ROE Vs ROCE: The Ultimate Financial Metrics Showdown You Need To Know

Have you ever wondered what separates the financial powerhouses from the also-rans in the business world? Well, buckle up because we're diving deep into ROE vs ROCE, two of the most crucial financial metrics that can make or break your investment decisions. These ratios are like the secret ingredients in a chef's recipe – they might not be obvious at first glance, but they play a massive role in determining success. If you're serious about understanding how companies perform, this is where the magic happens.

Imagine walking into a casino without knowing the odds. That's kind of like investing in stocks without grasping the difference between ROE and ROCE. Both these ratios measure profitability, but they do it in totally different ways. It's like comparing apples and oranges – both are fruits, but they serve very different purposes. Stick with me, and I'll break it down so even your grandma could understand it.

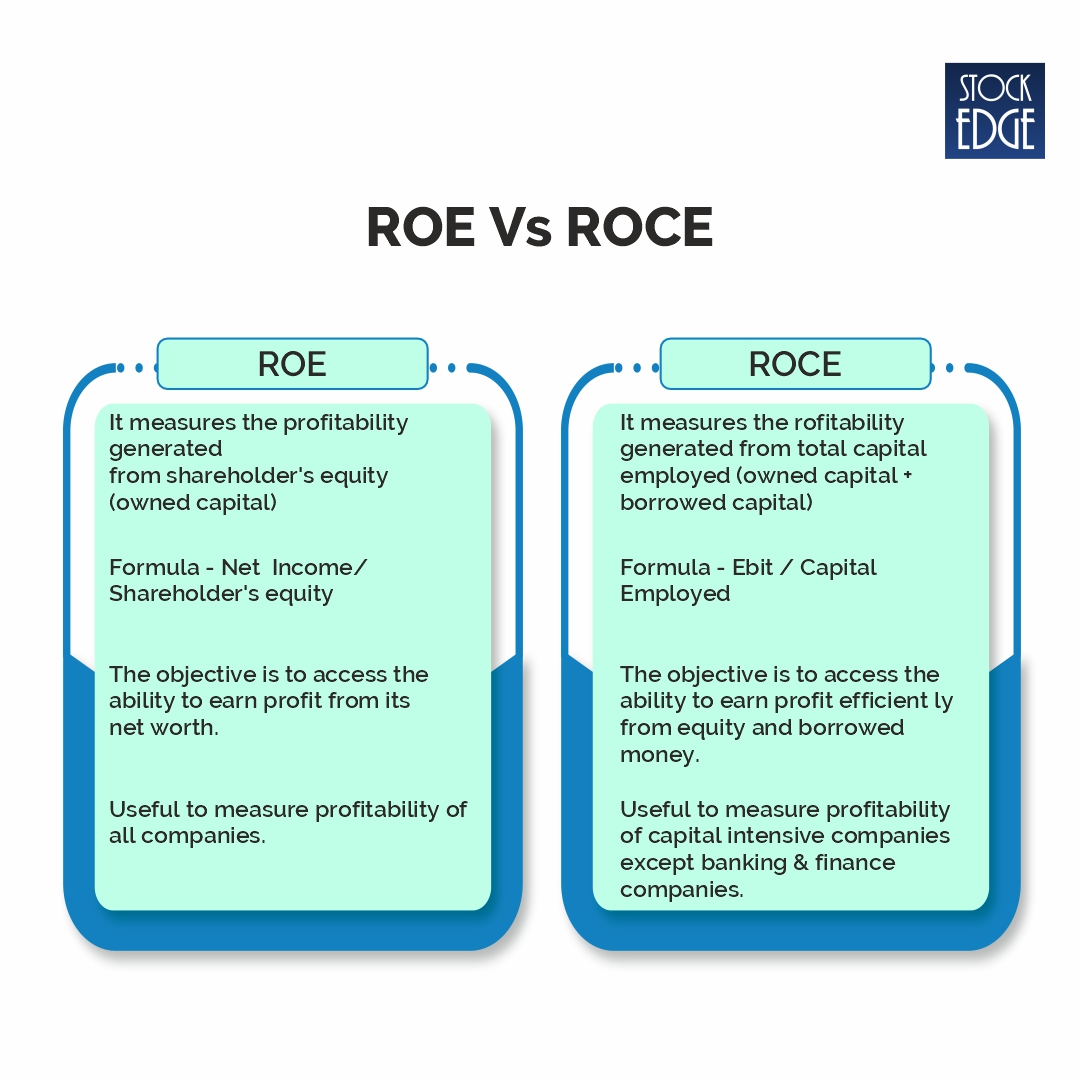

Now, before we dive headfirst into the nitty-gritty, let's set the stage. ROE (Return on Equity) and ROCE (Return on Capital Employed) are financial indicators that businesses use to show how well they're managing their resources. But here's the kicker – one focuses on equity, while the other looks at total capital. See the difference? It's subtle, but oh-so-important if you're trying to pick the right stocks for your portfolio. Let's get started, shall we?

