Swing Trading Vs Scalping: Which One Suits Your Style Better?

Let’s cut straight to the chase, folks—swing trading vs scalping is one of the hottest debates in the world of financial trading. Imagine this: you’ve got two fighters in the ring, each with their own strategies, risks, and rewards. On one side, you’ve got swing trading, the patient contender who waits for the perfect moment to strike. On the other, you’ve got scalping, the quick-footed fighter who makes lightning-fast moves. Which one’s gonna win? Well, that depends on YOU, buddy. Your personality, goals, and risk tolerance will ultimately decide which side you’re on in this battle.

Now, before we dive deep into the nitty-gritty details, let’s address the elephant in the room. Both swing trading and scalping are legit ways to make money in the markets, but they’re not for everyone. Swing trading is like a marathon—it’s all about endurance and strategy. Scalping, on the other hand, is like a sprint—it’s fast, intense, and requires razor-sharp focus. So, whether you’re a newbie or a seasoned trader, it’s crucial to know the ins and outs of both styles.

And hey, don’t worry if you’re feeling a little overwhelmed. By the time you finish reading this article, you’ll have a crystal-clear understanding of swing trading vs scalping. Plus, we’ll throw in some tips, tricks, and real-world examples to help you make an informed decision. So, buckle up, grab your favorite drink, and let’s get into it!

Table of Contents

- What is Swing Trading?

- What is Scalping?

- Key Differences Between Swing Trading and Scalping

- Pros and Cons of Swing Trading

- Pros and Cons of Scalping

- Which One Suits Your Style?

- Tools and Techniques for Both Strategies

- Risk Management in Swing Trading and Scalping

- Real-World Examples of Swing Trading and Scalping

- Conclusion: Swing Trading vs Scalping—The Final Verdict

What is Swing Trading?

Alright, let’s start with the big guy in the ring—swing trading. Swing trading is like a chess game. You’re not rushing into every move; instead, you’re waiting for the perfect opportunity to capitalize on market trends. Typically, swing traders hold positions for a few days to a couple of weeks. It’s all about riding the waves of the market and making moves when the time is right.

Here’s the deal: swing traders focus on technical analysis, chart patterns, and market trends. They’re not interested in the minute-by-minute fluctuations that can drive you crazy. Instead, they’re looking for bigger price movements that offer more substantial profits. Think of it as fishing for big fish instead of catching a bunch of tiny ones.

Why Swing Trading Could Be for You

If you’re the type of person who prefers a balanced approach to trading, swing trading might just be your thing. It gives you the flexibility to trade around your day job or other commitments. Plus, you don’t have to be glued to your screen all day, which can save your sanity and your eyesight.

- Vega Thompson Onlyfans The Rising Star In The Digital Spotlight

- Discover The Power Of Mindfulness Meditation

What is Scalping?

Now, let’s talk about the speed demon in the ring—scalping. Scalping is like a high-stakes game of poker. You’re making quick, calculated moves to grab small profits from the market. Scalpers hold positions for just a few minutes—or even seconds—and they do it repeatedly throughout the day. It’s all about capitalizing on the smallest price movements and adding up those tiny gains.

Here’s the kicker: scalping requires serious focus and discipline. You need to be on top of your game at all times because the market can turn on a dime. If you blink, you might miss an opportunity—or worse, a loss. But hey, if you’ve got the skills and the nerves of steel, scalping can be incredibly rewarding.

Why Scalping Could Be for You

If you thrive under pressure and love the adrenaline rush of fast-paced trading, scalping might be your jam. It’s perfect for traders who want to be actively involved in the market and aren’t afraid to take on the challenge of making split-second decisions.

Key Differences Between Swing Trading and Scalping

Now that we’ve introduced both trading styles, let’s break down the key differences. Think of this as the scorecard for our trading match. Here’s what sets swing trading and scalping apart:

- Timeframe: Swing trading involves holding positions for days to weeks, while scalping is all about quick, short-term trades.

- Risk Tolerance: Swing traders are more patient and can handle larger price swings, whereas scalpers need to be comfortable with high-frequency, low-margin risks.

- Market Focus: Swing trading focuses on broader trends, while scalping zeroes in on minute-by-minute fluctuations.

- Time Commitment: Swing trading allows for more flexibility in your schedule, while scalping demands constant attention to the market.

Which Style Matches Your Personality?

Let’s be real—your trading style should align with who you are as a person. Are you the type who prefers slow and steady wins? Or do you live for the thrill of fast-paced action? Understanding your personality will help you choose the right trading style for you.

Pros and Cons of Swing Trading

Every trading style has its pros and cons, and swing trading is no exception. Let’s weigh the good and the bad:

Pros of Swing Trading

- Less Stress: You don’t have to monitor the market 24/7, which can reduce stress and burnout.

- Higher Potential Profits: By holding positions longer, you can capture larger price movements and potentially earn bigger profits.

- Flexibility: Swing trading fits well with busy lifestyles, allowing you to trade around your other commitments.

Cons of Swing Trading

- Higher Risk: Longer holding periods mean you’re exposed to more market volatility and potential losses.

- Less Control: You can’t micromanage your trades as much as you can with scalping.

Pros and Cons of Scalping

Now, let’s flip the coin and look at the pros and cons of scalping:

Pros of Scalping

- Quick Profits: Scalping allows you to accumulate small profits rapidly, which can add up over time.

