Negative P/E Ratio Means: What It Tells You About A Company’s Performance

When you dive into the world of stock investing, understanding financial metrics like the P/E ratio is crucial. But what happens when a company has a negative P/E ratio? Does it mean the company is doomed? Not exactly. A negative P/E ratio can be a bit tricky to understand, but it’s not always a bad thing. In fact, it might tell you something important about the company’s current financial situation. Let’s break it down so you can make smarter investment decisions.

A negative P/E ratio is often seen as a red flag by many investors, but it’s important to dig deeper. This metric doesn’t always mean the company is failing. Sometimes, it simply indicates that the company is in a growth phase or facing temporary challenges. Understanding why a negative P/E ratio occurs and what it means for the company’s future can help you make better investment choices.

Whether you’re a seasoned investor or just starting out, having a solid grasp of financial ratios is key. In this article, we’ll explore everything you need to know about negative P/E ratios, including what they mean, why they happen, and how to interpret them. So, buckle up, and let’s dive into the world of negative P/E ratios!

- Pineapplebrat Nude A Deep Dive Into The Viral Sensation Facts And Myths

- Unveiling The Truth Behind Diva Flawless Sex Video Ndash The Real Story

What is a P/E Ratio?

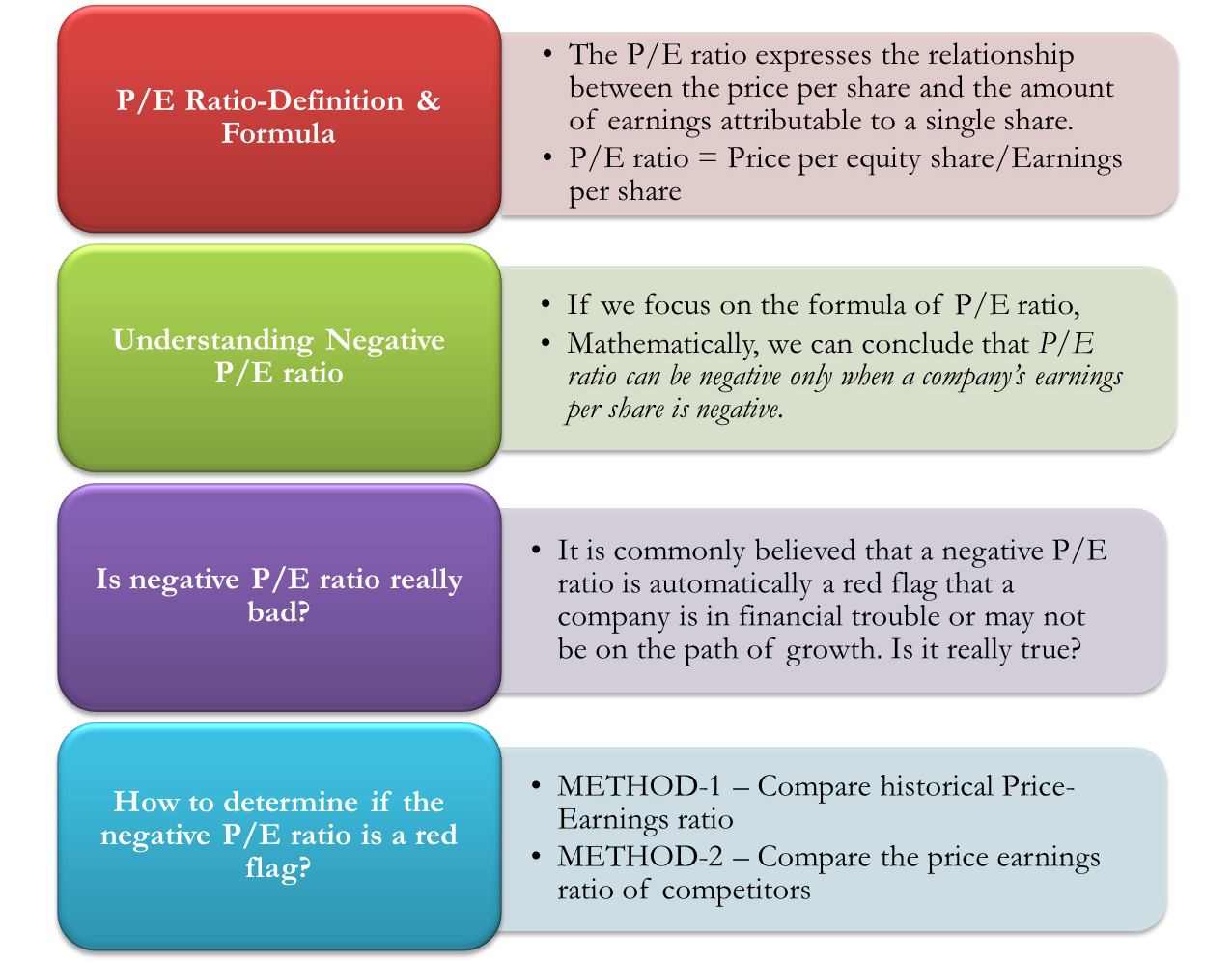

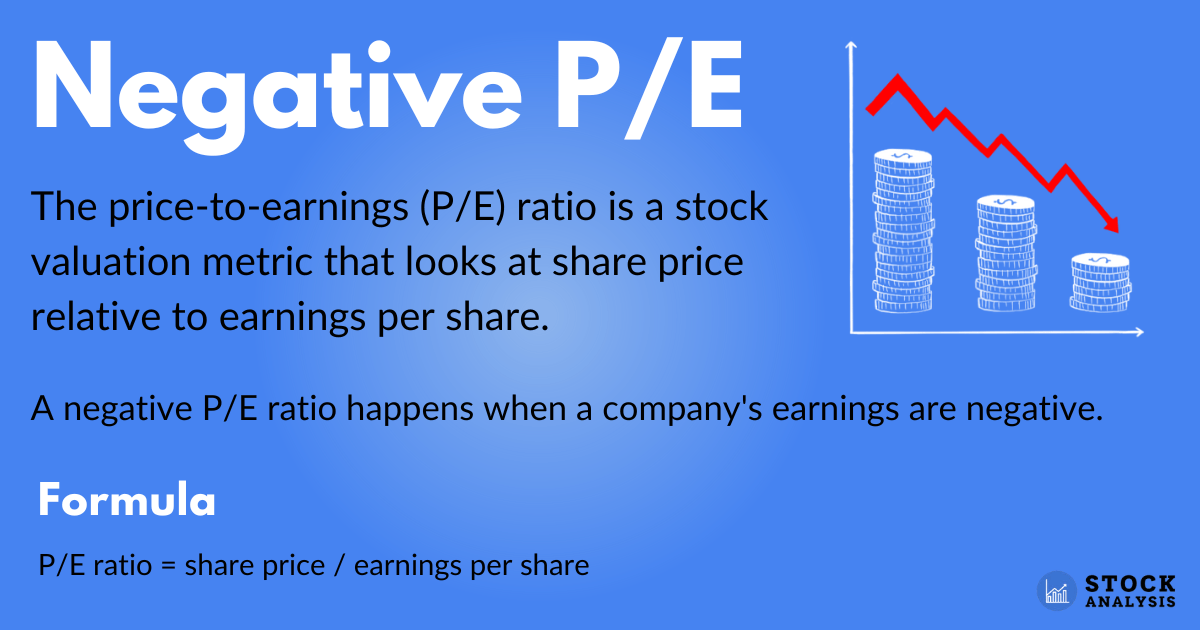

Before we talk about negative P/E ratios, let’s first understand what a P/E ratio is. The P/E ratio, or price-to-earnings ratio, is a financial metric that compares a company’s stock price to its earnings per share (EPS). It’s a quick way to gauge how much investors are willing to pay for each dollar of a company’s earnings.

