Stock Screener For Indian Stocks: Your Ultimate Guide To Finding Profitable Investments

Are you looking for a powerful stock screener for Indian stocks to level up your investment game? If yes, you're in the right place. Investing in the Indian stock market can be both exciting and profitable—but only if you know where to look and how to filter through the noise. With so many options out there, finding the right tool to help you pick the best stocks is crucial. Let me tell you, a good stock screener is like having a personal assistant who does all the heavy lifting for you.

Imagine this: you’ve got thousands of stocks listed on exchanges like NSE and BSE, and you want to narrow down your options without spending hours poring over spreadsheets. That's where a stock screener comes in. It’s not just a tool; it's your secret weapon to identify undervalued gems and high-growth opportunities. Whether you're a seasoned investor or just starting out, a stock screener can make your life so much easier.

Now, before we dive deep into the world of stock screeners for Indian stocks, let’s get one thing straight. The stock market isn’t just about luck—it’s about strategy, discipline, and the right tools. And guess what? A stock screener is one of those tools that can give you an edge. So, buckle up because we’re about to break down everything you need to know to find the perfect screener for your needs.

- Kid And His Mom Cctv Video The Untold Story Thats Capturing Everyones Attention

- Sundra Blustleaks The Untold Story Behind The Viral Sensation

What is a Stock Screener?

Let’s start with the basics. A stock screener is like a digital sieve that filters out irrelevant stocks and shows you only the ones that meet your criteria. Think of it as a matchmaker between you and the stocks that align with your investment goals. Instead of manually scanning through hundreds of stock symbols, a screener lets you set parameters like price-to-earnings ratio, market capitalization, dividend yield, and more. It’s like having a custom-built radar to spot profitable opportunities.

In the context of Indian stocks, a good screener can help you navigate the vast landscape of equities listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Whether you're into value investing, growth investing, or income-focused strategies, a stock screener can help you find stocks that match your investment style.

Why Do You Need a Stock Screener for Indian Stocks?

Here’s the deal: the Indian stock market is massive, with thousands of companies listed across various sectors. Without a proper screening tool, it’s easy to get overwhelmed by the sheer volume of data. A stock screener simplifies the process by letting you focus on what matters most—your investment criteria.

- Breckie Hill Naked The Ultimate Guide To Natures Beauty And Controversy

- David And Rebecca Muir Wedding Love Story That Captured Hearts Worldwide

Here are some reasons why a stock screener is essential:

- Time-Saving: Instead of spending hours researching individual stocks, a screener does the heavy lifting for you.

- Customizable Filters: You can tailor the screening process to match your investment strategy, whether you're looking for high-growth stocks or dividend-paying ones.

- Market Insights: A good screener provides real-time data and analytics, helping you stay on top of market trends.

- Risk Management: By filtering out stocks that don’t meet your risk tolerance, you can make more informed investment decisions.

Top Features to Look for in a Stock Screener for Indian Stocks

Not all stock screeners are created equal. When choosing a screener for Indian stocks, it’s important to look for features that align with your investment goals. Here are some key features to consider:

1. Real-Time Data

Access to real-time data is a must-have for any serious investor. Whether you're monitoring stock prices, volume, or technical indicators, having up-to-date information can make all the difference. Look for a screener that provides live updates from both NSE and BSE.

2. Customizable Filters

Every investor has unique preferences, and a good screener should allow you to create custom filters. Whether you're interested in stocks with a specific price range, earnings growth rate, or debt-to-equity ratio, you should be able to set these parameters easily.

3. Technical Analysis Tools

For those who rely on technical analysis, having built-in tools like moving averages, RSI, and MACD can be a game-changer. These tools help you identify trends and potential entry or exit points for your trades.

4. Fundamental Analysis Metrics

Value investors will appreciate screeners that provide in-depth fundamental data, such as P/E ratio, P/B ratio, ROE, and dividend yield. These metrics help you assess the intrinsic value of a stock and determine whether it’s undervalued or overvalued.

5. Sector and Industry Filters

Investing in specific sectors or industries can be a smart strategy, especially if you have a particular interest or expertise in a certain area. A good screener should allow you to filter stocks by sector, such as IT, banking, pharmaceuticals, or consumer goods.

