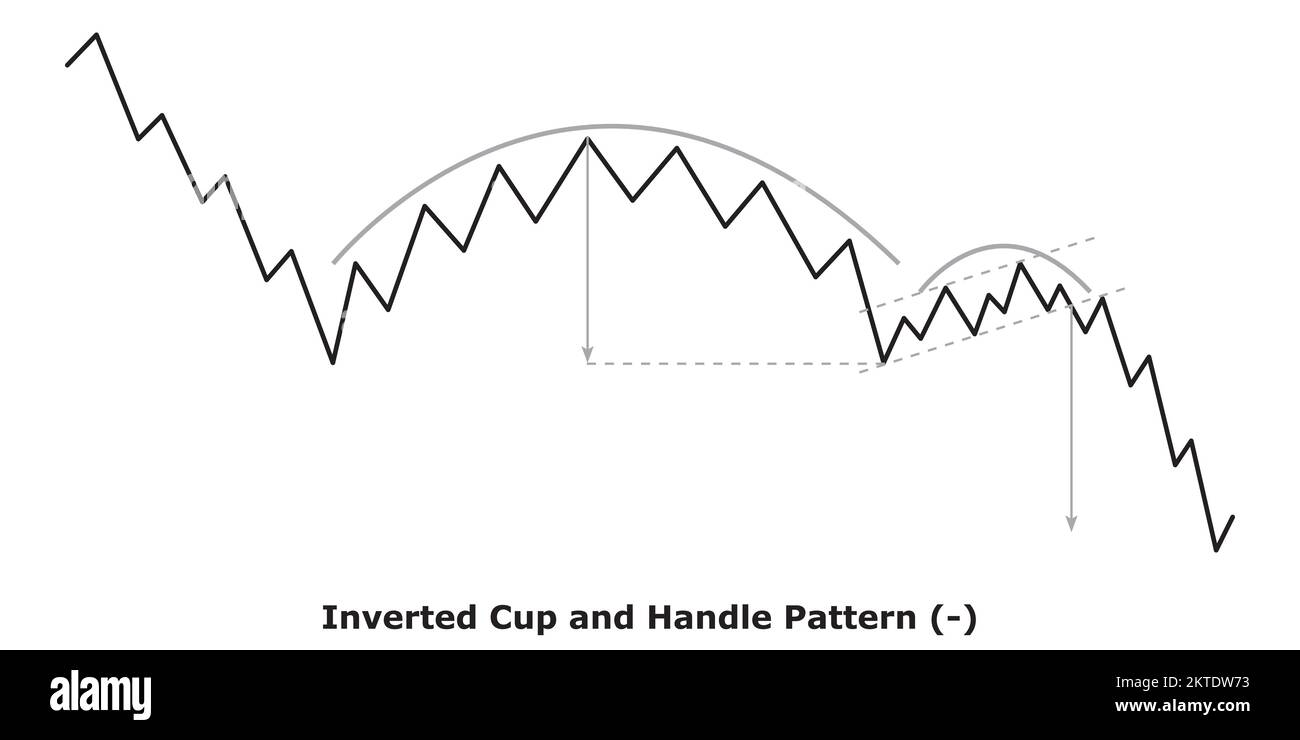

Alright, let’s start with the basics. The bearish cup and handle pattern is essentially a reversal chart pattern that indicates a potential downtrend. Think of it like a U-shaped bowl followed by a small consolidation phase (the handle). It’s kind of like when you’re at a party and everyone’s having fun, but then suddenly the mood shifts, and people start leaving. That’s what this pattern does—it signals a shift in momentum.

Here’s the cool part: this pattern works across all timeframes, from intraday charts to weekly charts. It’s like a Swiss Army knife for traders. The cup part represents a consolidation phase where the price moves sideways or slightly upwards, and the handle is a smaller consolidation phase that confirms the pattern. When the price breaks below the handle, that’s when the fireworks start—prices can plummet.

- Paige Vanzant Leaked The Untold Story And What You Need To Know

- Anjali Arora Viral Video The Story Behind The Sensation

Why Should You Care?

This pattern is not just some random squiggle on a chart; it’s a powerful tool for predicting bearish movements. If you’re a short seller or just someone looking to protect your portfolio, this is gold. It helps you anticipate when a market or stock is about to take a nosedive, giving you a heads-up to either exit positions or go short.

How to Identify the Bearish Cup and Handle Pattern

Now, let’s talk about how to spot this beast. Identifying the bearish cup and handle pattern isn’t rocket science, but it does require some practice. Here’s what you’re looking for:

- A U-shaped cup where the price consolidates after an uptrend.

- A handle that forms after the cup, which is a smaller consolidation phase.

- A breakout below the handle, signaling the start of a downtrend.

Think of it like a bowl of cereal with a spoon stuck in it. The bowl is the cup, and the spoon is the handle. Simple, right? But here’s the thing: the pattern needs to be symmetrical. If the cup is all wonky or the handle is too long, it might not be a valid signal. So, keep an eye out for those details.

Key Characteristics

The bearish cup and handle pattern usually forms after a significant uptrend. The cup should be relatively shallow, and the handle should be a smaller pullback. Ideally, the handle should retrace about 1/3 to 1/2 of the cup’s depth. Anything more than that, and the pattern might lose its predictive power.

Key Components of the Bearish Cup and Handle

Let’s break down the main parts of this pattern:

- Cup: The U-shaped portion where the price consolidates after an uptrend. It should be symmetrical and not too steep.

- Handle: The smaller consolidation phase after the cup. It acts as a confirmation of the pattern.

- Breakout Point: The moment when the price breaks below the handle, signaling the start of a downtrend.