For example, if a company has a P/E ratio of 20, it means investors are paying $20 for every $1 of earnings. This ratio helps investors determine whether a stock is overvalued or undervalued compared to its peers.

Why is the P/E Ratio Important?

The P/E ratio is one of the most widely used metrics in stock analysis. Here’s why it matters:

- It helps investors assess the value of a stock.

- It provides insights into market expectations for a company’s future earnings growth.

- It allows for comparisons between companies in the same industry.

However, the P/E ratio isn’t perfect. It doesn’t tell the whole story about a company’s financial health, and it can sometimes be misleading, especially when dealing with negative earnings.

What Does a Negative P/E Ratio Mean?

A negative P/E ratio occurs when a company reports negative earnings, meaning it’s losing money. In simple terms, the company’s earnings per share (EPS) is below zero, which makes the P/E ratio negative. This situation often raises eyebrows among investors, but it’s not always a sign of disaster.

For example, if a company’s stock price is $50 and its EPS is -$2, the P/E ratio would be -25. This doesn’t mean the company is worthless—it just means it’s not currently profitable. Let’s explore why this happens and what it could mean for investors.

Why Do Companies Have Negative Earnings?

There are several reasons why a company might report negative earnings:

- Expansion Phase: The company may be investing heavily in growth opportunities, such as expanding into new markets or developing new products.

- Economic Downturn: External factors, like a recession or industry downturn, can impact a company’s profitability.

- One-Time Expenses: Large, one-time expenses, such as restructuring costs or legal settlements, can temporarily push earnings into the negative.

Understanding the context behind negative earnings is crucial for interpreting a negative P/E ratio correctly.