Best Stock Screeners for Indian Stocks

Now that you know what to look for in a stock screener, let’s take a look at some of the best options available for Indian investors. Keep in mind that the right screener for you depends on your investment goals, budget, and preferences.

1. Screener.in

Screener.in is one of the most popular stock screeners in India, and for good reason. It offers a wide range of filters, including financial ratios, market capitalization, and technical indicators. Plus, it’s free to use, making it an excellent choice for beginners and budget-conscious investors.

2. Trade Brains

Trade Brains is another great option for Indian investors. It provides a user-friendly interface and a variety of screening tools, including fundamental and technical analysis. The platform also offers educational resources to help you improve your investment skills.

3. Finology

Finology is known for its comprehensive stock analysis tools and detailed reports. It’s particularly useful for value investors who want to dig deep into a company’s financial health. While some features are premium-only, the free version still offers a lot of value.

4. Angel One

Angel One (formerly Angel Broking) offers a robust stock screener as part of its trading platform. It includes real-time data, customizable filters, and technical analysis tools. If you’re already trading with Angel One, this screener is a great addition to your toolkit.

5. Upstox Pencil

Upstox Pencil is a powerful stock screener that caters to both beginners and advanced investors. It offers a wide range of filters, including technical indicators and fundamental metrics. Plus, it integrates seamlessly with the Upstox trading platform, making it easy to execute trades based on your screening results.

How to Use a Stock Screener Effectively

Having a stock screener is one thing, but using it effectively is another. Here are some tips to help you get the most out of your screener:

- Define Your Criteria: Before you start screening, decide what you’re looking for. Are you interested in growth stocks, value stocks, or dividend payers? Setting clear criteria will help you narrow down your options.

- Start Simple: If you’re new to stock screeners, start with basic filters and gradually add more as you become more comfortable.

- Test Different Combinations: Experiment with different filter combinations to see what works best for your investment strategy.

- Stay Updated: The market is constantly changing, so make it a habit to regularly review your screened results to stay on top of new opportunities.

Common Mistakes to Avoid When Using a Stock Screener

While stock screeners are powerful tools, they’re not foolproof. Here are some common mistakes to avoid:

- Over-Reliance on Screeners: A screener can help you identify potential investments, but it shouldn’t be the only factor in your decision-making process. Always do your own research and due diligence.

- Ignoring Market Trends: Screening alone won’t tell you everything about the market. Stay informed about macroeconomic factors, industry trends, and geopolitical events that could impact your investments.

- Chasing High Returns: While high returns are tempting, they often come with higher risks. Make sure you’re comfortable with the level of risk involved before investing in any stock.

Data and Statistics: Why Stock Screeners Matter

According to a study by Statista, the Indian stock market has been growing rapidly in recent years, with total market capitalization exceeding $3 trillion in 2022. With such a large market, having the right tools to navigate it is crucial. A survey conducted by a leading financial publication found that 70% of successful investors use stock screeners as part of their investment process.

Another interesting statistic is that value investors who use fundamental analysis tools like P/E ratios and ROE tend to outperform the market by an average of 5-7% annually. This highlights the importance of using data-driven tools like stock screeners to make informed investment decisions.

Conclusion: Take Action Today

Investing in the Indian stock market can be a rewarding experience, but it requires the right tools and strategies. A stock screener for Indian stocks is an invaluable asset that can help you find profitable opportunities and make smarter investment decisions. Whether you’re a beginner or an experienced investor, a good screener can give you the edge you need to succeed.

So, what are you waiting for? Start exploring the stock screeners we’ve mentioned and find the one that suits your needs. And don’t forget to share your thoughts and experiences in the comments below. Your feedback could help other investors on their journey to financial success!

Table of Contents

- What is a Stock Screener?

- Why Do You Need a Stock Screener for Indian Stocks?

