How Do I Learn Stock Market? The Ultimate Guide For Beginners

Learning the stock market might feel like diving into uncharted territory, but don’t sweat it! If you're wondering how do I learn stock market, you're in the right place. Think of it as a game where you’re the player, and the market is your arena. The stock market isn’t just for Wall Street bigwigs anymore—it’s now a playground for everyday people looking to grow their wealth. Whether you’re saving for a dream vacation, planning for retirement, or simply curious about investing, understanding the stock market is your golden ticket to financial independence.

Now, before you start panicking about numbers and charts, take a deep breath. This article will break it down step by step so you can feel confident about diving into the world of stocks. We’re not just throwing random tips at you; we’re giving you a roadmap that’s easy to follow and packed with actionable advice.

By the end of this guide, you’ll know everything from the basics of what a stock is to advanced strategies that even seasoned investors use. So, grab a cup of coffee, sit back, and let’s get started on your journey to mastering the stock market. Trust me, it’s not as intimidating as it seems!

- Sophie Rain Leaked The Untold Story Behind The Viral Sensation

- Jameliz Benitez The Truth Behind The Controversial Search Term

Table of Contents:

- What is the Stock Market?

- Why Learn the Stock Market?

- Basic Concepts of the Stock Market

- How to Start Learning the Stock Market

- Resources for Learning the Stock Market

- Common Mistakes to Avoid

- Trading vs. Investing

- Building a Diversified Portfolio

- Tips for Beginners

- The Future of Stock Market Investing

What is the Stock Market?

The stock market is basically a marketplace where people buy and sell shares of publicly traded companies. Think of it as a giant auction where everyone’s trying to buy low and sell high. When you buy a stock, you’re buying a tiny piece of ownership in a company. It’s like being a part-owner, but instead of running the business, you get to enjoy a share of its profits—or face its losses.

Now, you might be wondering, "What’s the big deal about the stock market?" Well, it’s one of the most powerful ways to grow your money over time. Unlike stashing cash under your mattress, investing in stocks allows you to take advantage of compound growth, meaning your money can grow exponentially. Cool, right?

- Anjali Arora Viral Video The Story Behind The Sensation

- Crazyjamjam Leaks The Inside Story You Need To Know

How Does the Stock Market Work?

Here’s a quick rundown: Companies issue stocks to raise money for expansion or other business needs. Investors like you and me buy these stocks, hoping the company will perform well and its stock price will rise. When that happens, you can sell your shares for a profit. But remember, the stock market is unpredictable, so there’s always a risk involved.

Pro tip: Don’t put all your eggs in one basket. Diversify your investments to reduce risk.

Why Learn the Stock Market?

Learning how the stock market works can be a game-changer for your financial future. Let’s break it down:

- Financial Independence: Investing in stocks can help you achieve long-term financial goals, like buying a house or retiring early.

- Inflation Hedge: Stocks have historically outpaced inflation, meaning your money can keep up with rising living costs.

- Passive Income: Many stocks pay dividends, which are like little bonuses you get just for owning the stock.

- Knowledge is Power: The more you understand the stock market, the better equipped you’ll be to make smart investment decisions.

Remember, the earlier you start learning and investing, the more time your money has to grow. Time is your best ally in the world of stocks!

Basic Concepts of the Stock Market

Before you dive headfirst into the stock market, there are a few key concepts you need to understand:

Stock vs. Share

People often use the terms "stock" and "share" interchangeably, but they’re slightly different. A stock refers to your ownership in a company, while a share is a single unit of that ownership. For example, if you own 100 shares of Apple stock, you own 100 pieces of Apple’s company.

Bull Market vs. Bear Market

A bull market is when stock prices are rising, and investors are optimistic. A bear market, on the other hand, is when prices are falling, and there’s more pessimism. Knowing the difference can help you make better investment decisions.

Market Capitalization

Market cap is the total value of a company’s outstanding shares. It’s calculated by multiplying the stock price by the number of shares. Companies are often categorized by their market cap: small-cap, mid-cap, and large-cap.

