Unlock Your Financial Future: The Ultimate Stock Options Trading Course

Imagine diving into the world of stock options trading, armed with knowledge and confidence. A stock options trading course isn't just about learning; it's about transforming your financial mindset. Whether you're a beginner or someone looking to refine their trading skills, the right course can make all the difference. In this article, we'll explore everything you need to know about stock options trading courses and how they can propel your investment journey to new heights.

Let's be real here. The stock market isn't just for Wall Street wizards anymore. With the rise of online platforms and accessible education, anyone can jump into the game. But here's the catch—just like any other skill, mastering stock options trading takes more than just winging it. That's where a well-structured stock options trading course comes in. Think of it as your personal cheat code to navigating the complexities of the financial world.

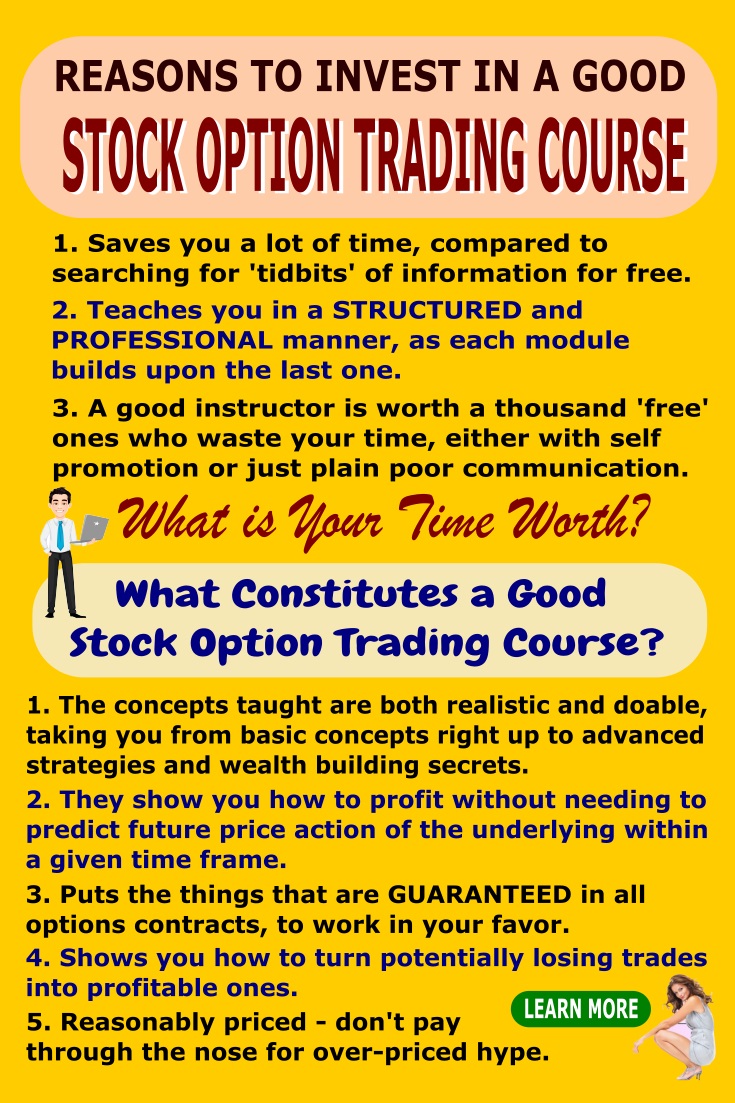

Now, I know what you're thinking. "Do I really need a course? Can't I just Google my way through it?" Sure, you could try that. But trust me, the market moves fast, and having a solid foundation can save you from costly mistakes. A good stock options trading course will teach you everything from the basics of options contracts to advanced strategies that can help you maximize your returns.

- Hdhub4u 18 Everything You Need To Know About This Adult Content Platform

- Unveiling The Truth About Yumi Eto Nude Facts Myths And Everything You Need To Know

What Exactly is Stock Options Trading?

Let's break it down. Stock options trading involves buying and selling options contracts, which give you the right—but not the obligation—to buy or sell a stock at a specific price within a certain timeframe. It's like having a VIP pass to the stock market, where you can make strategic moves without being locked into commitments. Sounds cool, right?

Options trading isn't just about speculation. It's a powerful tool for managing risk, generating income, and enhancing your overall investment portfolio. But here's the thing—it's not as simple as flipping a coin. Without the right knowledge, you could end up losing more than you gain. That's why investing in a quality stock options trading course is a smart move.

Why Should You Care About Stock Options?

Here's the deal. Stock options offer flexibility and leverage that traditional stocks can't match. For example, with options, you can control a larger amount of stock for a fraction of the cost. This means you can potentially earn bigger returns with less capital. Plus, options allow you to hedge your bets, protecting your portfolio from market volatility.

- Nikita Kinka Rising Star In The Spotlight

- Indian Mms Videos The Ultimate Guide To Understanding And Exploring

But wait, there's more. Options trading can also provide steady income streams through strategies like covered calls and cash-secured puts. These aren't just fancy terms—they're practical tools that can boost your financial stability. And the best part? You can learn all about them in a comprehensive stock options trading course.