Each component plays a crucial role in the pattern’s validity. If one part is off, the entire pattern might be a false signal. So, pay attention to the details. It’s like baking a cake—if you skip a step, it might not turn out right.

Volume Considerations

Volume is a key factor in confirming the pattern. During the formation of the cup, volume should decrease, indicating less buying pressure. When the price breaks below the handle, volume should pick up, confirming the downtrend. Think of volume as the fuel that powers the pattern—if it’s not there, the pattern might fizzle out.

Examples of the Pattern in Action

Let’s look at some real-world examples to see how this pattern plays out. One classic example is the 2008 financial crisis. Many stocks formed bearish cup and handle patterns just before the market crash. Traders who spotted these patterns were able to short the market and profit from the downturn.

Another example is the cryptocurrency market. Bitcoin has formed several bearish cup and handle patterns over the years, each time signaling a potential correction. If you were paying attention, you could have avoided some major losses—or even made a killing by going short.

Chart Analysis

Here’s a quick breakdown of what you might see on a chart:

- The cup forms after a significant uptrend, with the price consolidating in a U-shape.

- The handle forms as a smaller consolidation phase, often with lower volume.

- The breakout occurs when the price breaks below the handle, usually with increased volume.

It’s like watching a movie—you see the setup, the build-up, and then the climax. Each part of the pattern tells a story, and if you’re paying attention, you can predict the ending.

Developing a Trading Strategy with Bearish Cup and Handle

Now that you know what to look for, let’s talk about how to trade this pattern. The first step is to confirm the pattern. Make sure the cup is symmetrical, the handle is small, and the breakout is supported by volume. Once you’ve confirmed the pattern, it’s time to set up your trade.

Here’s a simple strategy:

- Set a stop-loss above the handle to protect yourself from false breakouts.

- Set a profit target based on the depth of the cup. For example, if the cup is 10% deep, aim for a 10% profit after the breakout.

- Use risk management techniques to ensure you don’t lose more than you can afford.

Remember, trading is all about managing risk. Even if you spot the perfect bearish cup and handle pattern, it’s no guarantee of success. But with the right strategy, you can increase your chances of making profitable trades.

When to Enter and Exit

The ideal entry point is just after the breakout below the handle. This is when the pattern confirms its bearish signal. As for the exit point, it depends on your trading style. If you’re a short-term trader, you might exit after a quick profit. If you’re a long-term trader, you might wait for the downtrend to fully play out.

Common Mistakes to Avoid

Even the best traders make mistakes. Here are a few common ones to watch out for:

- Jumping the Gun: Entering a trade too early before the pattern is fully formed.

- Ignoring Volume: Failing to check volume during the breakout can lead to false signals.

- Overtrading: Trying to trade every pattern you see can lead to burnout and losses.

Trading is a marathon, not a sprint. Take your time, do your research, and don’t let emotions cloud your judgment. It’s like playing poker—you gotta know when to hold ’em and when to fold ’em.

How to Avoid These Mistakes

Here are some tips to help you stay on track:

- Use charting tools to help you identify patterns more accurately.

- Set clear rules for entering and exiting trades, and stick to them.

- Stay disciplined and avoid letting emotions dictate your trading decisions.

Tips for Beginners

If you’re new to trading, here are a few tips to help you get started:

- Start with a demo account to practice without risking real money.

- Focus on one or two markets at first to build your expertise.

- Learn from experienced traders and join online communities to share knowledge.

Trading can be intimidating at first, but with practice and patience, you can master it. It’s like learning to ride a bike—you might fall a few times, but eventually, you’ll get the hang of it.

Building Confidence

Confidence comes with experience. The more you practice, the more comfortable you’ll become with spotting patterns and making trades. But remember, even the best traders have off days. Don’t be too hard on yourself if things don’t go as planned. Learn from your mistakes and keep moving forward.

The Psychology Behind This Pattern

Why does the bearish cup and handle pattern work? It’s all about psychology. Traders tend to follow trends, and when they see a potential reversal, they act accordingly. The cup represents a period of uncertainty, where traders are unsure whether the uptrend will continue. The handle represents a period of consolidation, where traders test the support level. When the price breaks below the handle, it triggers a wave of selling, leading to a downtrend.

It’s like a herd mentality—if one trader sells, others follow suit. That’s why patterns like the bearish cup and handle are so effective. They tap into the collective psychology of the market, making them reliable indicators of future price movements.

Impact on Different Markets

This pattern works across all markets, but its impact can vary. In the stock market, it might signal a correction in a specific stock or sector. In the forex market, it could indicate a shift in currency pairs. In the crypto market, it might predict a major correction in prices.

Each market has its own nuances, so it’s important to understand the specific characteristics of the market you’re trading. But the underlying principle remains the same: the bearish cup and handle pattern is a powerful tool for predicting downtrends.

Adapting to Different Markets

Here’s how you can adapt your strategy to different markets:

- In the stock market, focus on individual stocks or sectors that show strong patterns.

- In the forex market, look for patterns in major currency pairs like EUR/USD or GBP/USD.

- In the crypto market, pay attention to Bitcoin and Ethereum, as they often lead the way.

Remember, flexibility is key. The more you adapt to different markets, the better your chances of success.

Conclusion and Next Steps

There you have it—the ultimate guide to the bearish cup and

- Karlye Taylor Nude The Truth Behind The Controversy And Clickbait

- Breckie Hill Erome The Ultimate Guide To This Rising Star

Bearish Cup and handle pattern for BITSTAMPBTCUSD by cryptoonchain

Inverted Cup and Handle Pattern Bearish () White & Black Bearish

Trading The Bullish & Bearish ‘Cup and Handle’ Pattern Forex Academy