What Makes Stocks Go Up And Down: The Insider Scoop You’ve Been Waiting For

Ever wondered why stock prices feel like a wild rollercoaster ride? You're not alone. Understanding what makes stocks go up and down is like cracking a secret code that everyone's buzzing about. Whether you're a rookie investor or just curious about how the market works, this article dives deep into the forces that drive stock price movements. So buckle up, because we're about to unravel the mystery!

Investing in stocks can be thrilling, but it’s also a bit scary if you don’t know what’s going on behind the scenes. Imagine throwing your money into the stock market without understanding why prices move the way they do. It’s like playing poker blindfolded—you might get lucky, but chances are, you’ll end up losing big time. That’s why learning what makes stocks go up and down is crucial for anyone looking to make smart investment decisions.

This article isn’t just another boring finance lecture. We’re going to break it down in a way that’s easy to digest, fun to read, and packed with actionable insights. From market sentiment to economic factors, we’ll cover everything you need to know. Ready to dive in? Let’s go!

- Marie Temara Leaked The Truth Behind The Controversy

- Why Divaflawless Onlyfans Is Taking The Internet By Storm

Here’s a quick roadmap of what we’ll cover:

- The Basics of Stock Market Movements

- Supply and Demand: The Heart of Stock Price Changes

- Economic Indicators That Impact Stocks

- How Company Performance Affects Stock Prices

- Investor Sentiment: The Emotional Side of Trading

- Global Events and Their Ripple Effects

- Interest Rates: The Silent Market Mover

- Technical Analysis: Patterns and Predictions

- Tips for Investors: Staying Ahead of the Curve

- Wrapping It Up: What You Need to Know

The Basics of Stock Market Movements

Before we dive into the nitty-gritty, let’s get our basics straight. Stocks represent ownership in a company, and their prices fluctuate based on a variety of factors. Think of the stock market as a giant auction where buyers and sellers come together to trade shares. When more people want to buy a stock than sell it, the price goes up. Conversely, when sellers outnumber buyers, the price drops. Simple, right? Well, not exactly.

Understanding Market Dynamics

Market dynamics are influenced by a complex web of factors, including company performance, economic conditions, and investor behavior. For instance, if a company releases impressive quarterly earnings, investors might rush to buy its stock, driving the price higher. On the flip side, negative news, like a scandal or a poor earnings report, can send the stock price tumbling.

- Xxmx The Ultimate Guide To Unlocking The Power Of Xxmx

- Faith Ordway Nude A Comprehensive And Respectful Discussion

It’s also important to note that the stock market doesn’t operate in a vacuum. Global events, political developments, and even social media trends can have a significant impact on stock prices. In today’s interconnected world, what happens in one corner of the globe can ripple through financial markets worldwide.

Supply and Demand: The Heart of Stock Price Changes

Supply and demand is the bread and butter of stock price movements. When demand for a stock exceeds supply, prices rise. Conversely, when supply exceeds demand, prices fall. It’s a simple concept, but the factors influencing supply and demand can be anything but simple.

Factors Affecting Supply and Demand

- Earnings Reports: Strong earnings can increase demand, while weak earnings can lead to selling pressure.

- News and Rumors: Positive news can boost demand, while negative rumors can scare investors away.

- Institutional Investors: Large institutional players, like mutual funds and hedge funds, can significantly impact demand by buying or selling in bulk.

For example, if a tech giant announces a groundbreaking new product, investors might flock to buy its stock, driving up the price. On the other hand, if a company faces a lawsuit or a regulatory issue, investors might dump their shares, causing the price to plummet.

Economic Indicators That Impact Stocks

Economic indicators play a crucial role in shaping stock market movements. From GDP growth to inflation rates, these metrics provide insights into the health of the economy and, by extension, the stock market. Investors closely monitor these indicators to gauge the overall economic environment and make informed decisions.

Key Economic Indicators

- GDP Growth: Strong GDP growth usually signals a healthy economy, which can boost stock prices.

- Inflation Rates: High inflation can erode purchasing power, negatively impacting stocks.

- Unemployment Rates: Low unemployment often correlates with higher consumer spending, which can benefit stocks.

For instance, during periods of economic expansion, companies tend to perform well, leading to rising stock prices. Conversely, during recessions, stock prices often decline as companies struggle with reduced demand and lower profits.

How Company Performance Affects Stock Prices

A company’s performance is one of the most direct factors influencing its stock price. Earnings reports, revenue growth, and profit margins are key metrics that investors use to evaluate a company’s health. Strong performance can lead to rising stock prices, while poor performance can have the opposite effect.

Metrics to Watch

- Earnings Per Share (EPS): Higher EPS indicates better profitability, which can drive stock prices up.

- Revenue Growth: Consistent revenue growth signals a company’s ability to expand its customer base and market share.

- Profit Margins: Higher profit margins suggest efficiency and cost management, which investors love.

Consider a company that consistently beats earnings estimates. Investors are likely to reward it with higher stock prices, as it demonstrates strong financial health and growth potential. However, if a company misses its targets or faces operational challenges, its stock price might take a hit.

Investor Sentiment: The Emotional Side of Trading

Investor sentiment refers to the collective mood of investors in the market. It’s the emotional side of trading that can sometimes overshadow fundamental analysis. When investors are optimistic, they’re more likely to buy stocks, driving prices up. Conversely, when fear takes over, selling pressure can push prices down.

Factors Influencing Investor Sentiment

- News and Media: Headlines can sway investor sentiment, especially if they’re sensational or alarming.

- Political Developments: Elections, policy changes, and geopolitical tensions can impact investor confidence.

