Learn Stock Market: A Beginner's Guide To Building Wealth

So, you want to learn stock market basics? You’re not alone. Millions of people worldwide are diving into the world of stocks, bonds, and investments every day. But let’s be real—investing in the stock market can feel like trying to solve a puzzle without the box cover. That’s why we’re here. This guide will take you step by step through everything you need to know to start your journey into the stock market.

Before we dive deep, let’s get one thing straight: learning the stock market isn’t just about making quick bucks. It’s about building long-term wealth, understanding risks, and creating a solid financial foundation for yourself. Whether you’re saving for retirement or planning your dream vacation, the stock market can help you achieve those goals—if you play your cards right.

Now, I know what you’re thinking. “Do I really need to learn stock market stuff? Can’t I just rely on my savings account?” Here’s the deal: while savings accounts are safe, they won’t grow your money as fast as the stock market can. Plus, inflation might eat away at your savings over time. So yeah, it’s worth learning. Stick with me, and we’ll make sense of it all.

- Exploring The World Of Diva Flawless Nudes Unveiling Secrets Behind The Scenes

- Erome Sophie Rain The Rising Star Redefining Digital Content

Why Learn Stock Market Today?

Let’s face it—the stock market isn’t some secret club reserved for Wall Street elites anymore. Thanks to technology, anyone with an internet connection can start investing. But why should YOU care? Because the stock market offers opportunities that traditional banking simply can’t match. Here are a few reasons:

- Higher Returns: Historically, the stock market has delivered returns of around 7-10% annually.

- Flexibility: You can invest small amounts regularly or go all-in when you’re ready.

- Diversification: Spread your risk across different assets to protect your portfolio.

- Financial Independence: The earlier you start, the closer you get to achieving your financial dreams.

But here’s the catch: you can’t just throw money at the market and hope for the best. That’s where learning comes in. Understanding how the stock market works is key to avoiding costly mistakes.

What Exactly Is the Stock Market?

Alright, let’s break it down. The stock market is essentially a marketplace where people buy and sell shares of publicly traded companies. When you buy a share, you’re buying a tiny piece of ownership in that company. Cool, right? But there’s more to it than that.

- Layla Jenner Ethnicity A Deep Dive Into Her Roots And Identity

- Marie Temara Nudes Debunking The Viral Sensation And Setting The Record Straight

Think of the stock market like a giant auction house. Buyers and sellers come together to negotiate prices based on supply and demand. If lots of people want to buy shares of a company, the price goes up. If no one’s interested, the price drops. Simple enough, but there’s a lot of nuance to it.

Key Players in the Stock Market

There are several players involved in the stock market:

- Investors: People like you who buy and sell stocks.

- Brokers: Middlemen who execute trades on your behalf.

- Companies: Businesses that issue stocks to raise capital.

- Regulators: Organizations like the SEC that ensure fair trading practices.

Each player has a role to play, and understanding their roles will help you navigate the market better.

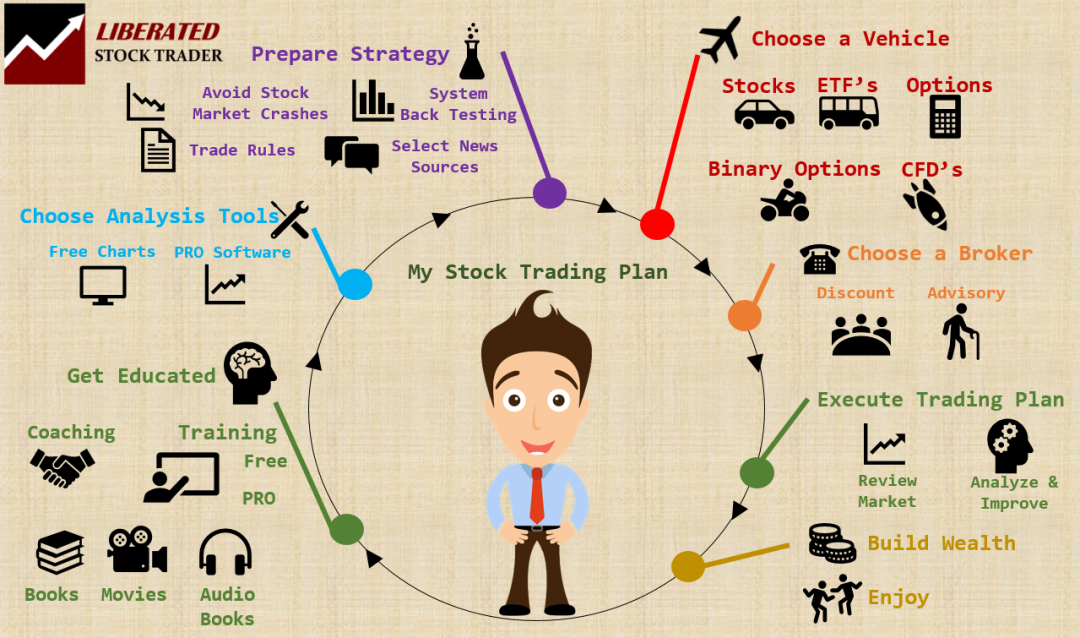

How to Learn Stock Market Basics

Now that you know what the stock market is, let’s talk about how to learn it. Here’s a step-by-step guide to get you started:

Step 1: Educate Yourself

Start by reading books, articles, and watching videos about investing. Some great resources include:

- “The Intelligent Investor” by Benjamin Graham

- “A Random Walk Down Wall Street” by Burton Malkiel

- YouTube channels like Investopedia or CNBC

These resources will give you a solid foundation in investing principles.

