What Happened To Harshad Mehta: The Untold Story Behind India's Infamous Stock Market Scandal

When we talk about financial scandals, Harshad Mehta's name often pops up in conversations. The story of what happened to Harshad Mehta is not just a tale of greed and ambition but also a reminder of how fragile the financial system can be. Back in 1992, Harshad Mehta was the guy everyone wanted to know—stockbrokers admired him, investors followed his moves, and the media called him the "Big Bull." But then, everything came crashing down, and the world wanted answers. So, what exactly went wrong? Let's dive in!

This isn't just a story about one man's rise and fall; it's a cautionary tale for all of us who dream big but forget to play by the rules. Harshad Mehta's scandal shook the Indian stock market to its core and led to massive reforms. But before we get into the nitty-gritty, let's set the stage. Imagine a time when stock trading wasn't as regulated as it is today. That's the world Harshad Mehta lived in, and that's where our story begins.

Now, if you're wondering why this story matters, well, it's because it's more than just a scandal. It's about how one man's actions could ripple through an entire economy, affecting millions of lives. By the end of this article, you'll have a clear understanding of what happened to Harshad Mehta and the lessons we can learn from his story. So, grab a cup of coffee, and let's get started!

- Amanda Cerny Onlyfans The Ultimate Guide To Her Success And Impact

- Jasi Bae Naked The Truth Behind The Viral Sensation Youve Been Missing

Who Was Harshad Mehta?

Before we talk about what happened to Harshad Mehta, let's take a quick trip down memory lane and meet the man himself. Harshad Mehta wasn't just another stockbroker; he was a legend in the making. Born in 1954 in Bombay, India, Harshad grew up in a middle-class family with dreams as big as the ocean. He started his career in the financial world as a clerk at a brokerage firm, but by the late 1980s, he was already making waves in the stock market.

Harshad was known for his sharp mind and innovative trading strategies. He didn't just play the game; he rewrote the rules. By the early 1990s, he had become one of the most influential figures in the Indian stock market. People called him the "Big Bull," and for a good reason—he was unstoppable. But as they say, all good things must come to an end.

Harshad Mehta's Early Life and Career

Harshad Mehta's journey from a small-time clerk to a stock market tycoon is nothing short of inspiring. He began his career in the late 1970s, working odd jobs in the financial sector. His big break came when he joined a brokerage firm, where he quickly climbed the ranks. By the 1980s, Harshad had already established himself as a force to be reckoned with in the stock market.

- Shanin Blake Leaked The Untold Story Behind The Viral Sensation

- Crazyjamjam Leaks The Inside Story You Need To Know

His trading strategies were unconventional, and he had a knack for spotting opportunities that others missed. Harshad believed in taking risks, and it paid off big time. By the late 1980s, he had amassed a fortune and became a household name in India. But with great power comes great responsibility, and Harshad soon learned that lesson the hard way.

What Happened to Harshad Mehta: The Scandal Begins

By 1992, Harshad Mehta was at the peak of his career. He was the guy everyone wanted to be, and his every move was closely watched. But behind the scenes, something sinister was brewing. Harshad had discovered a loophole in the banking system that allowed him to manipulate the stock market on an unprecedented scale. This is where the story takes a dark turn.

Harshad used a scheme known as the "Ready Forward Deal" to exploit the banking system. In simple terms, he borrowed money from banks using fake receipts and used that money to inflate stock prices. It was a brilliant plan, but like all good things, it couldn't last forever. The bubble eventually burst, and the scandal came to light, leaving a trail of destruction in its wake.

How the Scam Worked

Let's break it down for you. Harshad Mehta's scam was a complex web of deceit and manipulation. Here's how it worked:

- Harshad used fake bank receipts to borrow massive amounts of money from banks.

- He then used this money to buy large quantities of stocks, driving up their prices.

- Once the stock prices were high enough, he sold them off, pocketing the profits.

- This cycle continued for months, with Harshad raking in millions of dollars.

But as they say, every scam has an expiration date. By the time the authorities caught on, the damage was already done. The Indian stock market was in shambles, and Harshad Mehta's name was mud.

The Fallout: What Happened Next?

When the scam came to light, the Indian stock market went into a tailspin. Investors lost billions of dollars, and trust in the financial system was shattered. Harshad Mehta became the face of the scandal, and his fall from grace was swift and brutal. But what exactly happened to Harshad Mehta after the scandal broke?