- Social Media: Platforms like Twitter and Reddit can amplify trends and influence trading decisions.

Remember the GameStop saga? A group of retail investors on Reddit fueled a massive rally in GameStop’s stock, defying traditional market logic. It’s a prime example of how investor sentiment can drive stock prices, sometimes in unexpected ways.

Global Events and Their Ripple Effects

Global events can have a profound impact on stock prices. From pandemics to natural disasters, these events can disrupt economies, industries, and individual companies. Investors need to stay informed about global developments to anticipate their potential effects on the market.

Examples of Global Events

- Pandemics: The COVID-19 pandemic caused widespread market volatility as businesses shut down and supply chains were disrupted.

- Trade Wars: Tariffs and trade restrictions can hurt companies that rely on international trade.

- Political Unrest: Elections, coups, and protests can create uncertainty, leading to market fluctuations.

During the pandemic, for instance, travel and hospitality stocks were hit hard, while tech and e-commerce stocks soared as people shifted to remote work and online shopping. It’s a testament to how global events can reshape entire industries overnight.

Interest Rates: The Silent Market Mover

Interest rates set by central banks, like the Federal Reserve, play a critical role in influencing stock prices. Lower interest rates make borrowing cheaper, encouraging businesses to invest and expand. This can lead to higher stock prices. Conversely, higher interest rates can slow economic growth, negatively impacting stocks.

How Interest Rates Affect Stocks

- Borrowing Costs: Lower rates reduce borrowing costs for companies, boosting their profitability.

- Consumer Spending: Lower rates encourage consumer spending, benefiting companies in consumer-driven sectors.

- Investment Alternatives: Higher rates make bonds more attractive, potentially drawing investors away from stocks.

When the Fed lowers interest rates, it’s often seen as a positive signal for the economy, leading to rising stock prices. However, if rates are raised too quickly, it can lead to a market correction as investors reassess their portfolios.

Technical Analysis: Patterns and Predictions

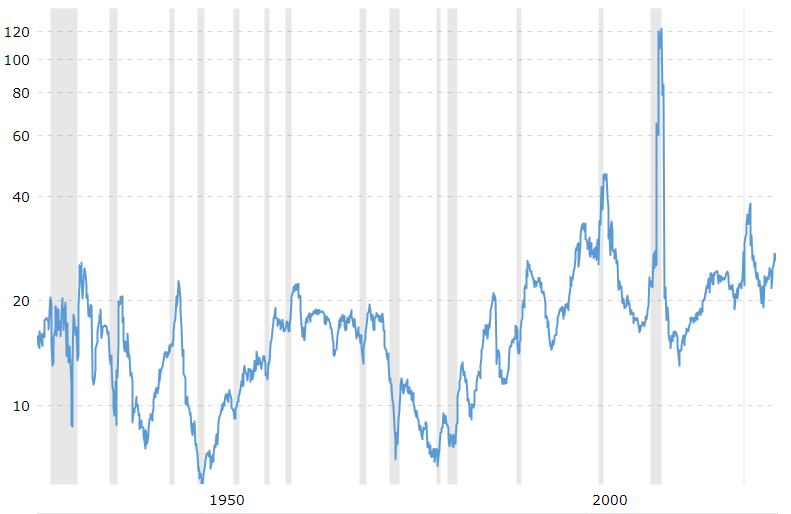

Technical analysis involves studying past market data, primarily price and volume, to predict future price movements. Traders use charts and technical indicators to identify trends and patterns that might signal buying or selling opportunities.

Common Technical Indicators

- Moving Averages: These smooth out price data to form a trend-following indicator.

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

- Support and Resistance Levels: Key price points where a stock might find buying or selling pressure.

While technical analysis isn’t foolproof, it can provide valuable insights into market behavior. For example, if a stock breaks above a key resistance level, it might signal a breakout, attracting more buyers and pushing the price higher.

Tips for Investors: Staying Ahead of the Curve

Investing in stocks requires a combination of knowledge, strategy, and discipline. Here are some tips to help you navigate the ups and downs of the market:

Key Takeaways

- Do Your Research: Understand the companies you invest in and the factors that influence their stock prices.

- Diversify Your Portfolio: Spreading your investments across different sectors and asset classes can reduce risk.

- Stay Informed: Keep up with economic indicators, global events, and company news that might impact your investments.

Remember, the stock market is unpredictable, and no one can predict its movements with 100% accuracy. However, by staying informed and making data-driven decisions, you can increase your chances of success.

Wrapping It Up: What You Need to Know

What makes stocks go up and down is a complex interplay of factors, ranging from company performance and economic indicators to investor sentiment and global events. Understanding these dynamics can help you make smarter investment decisions and navigate the market with confidence.

Here’s a quick recap of what we’ve covered:

- Supply and demand are the driving forces behind stock price movements.

- Economic indicators, company performance, and global events all play a role in shaping the market.

- Investor sentiment can amplify or dampen price movements, sometimes defying traditional logic.

- Interest rates and technical analysis provide additional tools for analyzing market behavior.

So, whether you’re a seasoned investor or just starting out, remember that knowledge is power. Stay informed, stay disciplined, and most importantly, stay curious. And if you found this article helpful, don’t forget to share it with your friends and leave a comment below. Until next time, happy investing!

- Hdhub4uearth Your Ultimate Destination For Highquality Entertainment

- Penelope Menchaca Onlyfans Your Ultimate Guide To Her Content Journey And Success

Stocks go up down up down up down up Page 47 Finance/Investments

Stocks go up down up down up down up Page 49 Finance/Investments

What Makes Stocks Go Up and Down