How Soon After Ex-Dividend Date Can I Sell? Unlock The Secrets Of Stock Dividends

Ever wondered how soon after the ex-dividend date you can sell your stocks without losing out on dividend payments? Well, buckle up because we're diving deep into the world of stock dividends and sales. Understanding this process is crucial if you want to maximize your profits and make informed decisions. Let’s break it down in a way that’s simple, straightforward, and easy to grasp!

Imagine this: You’re holding onto some stocks, eagerly waiting for that sweet dividend payout. But then the question hits you—how soon after the ex-dividend date can I sell my shares? It’s a common query among investors, and the answer isn’t as straightforward as you might think. Stick around, and we’ll unravel the mystery together.

In this article, we’ll explore everything you need to know about selling stocks after the ex-dividend date. From understanding key terms to navigating the timeline, we’ve got you covered. Whether you’re a seasoned investor or just starting out, this guide will provide clarity and confidence in your investment decisions. So, let’s get to it!

- Ullu Uncut The Hottest Buzzword In Entertainment Thats Got Everyone Talking

- Camilla Araujo Porn Unveiling The Truth Behind The Viral Sensation

Here's a quick glance at what we'll cover:

- What Is the Ex-Dividend Date?

- How Soon Can I Sell After the Ex-Dividend Date?

- Important Dates to Know

- Impact on Stock Price

- Tax Implications

- Strategies for Selling After the Ex-Dividend Date

- Common Mistakes to Avoid

- Real-World Examples

- Frequently Asked Questions

- Conclusion

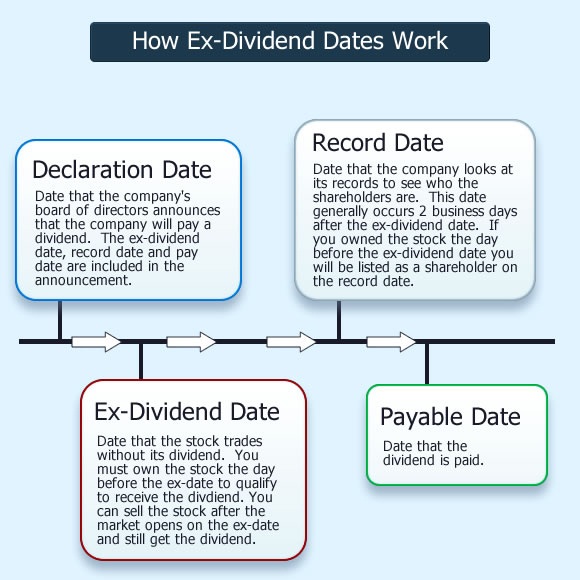

What Is the Ex-Dividend Date?

Alright, let’s start with the basics. The ex-dividend date is the date on which a stock begins trading without the upcoming dividend. If you purchase shares on or after this date, you won’t be eligible for the dividend payout. It’s like a cutoff point set by the company to determine who gets the dividend and who doesn’t.

Here’s the deal: When a company announces a dividend, they also declare a record date. The ex-dividend date is typically set one business day before the record date. So, if you own the stock before the ex-dividend date, you’re golden. You’ll receive the dividend as long as you hold the shares until the record date.

- Joel Michael Singer Fired The Inside Scoop You Need To Know

- Browse Kid And His Mom Video Original A Deep Dive Into The Phenomenon

Think of it like a lottery ticket. You need to buy your ticket before the deadline to be eligible for the prize. Similarly, you need to own the stock before the ex-dividend date to qualify for the dividend.

Why Does the Ex-Dividend Date Matter?

It matters because it directly affects your eligibility for dividend payments. If you’re planning to sell your shares, understanding this date is crucial. You don’t want to sell too early and miss out on the dividend, right?

Here’s a quick recap:

- Ex-dividend date = The date when the stock starts trading without the dividend.

- Record date = The date used to determine who gets the dividend.

- Payment date = The date when the dividend is actually paid out.

How Soon Can I Sell After the Ex-Dividend Date?

Now, here’s the million-dollar question: How soon after the ex-dividend date can you sell your stocks? The answer depends on a few factors, but generally, you can sell your shares anytime after the ex-dividend date and still receive the dividend—as long as you owned the stock before the ex-dividend date.

Let’s break it down:

Key Factors to Consider

1. Ownership Before the Ex-Divididend Date: To qualify for the dividend, you must own the stock before the ex-dividend date. If you sell your shares after this date, you’re still entitled to the dividend.

2. Record Date: As long as you’re listed as the owner of the stock on the record date, you’ll receive the dividend. The record date is usually one business day after the ex-dividend date.

3. Payment Date: The dividend is typically paid out a few weeks after the record date. So, even if you sell your shares before the payment date, you’ll still get the dividend.

What Happens If I Sell Before the Ex-Dividend Date?

If you sell your shares before the ex-dividend date, you won’t be eligible for the dividend. The new owner of the stock will receive the payout instead. It’s like missing the bus—once it’s gone, you’re out of luck.