- Jameliz Leaked The Untold Story You Need To Hear

- Ali Vitali Jeremy Diamond Split The Inside Scoop Youve Been Waiting For

What is ROE? Breaking It Down

ROE stands for Return on Equity, and it's basically the measure of how efficiently a company uses shareholder equity to generate profits. Think of it as a report card for management – the higher the ROE, the better job they're doing with the money you've entrusted them with. But here's the thing – a high ROE isn't always a good thing if it's achieved through excessive debt. More on that later.

Mathematically, ROE is calculated by dividing net income by shareholder equity. Simple, right? Well, not exactly. There are a bunch of factors that can skew this number, so you need to dig deeper to get the full picture. For example, companies with lots of assets or high debt levels might have inflated ROE figures, which can be misleading if you're not paying attention.

Why ROE Matters in Investing

Here's the deal – investors love ROE because it gives them a quick snapshot of a company's profitability relative to shareholder equity. It's like a cheat code for figuring out if a business is using its resources wisely. But here's the catch – you can't just look at ROE in isolation. You need to compare it to industry benchmarks and historical data to get a real sense of how well a company is performing.

- Unveiling The Truth Behind Buscar Kid And His Mom Cctv A Closer Look

- Breckie Hill Naked The Ultimate Guide To Natures Beauty And Controversy

For instance, a tech company might have an ROE of 20%, which sounds amazing. But if the industry average is 30%, you might want to rethink your investment strategy. That's why context is king when it comes to financial metrics. And hey, don't forget to factor in things like market trends and economic conditions – they can have a big impact on ROE too.

Understanding ROCE: The Other Side of the Coin

Now let's talk about ROCE, or Return on Capital Employed. This metric takes a broader view of a company's operations by considering all the capital it uses to generate profits, not just shareholder equity. It's like looking at the big picture instead of just one piece of the puzzle. ROCE is calculated by dividing earnings before interest and taxes (EBIT) by capital employed, which includes both equity and debt.

One of the coolest things about ROCE is that it gives you a more complete picture of a company's financial health. Unlike ROE, which can be skewed by high debt levels, ROCE paints a clearer picture of how efficiently a business is using all its resources. This makes it especially useful for comparing companies across different industries, where capital structures can vary widely.

Key Differences Between ROE and ROCE

So, what's the real difference between these two financial powerhouses? Let me break it down for you:

- Scope: ROE focuses on shareholder equity, while ROCE looks at total capital employed.

- Calculation: ROE uses net income and equity, whereas ROCE uses EBIT and capital employed.

- Perspective: ROE gives you an equity-centric view, while ROCE offers a more holistic approach.

- Debt Impact: High debt can inflate ROE but has less impact on ROCE.

See the difference? Both metrics are valuable, but they tell you different things about a company's financial performance. It's like having two different lenses to view the same picture – each one highlights something unique.

How ROE vs ROCE Impacts Investment Decisions

When it comes to investing, understanding the nuances of ROE vs ROCE can make all the difference. For example, a company with a high ROE might look great on paper, but if it's loaded with debt, it could be a ticking time bomb. On the other hand, a company with a solid ROCE might be a safer bet because it's using all its resources efficiently, not just equity.