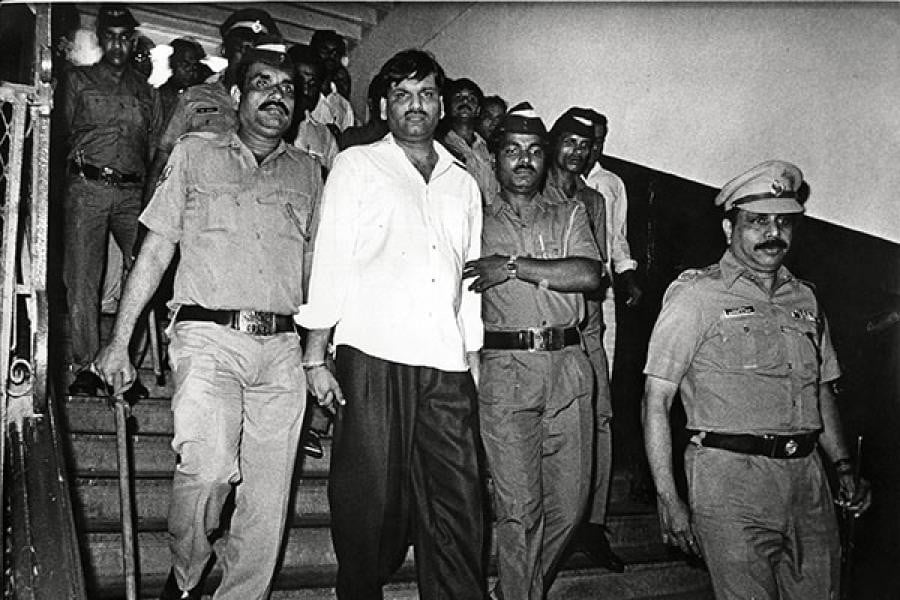

Harshad was arrested in 1992 and faced multiple charges, including fraud and conspiracy. He spent several years in and out of court, fighting the legal battles that followed. The scandal led to massive reforms in the Indian financial system, including the establishment of SEBI (Securities and Exchange Board of India) to regulate the stock market.

Harshad Mehta's Arrest and Legal Battles

After his arrest, Harshad Mehta's life took a dramatic turn. He was no longer the untouchable stock market wizard but a man fighting for his freedom. The legal proceedings were long and drawn out, with Harshad facing over 70 criminal charges. Despite his efforts, he was convicted on several counts and sentenced to prison.

But even behind bars, Harshad remained a controversial figure. He wrote books, gave interviews, and tried to paint himself as a victim of circumstance. Some believed him, while others saw him as a master manipulator who got what he deserved.

What Happened to Harshad Mehta: The Aftermath

While Harshad Mehta's legal battles dominated the headlines, the real story was the impact his actions had on the Indian economy. The scandal exposed the flaws in the financial system and led to sweeping changes. SEBI was given more power to regulate the stock market, and new laws were introduced to prevent similar scams in the future.

But the damage had already been done. Thousands of investors lost their life savings, and trust in the financial system was at an all-time low. Harshad's actions had far-reaching consequences that are still felt today. So, what happened to Harshad Mehta in the end?

Harshad Mehta's Death and Legacy

Harshad Mehta passed away in 2001 at the age of 47, leaving behind a legacy of controversy and intrigue. His death was shrouded in mystery, with some claiming it was a heart attack, while others speculated foul play. Whatever the truth may be, Harshad's story remains a fascinating chapter in the history of financial scandals.

Today, Harshad Mehta is remembered as both a villain and a visionary. He exposed the flaws in the Indian financial system and forced regulators to take action. While his methods were questionable, his impact on the stock market cannot be denied.

Lessons Learned: What Can We Take Away?

So, what can we learn from Harshad Mehta's story? For starters, it's a reminder of the importance of transparency and accountability in the financial world. The scandal exposed the flaws in the system and led to much-needed reforms. But more importantly, it taught us that greed and ambition, if left unchecked, can lead to catastrophic consequences.

Harshad Mehta's story is a cautionary tale for all of us. It's a reminder that success should never come at the cost of integrity. As we move forward, let's remember the lessons of the past and strive to build a better, more transparent financial system.

Key Takeaways

- Transparency and accountability are crucial in the financial world.

- Greed and ambition, if left unchecked, can lead to disaster.

- Regulations and reforms are essential to prevent future scandals.

The Future of Stock Market Regulation

Looking ahead, the story of Harshad Mehta serves as a reminder of the importance of robust regulations in the stock market. With the rise of technology and the increasing complexity of financial instruments, the need for oversight has never been greater. Regulators must stay ahead of the curve to prevent another scandal like the one Harshad orchestrated.

But it's not just about regulations; it's about building a culture of integrity and trust. The financial world must prioritize ethics and responsibility, ensuring that no one person or entity can manipulate the system for personal gain.

Building a Better Financial System

As we reflect on Harshad Mehta's legacy, it's clear that the road ahead is long and challenging. But with the right regulations, education, and mindset, we can build a better, more transparent financial system. It's a responsibility we all share, and one we must take seriously.

Conclusion: Reflecting on Harshad Mehta's Story

So, what happened to Harshad Mehta? In the end, he became a symbol of everything that can go wrong in the financial world. His story is a reminder of the dangers of unchecked ambition and the importance of integrity. While his actions had devastating consequences, they also led to much-needed reforms in the Indian stock market.

As we wrap up this article, we invite you to share your thoughts and insights in the comments below. What lessons do you think we can learn from Harshad Mehta's story? And how can we ensure that history doesn't repeat itself? Let's keep the conversation going!

Table of Contents

- What Happened to Harshad Mehta: The Untold Story Behind India's Infamous Stock Market Scandal

- Who Was Harshad Mehta?

- Harshad Mehta's Early Life and Career

- What Happened to Harshad Mehta: The Scandal Begins

- How the Scam Worked

- The Fallout: What Happened Next?

- Harshad Mehta's Arrest and Legal Battles

- What Happened to Harshad Mehta: The Aftermath

- Harshad Mehta's Death and Legacy

- Lessons Learned: What Can We Take Away?

- Key Takeaways

- The Future of Stock Market Regulation

- Building a Better Financial System

- Conclusion: Reflecting on Harshad Mehta's Story

- Sophie Rain Nudes The Truth Behind The Viral Sensation And How To Protect Your Privacy Online

- Indian Leaked Mms A Comprehensive Look Into The Phenomenon

Harshad Mehta Age, Death, Wife, Children, Family, Biography & More

Atur Mehta Business Career, Business Man, Bombay Stock Exchange

Harshad Mehta Family Where Are They Now Jyoti Mehta A vrogue.co