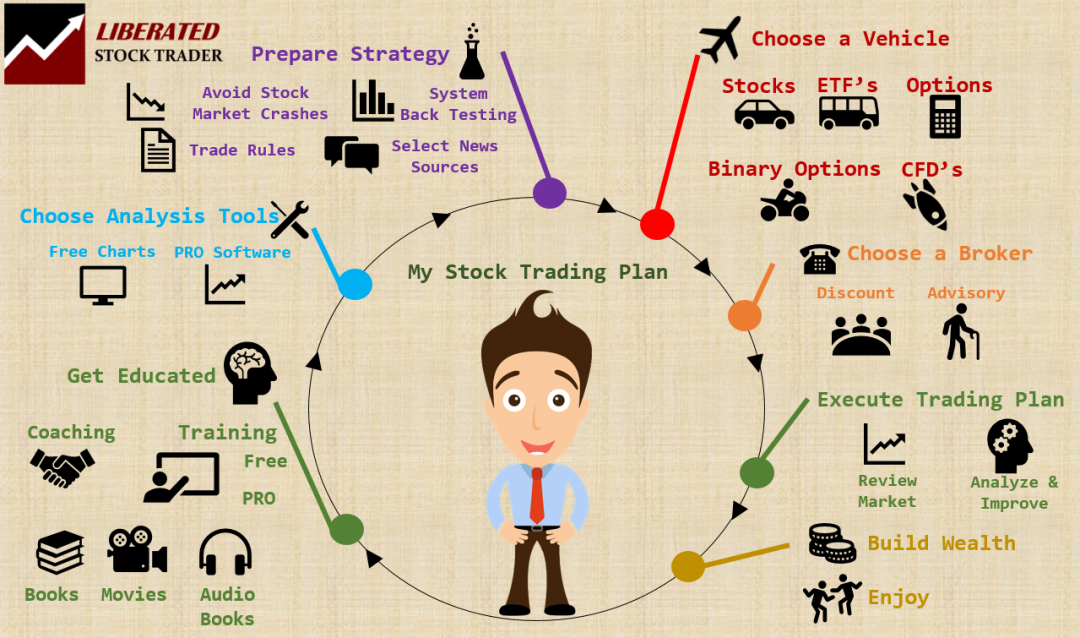

How to Start Learning the Stock Market

So, how do you actually start learning the stock market? Here’s a step-by-step guide:

- Read Books: There are tons of great books on investing, like "The Intelligent Investor" by Benjamin Graham and "One Up On Wall Street" by Peter Lynch.

- Take Online Courses: Platforms like Coursera and Udemy offer courses on stock market basics.

- Follow Financial News: Stay updated with what’s happening in the markets by following reputable sources like Bloomberg and CNBC.

- Practice with Simulators: Many platforms offer stock market simulators where you can practice trading without risking real money.

Fun fact: Warren Buffett, one of the most successful investors of all time, started learning about stocks when he was just a teenager!

Resources for Learning the Stock Market

There’s no shortage of resources to help you learn the stock market. Here are a few you should check out:

Books

- "A Random Walk Down Wall Street" by Burton G. Malkiel

- "Common Stocks and Uncommon Profits" by Philip Fisher

- "The Little Book of Common Sense Investing" by John C. Bogle

Podcasts

- The Investors Podcast

- Marketplace

- How to Money

Websites

- Investopedia

- Yahoo Finance

- Seeking Alpha

Common Mistakes to Avoid

Even the best investors make mistakes, but you can avoid some common pitfalls by being aware of them:

- Emotional Trading: Don’t let fear or greed drive your decisions. Stick to a solid strategy.

- Chasing Trends: Just because a stock is popular doesn’t mean it’s a good investment.

- Ignoring Fees: High fees can eat into your profits, so always check the costs associated with your investments.

- Overtrading: Constantly buying and selling can lead to losses due to transaction costs and taxes.

Remember, patience is key in the stock market. Don’t expect to get rich overnight!

Trading vs. Investing

While both involve the stock market, trading and investing are quite different. Trading is about buying and selling stocks quickly to capitalize on short-term price movements. Investing, on the other hand, is about holding stocks for the long term and benefiting from their growth over time.

Which One is Right for You?

It depends on your goals and risk tolerance. If you’re looking for quick gains and enjoy the thrill of the market, trading might be for you. But if you prefer a more stable approach and want to build wealth over time, investing is the way to go.

Building a Diversified Portfolio

A diversified portfolio means spreading your investments across different asset classes, sectors, and geographies. This reduces your risk because if one investment performs poorly, others might perform well.

Steps to Building a Diversified Portfolio

- Identify your investment goals and risk tolerance.

- Research different asset classes, like stocks, bonds, and real estate.

- Choose a mix of investments that align with your goals.

- Regularly review and rebalance your portfolio to ensure it stays aligned with your objectives.

Pro tip: Consider using ETFs (Exchange-Traded Funds) or mutual funds to easily diversify your portfolio.

Tips for Beginners

Here are a few tips to help you get started on the right foot:

- Start Small: You don’t need a lot of money to start investing. Many platforms allow you to invest with as little as $5.

- Focus on the Long Term: The stock market can be volatile in the short term, but historically, it has always trended upward over the long term.

- Stay Informed: Keep learning and stay updated with market trends and news.

- Be Patient: Building wealth through the stock market takes time, so don’t get discouraged by short-term setbacks.

The Future of Stock Market Investing

The world of investing is constantly evolving. With advancements in technology, we’re seeing new ways to invest, like fractional shares and cryptocurrency. The future looks bright for those willing to adapt and learn.

As more people gain access to the stock market through apps and online platforms, the barriers to entry are lower than ever. This democratization of investing means anyone can become a successful investor with the right knowledge and tools.

What’s Next for You?

Now that you’ve got the basics down, it’s time to take action. Start small, stay curious, and most importantly, keep learning. The stock market can be a powerful tool for building wealth, and with the right approach, you can achieve your financial dreams.

Call to Action: Ready to take the next step? Share your thoughts in the comments below or check out our other articles on personal finance and investing. Let’s grow together!

- Brooke Monk Nudes The Truth Behind The Clickbait And The Real Story

- Lia Thomas Wife The Story Behind The Spotlight

Learn Stock Market How to Understand Stock Market in India?

Learn About Stock Market

How Can I Learn The Stock Market?