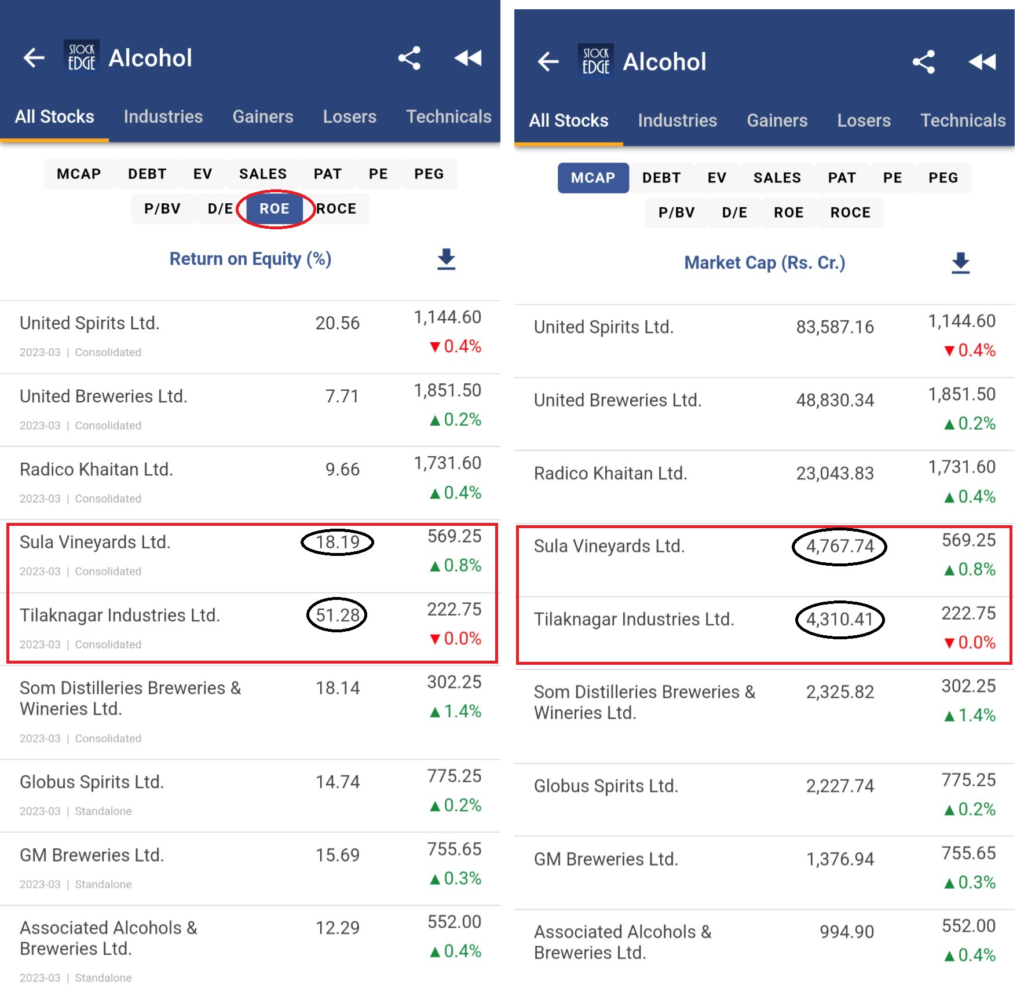

Let's say you're comparing two companies in the same industry. Company A has an ROE of 25% and a ROCE of 15%, while Company B has an ROE of 15% and a ROCE of 20%. At first glance, Company A might seem like the better choice, but if you dig deeper, you might find that Company B is actually using its capital more efficiently. That's why it's important to look at both metrics together when making investment decisions.

Factors to Consider When Analyzing ROE and ROCE

Now that you know the basics, here are a few things to keep in mind when analyzing ROE and ROCE:

- Industry Norms: Compare the ratios to industry averages to get a sense of how a company stacks up against its peers.

- Historical Trends: Look at how these metrics have changed over time to spot potential red flags or opportunities.

- Capital Structure: Consider how much debt a company has relative to equity – it can have a big impact on both ROE and ROCE.

- Economic Conditions: External factors like interest rates and market trends can influence these ratios, so don't ignore them.

By taking all these factors into account, you'll be able to make more informed investment decisions that align with your goals and risk tolerance.

Real-World Examples of ROE vs ROCE in Action

Talking about financial metrics is all well and good, but let's see how they play out in the real world. Take Apple, for instance – they've got an ROE of around 90% and a ROCE of about 30%. Now, that might seem like a huge disparity, but it makes sense when you consider their business model. Apple generates massive profits relative to shareholder equity, but they also invest heavily in research and development, which requires a lot of capital.

On the flip side, look at Walmart. Their ROE is closer to 20%, but their ROCE is around 12%. Again, this makes sense given their business model – Walmart relies on high volume, low-margin sales, so they need a lot of capital to keep operations running smoothly. See how different industries can have vastly different ROE and ROCE figures? That's why context matters.