Step 2: Open a Brokerage Account

Once you’ve done your homework, it’s time to open a brokerage account. Platforms like Robinhood, Fidelity, or Charles Schwab are great for beginners. They offer user-friendly interfaces and low fees.

Pro tip: Look for accounts with no minimum deposit requirements if you’re just starting out.

Step 3: Start Small

Don’t jump in with both feet right away. Start with small investments to test the waters. Consider buying fractional shares if your platform allows it. This way, you can experiment without risking too much money.

Understanding Key Concepts

To truly learn stock market strategies, you need to grasp some key concepts. Here are a few to focus on:

1. Risk vs. Reward

In the stock market, higher risk often means higher reward. For example, tech startups might offer bigger returns, but they’re also riskier than established companies like Apple or Microsoft. Decide how much risk you’re comfortable taking before you invest.

2. Diversification

Don’t put all your eggs in one basket. Spread your investments across different sectors, industries, and asset classes. This reduces your overall risk and increases your chances of success.

3. Compound Interest

This is the magic ingredient of investing. Compound interest means earning interest on your initial investment plus any earnings it generates. Over time, this can lead to exponential growth.

Common Mistakes to Avoid

Even experienced investors make mistakes. Here are a few common ones to watch out for:

- Emotional Trading: Don’t let fear or greed drive your decisions.

- Overtrading: Constantly buying and selling can rack up fees and hurt your returns.

- Ignoring Fees: High fees can eat into your profits, so choose low-cost platforms.

Remember, patience is key. The stock market isn’t a get-rich-quick scheme. It’s a marathon, not a sprint.

Tools and Resources for Learning

There are tons of tools and resources available to help you learn stock market strategies. Here are a few:

1. Stock Simulators

Practice trading without risking real money using stock simulators. Websites like HowTheMarketWorks offer free platforms to test your skills.

2. Financial News Websites

Stay updated on market trends by reading sites like Bloomberg, Reuters, or CNBC. These sources provide valuable insights into economic developments.

3. Online Courses

Platforms like Coursera, Udemy, and Khan Academy offer courses specifically designed for beginners. They cover everything from basic concepts to advanced strategies.

Building Your Investment Portfolio

Once you’ve learned the basics, it’s time to build your portfolio. Here’s how:

Step 1: Set Clear Goals

Define what you want to achieve with your investments. Are you saving for retirement, buying a house, or funding a business? Your goals will dictate your investment strategy.

Step 2: Choose Your Assets

Decide which types of assets to include in your portfolio. Common options include:

- Stocks

- Bonds

- Mutual Funds

- Exchange-Traded Funds (ETFs)

Each asset class has its own risks and rewards, so choose wisely.

Step 3: Monitor and Adjust

Regularly review your portfolio to ensure it aligns with your goals. Don’t be afraid to make adjustments as needed. Market conditions change, and so should your strategy.

Real-Life Examples

Let’s look at a couple of real-life examples to illustrate how learning the stock market can pay off:

Example 1: Warren Buffett

Warren Buffett, aka the Oracle of Omaha, started investing at age 11. Today, he’s one of the richest people in the world, with a net worth of over $100 billion. His success stems from disciplined investing and a long-term mindset.

Example 2: Tesla Investors

Back in 2010, Tesla’s stock price was around $17 per share. Fast forward to 2023, and it’s trading at over $200. Early investors who believed in the company’s vision reaped massive rewards. This shows the power of investing in growth stocks.

Conclusion

Learning the stock market may seem intimidating at first, but it’s absolutely worth it. By educating yourself, starting small, and staying disciplined, you can build wealth and secure your financial future.

So, what are you waiting for? Take the first step today. Open a brokerage account, read a book, or watch a tutorial. Every little bit helps. And don’t forget to share this article with your friends—if they’re smart, they’ll thank you later!

Table of Contents

- Why Learn Stock Market Today?

- What Exactly Is the Stock Market?

- How to Learn Stock Market Basics

- Understanding Key Concepts

- Common Mistakes to Avoid

- Tools and Resources for Learning

- Building Your Investment Portfolio

- Real-Life Examples

- Conclusion

- Joel Michael Singer Fired The Inside Scoop You Need To Know

- 5movierulz Kannada Movie 2024 Your Ultimate Guide To The Latest Blockbusters

Learn Stock Market Trading vrogue.co

Learn About Stock Market

Learn Stock Market How to Understand Stock Market in India?