Choosing the Right Stock Options Trading Course

With so many courses out there, how do you know which one is worth your time and money? Here are some key factors to consider:

- Credibility: Look for courses taught by experienced traders with a proven track record.

- Content Depth: Ensure the course covers everything from beginner concepts to advanced strategies.

- Interactive Features: Hands-on practice and simulations can make a huge difference in your learning experience.

- Community Support: Being part of a community can provide valuable insights and motivation.

Don't fall for shiny promises. Take the time to research and read reviews. Remember, your financial future depends on the quality of the education you receive.

Top Features to Look For in a Course

When evaluating stock options trading courses, keep an eye out for these must-have features:

- Comprehensive Curriculum: A well-rounded course should cover everything from the basics to advanced strategies.

- Practical Exercises: Learning by doing is key. Look for courses that offer simulations and real-world trading scenarios.

- Supportive Environment: Whether it's through live sessions or online forums, having access to support can make all the difference.

- Flexible Learning Options: Whether you're a full-time professional or a stay-at-home parent, choose a course that fits your schedule.

Remember, the best course is one that aligns with your learning style and goals. Don't rush the decision—your investment in education is an investment in your future.

Who Can Benefit from a Stock Options Trading Course?

Let's get real. Stock options trading isn't just for finance geeks or Wall Street pros. Anyone with an interest in investing can benefit from a solid course. Whether you're a:

- Beginner: Just starting out and looking to build a foundation.

- Intermediate Trader: Seeking to refine your skills and expand your knowledge.

- Advanced Investor: Looking to master advanced strategies and techniques.

A good stock options trading course can cater to all levels. The key is finding one that matches your current expertise and offers room for growth.

Breaking Down the Benefits

Here's why taking a stock options trading course is a no-brainer:

- Increased Confidence: Knowledge is power, and a course can equip you with the confidence to make informed decisions.

- Improved Risk Management: Learn how to protect your investments and minimize potential losses.

- Higher Potential Returns: With the right strategies, you can maximize your profits and achieve financial goals faster.

Think of it this way. A course isn't just an expense—it's an investment in your financial literacy and independence. And let's be honest, who doesn't want more control over their money?

How Much Should You Expect to Pay?

Pricing for stock options trading courses can vary widely, depending on factors like instructor experience, course length, and additional features. Here's a rough breakdown:

- Basic Courses: $50-$200. Great for beginners who want a taste of options trading.

- Premium Courses: $300-$1,000. These often include more in-depth content and interactive features.

- Elite Programs: $1,500+. These are typically for serious investors looking for personalized coaching and advanced strategies.

Remember, the cost doesn't always reflect the quality. Always compare features and reviews before making a decision.

Is It Worth the Investment?

Absolutely. Think about it. A few hundred dollars spent on a course could save you thousands in potential losses. Plus, the skills you gain can lead to long-term financial success. It's like paying for a gym membership—sure, it costs money, but the benefits far outweigh the initial expense.

What to Expect from a High-Quality Course

A top-notch stock options trading course should offer:

- Expert Instruction: Taught by seasoned traders with real-world experience.

- Up-to-Date Content: The financial world evolves quickly, so your course material should reflect current trends and strategies.

- Practical Application: Opportunities to practice what you've learned in a safe, simulated environment.

- Ongoing Support: Access to resources and community even after the course concludes.

Don't settle for mediocrity. Your financial education deserves the best.

Key Takeaways

Here's a quick recap of what we've covered:

- Stock options trading is a powerful tool for managing risk and enhancing returns.

- A quality course can provide the knowledge and confidence needed to succeed in the market.

- When choosing a course, focus on credibility, content depth, and interactive features.

- Investing in education is an investment in your financial future.

Conclusion: Take Action Today

So, there you have it. A stock options trading course can be your ticket to financial freedom. But here's the catch—you need to take action. Don't wait for the perfect moment or the ideal conditions. The market won't wait for you. Start exploring your options today and find the course that suits your needs.

And hey, don't forget to share this article with your friends or leave a comment below. Your journey to mastering stock options trading starts now. Let's make it count!

Table of Contents

- Unlock Your Financial Future: The Ultimate Stock Options Trading Course

- What Exactly is Stock Options Trading?

- Why Should You Care About Stock Options?

- Choosing the Right Stock Options Trading Course

- Top Features to Look For in a Course

- Who Can Benefit from a Stock Options Trading Course?

- Breaking Down the Benefits

- How Much Should You Expect to Pay?

- Is It Worth the Investment?

- What to Expect from a High-Quality Course

- Key Takeaways

- Conclusion: Take Action Today

- Faith Ordway Nude A Comprehensive And Respectful Discussion

- Camilla Araujo The Rise Of A Global Sensation And Her Impact On The World

30 Stock Market Option Trading Strategies

Options Trading Course Learn How to Trade Stock Options

Stock Option Trading Course