Important Dates to Know

When it comes to dividends, there are several key dates you need to keep in mind. Let’s take a closer look at each one:

1. Declaration Date

This is the date when the company announces the dividend. They’ll also declare the ex-dividend date, record date, and payment date.

2. Ex-Dividend Date

The date when the stock starts trading without the dividend. If you buy shares on or after this date, you won’t be eligible for the dividend.

3. Record Date

The date used to determine who gets the dividend. You must own the stock on this date to qualify for the payout.

4. Payment Date

The date when the dividend is actually paid out. This usually happens a few weeks after the record date.

Here’s a handy table to summarize:

| Date | Description |

|---|---|

| Declaration Date | When the company announces the dividend. |

| Ex-Divididend Date | When the stock starts trading without the dividend. |

| Record Date | When the company determines who gets the dividend. |

| Payment Date | When the dividend is actually paid out. |

Impact on Stock Price

Now, let’s talk about how the ex-dividend date affects the stock price. On the ex-dividend date, the stock price typically drops by the amount of the dividend. This adjustment reflects the fact that the stock is now trading without the dividend.

For example, if a stock is trading at $100 and the dividend is $2, the stock price might drop to $98 on the ex-dividend date. It’s not something to panic about—this price adjustment is normal and expected.

Why Does the Price Drop?

It’s simple supply and demand. When the stock starts trading without the dividend, it becomes less valuable to investors. As a result, the price adjusts downward to reflect this change.

Tax Implications

Let’s not forget about taxes. Depending on your location and investment account, there might be tax implications for selling stocks after the ex-dividend date. Here are a few things to keep in mind:

1. Ordinary Income Tax

If you hold the stock for less than a year, the dividend will be taxed as ordinary income. This means you’ll pay taxes at your regular income tax rate.

2. Qualified Dividends

If you hold the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date, the dividend may qualify for a lower tax rate. This is known as a qualified dividend.

3. Capital Gains Tax

If you sell your shares for a profit, you may be subject to capital gains tax. The rate depends on how long you held the stock and your income level.

Strategies for Selling After the Ex-Dividend Date

Now that you understand the basics, let’s talk about strategies for selling your stocks after the ex-dividend date. Here are a few tips to help you make the most of your investment:

1. Reinvest the Dividend

Instead of cashing out the dividend, consider reinvesting it to buy more shares. This can help you grow your investment over time.

2. Wait for Price Recovery

After the ex-dividend date, the stock price might drop. If you believe the stock has long-term potential, you could wait for the price to recover before selling.

3. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversify your portfolio to reduce risk and increase potential returns.

Common Mistakes to Avoid

Investing can be tricky, and mistakes happen. Here are a few common pitfalls to watch out for:

- Selling too early and missing out on the dividend.

- Not understanding the tax implications of selling stocks.

- Overreacting to short-term price fluctuations.

Real-World Examples

Let’s look at a couple of real-world examples to illustrate how this works:

Example 1: Apple Inc.

Apple declares a dividend of $0.23 per share. The ex-dividend date is set for October 7, the record date is October 12, and the payment date is November 10. If you own Apple stock before October 7, you’ll receive the dividend as long as you hold the shares until October 12. You can sell your shares anytime after October 7 and still get the dividend.

Example 2: Tesla Inc.

Tesla declares a dividend of $0.10 per share. The ex-dividend date is set for December 1, the record date is December 6, and the payment date is January 5. If you sell your Tesla shares on December 2, you’ll still receive the dividend because you owned the stock before the ex-dividend date.

Frequently Asked Questions

Q1: Can I sell my shares on the ex-dividend date?

Yes, you can sell your shares on the ex-dividend date, but you won’t be eligible for the dividend. To qualify for the dividend, you must own the stock before the ex-dividend date.

Q2: What happens if I sell my shares before the payment date?

If you sell your shares after the ex-dividend date but before the payment date, you’ll still receive the dividend as long as you owned the stock on the record date.

Q3: How are dividends taxed?

Dividends are taxed differently depending on your location and investment account. In general, qualified dividends are taxed at a lower rate than ordinary income.

Conclusion

In conclusion, understanding how soon after the ex-dividend date you can sell your stocks is essential for maximizing your investment returns. By familiarizing yourself with key dates and strategies, you can make informed decisions and avoid common pitfalls.

So, what’s next? Take action! Review your portfolio, consider reinvesting dividends, and diversify your investments. And don’t forget to consult with a financial advisor if you’re unsure about anything.

Got questions or comments? Drop them below, and let’s keep the conversation going. Share this article with your friends and family, and help them navigate the world of stock dividends with confidence. Happy investing, folks! Cheers!

ExDividend Date Calendar Dividend Ladder

Iep Ex Dividend Date 2025 Layla Ruby

Why the ExDividend Date Matters When Investing in Stocks