- Top Features to Look for in a Stock Screener for Indian Stocks

- Best Stock Screeners for Indian Stocks

- How to Use a Stock Screener Effectively

- Common Mistakes to Avoid When Using a Stock Screener

- Data and Statistics: Why Stock Screeners Matter

- Conclusion: Take Action Today

Stock Screener Software for Indian Market Best Stock Screener India

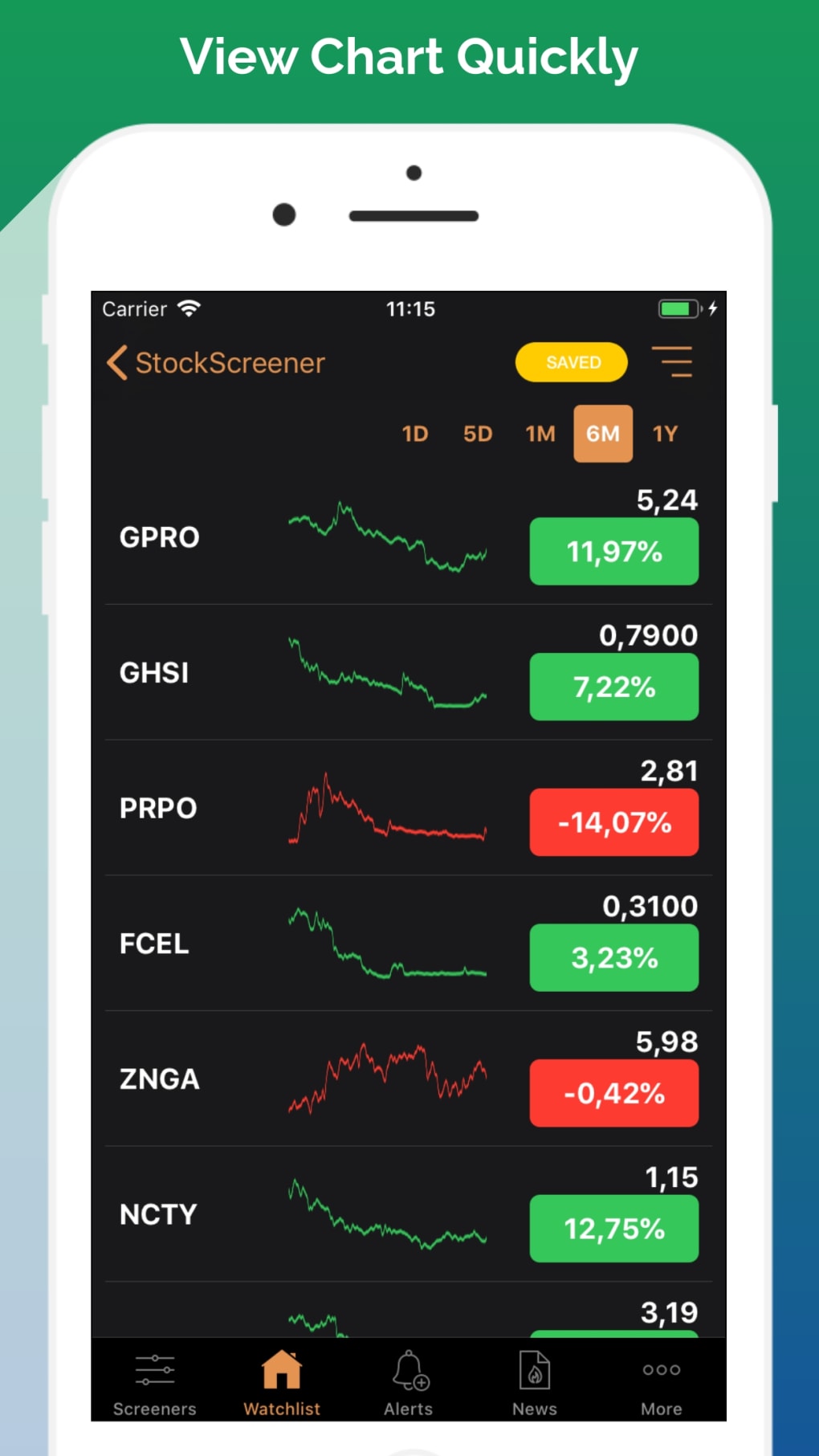

Stock Screener Stocks Scanner for iPhone Download

Stock Screener Stockbox Technologies Pvt Ltd