FinBrain: Your Ultimate Financial Genius In Your Pocket

FinBrain is more than just a financial tool—it’s a game-changer for anyone looking to take control of their money. Imagine having a financial advisor at your fingertips, ready to guide you through the complexities of investing, saving, and growing your wealth. That’s exactly what FinBrain offers. Whether you’re a seasoned investor or just starting out, this platform has everything you need to make smarter financial decisions.

In today’s fast-paced world, managing finances can feel overwhelming. Between fluctuating markets, unpredictable economies, and the constant bombardment of financial jargon, it’s easy to get lost. But here’s the good news: FinBrain steps in to simplify all that chaos. It’s like having a personal assistant who not only understands numbers but also speaks your language.

So, why should you care? Because your financial future depends on the choices you make today. And with FinBrain, those choices become smarter, faster, and more informed. Let’s dive into what makes FinBrain so special and how it can transform the way you handle your money.

- Sophie Rain Erome The Rising Star In The World Of Modeling And Entertainment

- Nikita Kinka Rising Star In The Spotlight

What Exactly is FinBrain?

FinBrain is an advanced financial analysis platform designed to help individuals and businesses navigate the often confusing world of finance. At its core, FinBrain uses cutting-edge AI and machine learning algorithms to provide real-time insights into stock markets, cryptocurrencies, and other investment opportunities. Think of it as your digital financial guru, offering advice tailored specifically to your needs.

But here’s the kicker: FinBrain isn’t just for Wall Street elites. It’s built for everyone—from beginners who want to dip their toes into investing to seasoned pros looking for an edge. By breaking down complex financial data into easy-to-understand insights, FinBrain empowers users to take control of their financial destinies.

How Does FinBrain Work?

FinBrain works by analyzing massive amounts of financial data from around the globe. Using AI and machine learning, it identifies trends, predicts market movements, and provides actionable recommendations. Here’s a quick breakdown:

- Karlye Taylor Nude The Truth Behind The Controversy And Clickbait

- Jasi Bae Leaks The Untold Story You Need To Know

- Data Collection: FinBrain gathers data from various sources, including stock exchanges, news outlets, and social media platforms.

- Analysis: The platform processes this data using sophisticated algorithms to identify patterns and trends.

- Predictions: Based on its analysis, FinBrain forecasts potential market movements and highlights investment opportunities.

- Personalized Insights: Users receive tailored recommendations based on their financial goals and risk tolerance.

It’s like having a crystal ball for your investments, minus the mysticism!

Why Choose FinBrain Over Other Platforms?

With so many financial tools out there, what sets FinBrain apart? Here are a few reasons:

- Accuracy: FinBrain’s AI-driven predictions have been shown to outperform traditional forecasting methods.

- User-Friendliness: Even if you’re new to investing, FinBrain’s intuitive interface makes it easy to get started.

- Real-Time Updates: Stay ahead of the curve with up-to-the-minute market insights.

- Customization: Tailor the platform to fit your unique financial situation and goals.

In short, FinBrain isn’t just another app—it’s a comprehensive solution that puts the power of finance in your hands.

FinBrain vs Traditional Financial Advisors

While traditional financial advisors offer valuable expertise, they come with significant downsides. High fees, limited availability, and a one-size-fits-all approach can leave many investors feeling underserved. Enter FinBrain, which offers:

- Lower Costs: No need to pay hefty advisory fees when you have FinBrain by your side.

- 24/7 Access: Need advice at 3 AM? FinBrain’s got you covered.

- Personalized Recommendations: Unlike generic advice, FinBrain’s insights are tailored specifically to you.

It’s no wonder more and more people are turning to FinBrain as their go-to financial partner.

Key Features of FinBrain

FinBrain boasts a range of features that make it a must-have for anyone serious about their finances. Here’s a closer look:

1. AI-Powered Market Analysis

FinBrain’s AI analyzes market data in real time, providing users with up-to-the-minute insights. This means you’re always ahead of the curve, ready to seize opportunities as they arise.

2. Cryptocurrency Insights

Crypto markets are notoriously volatile, but FinBrain helps you navigate them with confidence. Its advanced algorithms predict price movements and identify potential investment opportunities.