How to Interpret a Negative P/E Ratio

Interpreting a negative P/E ratio requires a bit of detective work. Here’s what you should consider:

1. Is the Company in a Growth Phase?

Some companies, especially startups or tech firms, may have negative earnings because they’re reinvesting profits into growth. These companies prioritize long-term success over short-term profitability. For example, companies like Amazon and Tesla had negative P/E ratios for years before becoming wildly successful.

2. Is the Industry Cyclical?

Cyclical industries, like automotive or construction, often experience fluctuations in profitability. A negative P/E ratio in these industries might just reflect a temporary downturn, rather than a long-term issue.

3. Are There One-Time Factors?

Occasionally, a company’s negative earnings are due to one-time events, such as a major lawsuit or restructuring. In these cases, the negative P/E ratio might not reflect the company’s overall health.

Can a Negative P/E Ratio Be a Good Thing?

Believe it or not, a negative P/E ratio can sometimes be a good thing. Here’s why:

1. Potential for Future Growth

If a company is investing heavily in growth, a negative P/E ratio might indicate that it’s laying the groundwork for future success. For example, a biotech company might have negative earnings while developing a groundbreaking drug, but its long-term potential could be enormous.

2. Undervalued Stock

In some cases, a negative P/E ratio might mean the stock is undervalued. If the market hasn’t yet recognized the company’s potential, you could be looking at a great investment opportunity.

Limitations of the P/E Ratio

While the P/E ratio is a useful tool, it has its limitations, especially when dealing with negative earnings. Here are a few things to keep in mind:

1. It Doesn’t Account for Debt

A company with high debt levels might have negative earnings, even if its operations are otherwise healthy. The P/E ratio doesn’t factor in debt, so you’ll need to look at other metrics, like the debt-to-equity ratio, to get the full picture.

2. It Can Be Misleading

Sometimes, a negative P/E ratio can give a false impression of a company’s financial health. For example, if a company had a profitable year but took a big hit in the current year, its negative P/E ratio might not reflect its true potential.

How to Analyze a Company with a Negative P/E Ratio

When analyzing a company with a negative P/E ratio, here are some steps you can take:

- Look at the company’s historical financial performance.

- Examine its growth prospects and competitive position.

- Consider industry trends and external factors affecting its earnings.

By taking a holistic approach, you can better understand whether a negative P/E ratio is a cause for concern or an opportunity for growth.

Key Metrics to Consider

Besides the P/E ratio, here are some other metrics that can provide valuable insights:

- Revenue Growth: Is the company’s revenue increasing over time?

- Operating Margin: How efficiently is the company managing its expenses?

- Cash Flow: Does the company have enough cash to sustain its operations?

Real-World Examples of Negative P/E Ratios

To better understand negative P/E ratios, let’s look at a few real-world examples:

Example 1: Tesla

Tesla had a negative P/E ratio for years as it invested heavily in electric vehicle production. Despite its losses, investors believed in its long-term potential, and the stock price soared once it became profitable.

Example 2: Netflix

Netflix also experienced negative earnings during its early years as it expanded its streaming services. Today, it’s one of the most valuable media companies in the world.

Conclusion: What You Need to Know About Negative P/E Ratios

In summary, a negative P/E ratio isn’t always a bad thing. It can indicate that a company is investing in growth, facing temporary challenges, or operating in a cyclical industry. By understanding the context behind the negative earnings, you can make more informed investment decisions.

Here are the key takeaways:

- A negative P/E ratio occurs when a company reports negative earnings.

- It doesn’t always mean the company is failing; sometimes, it reflects growth or temporary challenges.

- Other metrics, like revenue growth and cash flow, can provide additional insights into a company’s financial health.

So, the next time you come across a company with a negative P/E ratio, don’t panic. Instead, dig deeper and see what the numbers are really telling you. Who knows? You might just uncover the next big investment opportunity!

Call to Action

Did you find this article helpful? Leave a comment below and let us know your thoughts on negative P/E ratios. Also, don’t forget to share this article with your fellow investors!

Table of Contents

- What is a P/E Ratio?

- What Does a Negative P/E Ratio Mean?

- How to Interpret a Negative P/E Ratio

- Can a Negative P/E Ratio Be a Good Thing?

- Limitations of the P/E Ratio

- How to Analyze a Company with a Negative P/E Ratio

- Real-World Examples of Negative P/E Ratios

- Conclusion: What You Need to Know About Negative P/E Ratios

- Anjali Arora Viral Video The Story Behind The Sensation

- Anna Malygon Onlyfans The Untold Story Behind Her Rise To Fame

Negative P/E Ratio Really a Red Flag?

NEGATIVE PE RATIO What to Do with These Stocks?

Negative P/E Ratio Definition and What It Shows Stock Analysis