Case Study: Tesla's ROE vs ROCE Journey

Let's zoom in on Tesla for a moment. A few years ago, their ROE was negative because they were losing money hand over fist. But as they started turning a profit, their ROE skyrocketed to over 10%. Meanwhile, their ROCE has been steadily increasing as they scale up production and improve efficiency. This shows how these metrics can change dramatically over time, especially for fast-growing companies.

What can we learn from Tesla's journey? First, don't judge a company solely on its past performance – things can change quickly in the business world. Second, pay attention to trends and how they align with a company's growth strategy. If a company is investing heavily in the future, its ROE and ROCE might suffer in the short term, but it could pay off big time down the road.

Common Misconceptions About ROE and ROCE

There are a lot of myths floating around about ROE and ROCE, so let's clear a few of them up:

- Higher is Always Better: Not necessarily. A high ROE might indicate excessive risk, while a high ROCE could mean the company is underinvesting in growth opportunities.

- ROE is More Important: Depends on the situation. For companies with lots of debt, ROCE might give you a better picture of financial health.

- ROCE Ignores Equity: Not true. ROCE considers both equity and debt, giving you a more comprehensive view of capital usage.

Remember, financial metrics are tools, not answers. They can help guide your decision-making, but you need to interpret them in the right context to get the most value.

How to Avoid Falling Into the Trap of Misinterpreting ROE and ROCE

Here are a few tips to keep you from making rookie mistakes when analyzing ROE and ROCE:

- Look Beyond the Numbers: Understand the underlying factors driving these metrics, like business strategy and market conditions.

- Compare Apples to Apples: Don't compare ROE and ROCE across different industries – it's not a fair comparison.

- Consider Multiple Metrics: ROE and ROCE are just two pieces of the puzzle – use them in conjunction with other financial indicators for a complete picture.

By staying vigilant and avoiding common pitfalls, you'll be able to make smarter investment decisions that align with your goals.

Strategies for Maximizing ROE and ROCE

So, how can companies improve their ROE and ROCE? It's all about optimizing resource usage and boosting profitability. Here are a few strategies that can help:

- Cost Management: Cutting unnecessary expenses can boost both ROE and ROCE by improving profit margins.

- Capital Allocation: Investing in high-return projects can increase ROCE, while reducing equity dilution can boost ROE.

- Operational Efficiency: Streamlining operations can reduce capital requirements and improve both metrics.

Of course, every company is different, so there's no one-size-fits-all solution. But by focusing on these key areas, businesses can improve their financial performance and create more value for shareholders.

What Investors Should Look For When Evaluating ROE and ROCE

When you're evaluating ROE and ROCE, here are a few things to keep an eye on:

- Trends: Are these metrics improving or declining over time?

- Benchmarking: How do they compare to industry peers?

- Sustainability: Are the improvements sustainable, or are they based on one-time events?

By focusing on these factors, you'll be able to separate the wheat from the chaff and make smarter investment decisions.

Final Thoughts: Which Metric Wins the ROE vs ROCE Battle?

So, after all this, which metric comes out on top – ROE or ROCE? The truth is, they're both important, and the answer depends on what you're looking for. If you're focused on equity performance, ROE is your go-to metric. But if you want a more comprehensive view of capital usage, ROCE is the way to go.

Here's the bottom line – don't put all your eggs in one basket. Use both ROE and ROCE, along with other financial indicators, to get a complete picture of a company's financial health. And remember, investing is a marathon, not a sprint. Take your time, do your research, and make informed decisions that align with your long-term goals.

So, what do you think? Are you Team ROE or Team ROCE? Or do you think they both deserve a spot in your investment playbook? Drop a comment below and let me know – I'd love to hear your thoughts!

Table of Contents

- What is ROE? Breaking It Down

- Why ROE Matters in Investing

- Understanding ROCE: The Other Side of the Coin

- Key Differences Between ROE and ROCE

- How RO

- Why Was Girl Meets Farm Cancelled The Inside Scoop Youve Been Waiting For

- Camilla Araujo Leaked Onlyfans The Full Story You Need To Know

ROE vs ROCE What's the difference? Trade Brains

ROE Vs. ROCE Which Metric Better For Your Investment Decision?

ROE Vs. ROCE Which Metric Better For Your Investment Decision?