- Immediate Feedback: You get instant results from your trades, which can be satisfying for those who love instant gratification.

Cons of Scalping

- High Stress: The fast-paced nature of scalping can be mentally exhausting and stressful.

- Higher Transaction Costs: Frequent trading means higher fees, which can eat into your profits.

Which One Suits Your Style?

At the end of the day, the trading style that suits you best depends on your personality, goals, and risk tolerance. Ask yourself these questions:

- Do I prefer a more relaxed approach, or do I thrive under pressure?

- Am I comfortable with larger risks for potentially bigger rewards?

- How much time can I dedicate to trading each day?

Once you’ve answered these questions, you’ll have a clearer idea of whether swing trading or scalping is the right fit for you.

Tools and Techniques for Both Strategies

No matter which trading style you choose, having the right tools and techniques is crucial. Here’s what you’ll need:

For Swing Trading

- Technical Indicators: Use tools like moving averages, RSI, and MACD to identify trends and potential entry/exit points.

- Chart Patterns: Learn to recognize patterns like head and shoulders, triangles, and flags to spot opportunities.

For Scalping

- Price Action: Focus on candlestick patterns and price action to make quick, informed decisions.

- News and Economic Data: Stay updated on market-moving news and economic releases to capitalize on short-term fluctuations.

Risk Management in Swing Trading and Scalping

Risk management is the backbone of any successful trading strategy. Whether you’re a swing trader or a scalper, you need to have a solid risk management plan in place. Here’s how:

For Swing Trading

- Set stop-loss orders to limit potential losses.

- Use position sizing to ensure no single trade can wipe out your account.

For Scalping

- Keep your risk per trade low to minimize the impact of losing trades.

- Stay disciplined and avoid overtrading, even when the market is moving fast.

Real-World Examples of Swing Trading and Scalping

Let’s bring it all together with some real-world examples. Imagine this:

Swing Trading Example

A swing trader notices a strong uptrend in a stock. They buy the stock and hold it for a week, capturing a 5% gain before selling. They didn’t need to watch the market every second; they just waited for the right moment to strike.

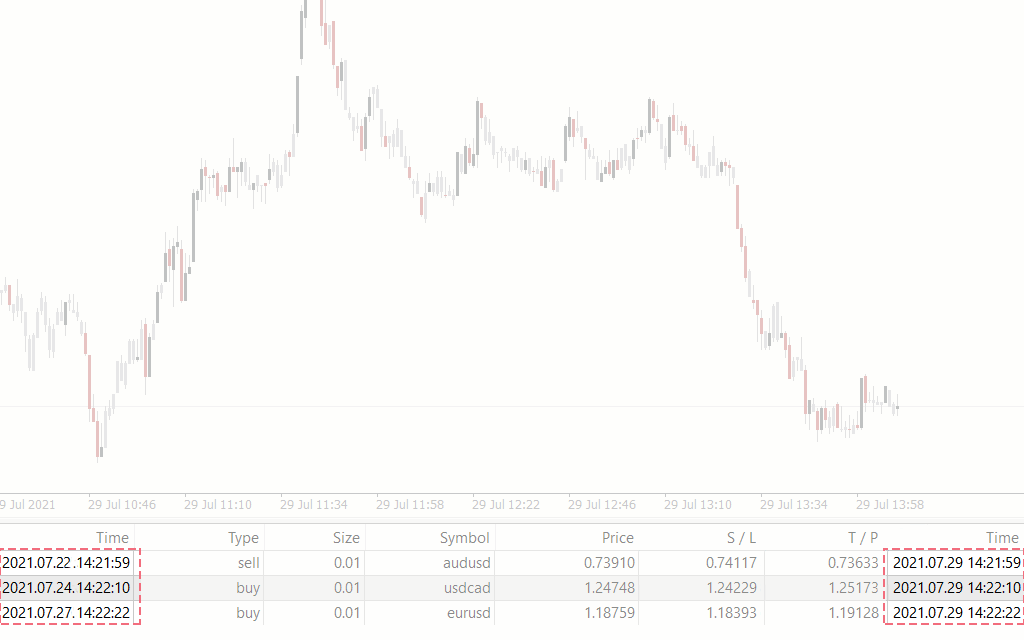

Scalping Example

A scalper sees a small price dip in a currency pair. They quickly buy, hold for a few minutes, and sell for a 0.2% profit. They repeat this process multiple times throughout the day, adding up those tiny gains.

Conclusion: Swing Trading vs Scalping—The Final Verdict

So, there you have it—swing trading vs scalping in a nutshell. Both strategies have their strengths and weaknesses, and the best one for you depends on your unique trading style. Whether you’re a patient planner or a quick thinker, there’s a place for you in the world of financial trading.

Here’s what we’ve learned:

- Swing trading is ideal for traders who prefer a balanced, long-term approach.

- Scalping is perfect for those who love the fast-paced, high-energy world of short-term trading.

Now, it’s your turn to take action. Leave a comment below and let us know which trading style resonates with you. And hey, don’t forget to share this article with your fellow traders. Together, we can make the trading world a better, more informed place!

- Hdhub4uearth Your Ultimate Destination For Highquality Entertainment

- Drew Gulliver Leaks The Untold Story Behind The Controversy

Scalping vs Swing Trading A Comparison

Swing Trading Vs Scalping AxleStreet

Swing Trading vs Scalping Which is Your Trading Style? FXSSI Forex