3. Portfolio Management

Track your investments, monitor performance, and adjust your strategy—all within the FinBrain platform. It’s like having a personal finance dashboard at your fingertips.

4. Educational Resources

FinBrain doesn’t just give you answers—it helps you understand the “why” behind them. Through tutorials, articles, and interactive tools, the platform empowers users to become better investors.

Who Should Use FinBrain?

FinBrain is versatile enough to cater to a wide range of users. Whether you’re a:

- Beginner Investor: Just starting out and looking for guidance? FinBrain simplifies the process, making it easy to get started.

- Seasoned Pro: Already an experienced investor? FinBrain provides the advanced analytics you need to stay ahead of the competition.

- Business Owner: Running a business and need financial insights? FinBrain offers tools to help you manage cash flow, invest wisely, and grow your company.

No matter where you are on your financial journey, FinBrain has something to offer.

Is FinBrain Right for You?

Ask yourself: Do I want to take control of my financial future? If the answer is yes, then FinBrain is definitely worth exploring. With its combination of advanced technology and user-friendly design, it’s a tool that can benefit almost anyone.

How to Get Started with FinBrain

Ready to jump in? Here’s how to get started with FinBrain:

- Sign Up: Create an account on the FinBrain website or download the app.

- Set Goals: Define your financial objectives and risk tolerance.

- Explore Features: Dive into the platform’s tools and resources to see what works best for you.

- Start Investing: Use FinBrain’s insights to make your first investment decision.

It’s that simple—and before you know it, you’ll be on your way to financial success.

Tips for Maximizing FinBrain’s Potential

To get the most out of FinBrain, keep these tips in mind:

- Stay Consistent: Regularly check the platform for updates and insights.

- Learn Continuously: Take advantage of FinBrain’s educational resources to deepen your financial knowledge.

- Be Patient: Investing is a long-term game; don’t expect overnight success.

With persistence and the right mindset, FinBrain can help you achieve your financial goals.

Success Stories: Real People, Real Results

Don’t just take our word for it—here are some real-life success stories from FinBrain users:

Case Study 1: John D.

John was a retail worker who wanted to start investing but didn’t know where to begin. After discovering FinBrain, he began following its recommendations and gradually built a diversified portfolio. Within two years, his investments had grown significantly, allowing him to pursue his dream of starting his own business.

Case Study 2: Sarah M.

Sarah was a busy mom who struggled to find time to manage her finances. With FinBrain’s automated tools and personalized insights, she was able to streamline her financial planning and make smarter investment decisions. Today, she’s on track to retire early and spend more time with her family.

These stories highlight the transformative power of FinBrain. It’s not just a tool—it’s a catalyst for change.

The Future of FinBrain

As technology continues to evolve, so too does FinBrain. The platform is constantly updating its algorithms and expanding its features to stay ahead of the curve. Some exciting developments on the horizon include:

- Enhanced AI Capabilities: Even more accurate predictions and insights.

- New Investment Opportunities: Expanded coverage of emerging markets and assets.

- Improved User Experience: A more intuitive interface and additional customization options.

The future looks bright for FinBrain—and for anyone who chooses to use it.

What’s Next for FinBrain Users?

For existing users, expect regular updates and new features to enhance your experience. For newcomers, now is the perfect time to join the FinBrain community and start your financial journey.

Conclusion: Take Control of Your Finances with FinBrain

FinBrain is more than just a financial tool—it’s a partner in your journey toward financial independence. By leveraging cutting-edge technology and user-friendly design, it empowers individuals and businesses to make smarter, more informed financial decisions.

So, what are you waiting for? Sign up today and discover the power of FinBrain for yourself. And don’t forget to share your experience with others—after all, knowledge is wealth!

Call to Action

Ready to transform your financial future? Click the link below to get started with FinBrain:

And while you’re at it, why not check out our other articles on personal finance and investing? Your financial education starts here.

Table of Contents

Why Choose FinBrain Over Other Platforms?

How to Get Started with FinBrain

Success Stories: Real People, Real Results

- Jameliz Benitez The Truth Behind The Controversial Search Term

- Mikayla Campino Leak The Untold Story You Need To Know About

FinBrain Stock Predictions with Artificial Intelligence

Fin Whale's Brain ClipPix ETC Educational Photos for Students and

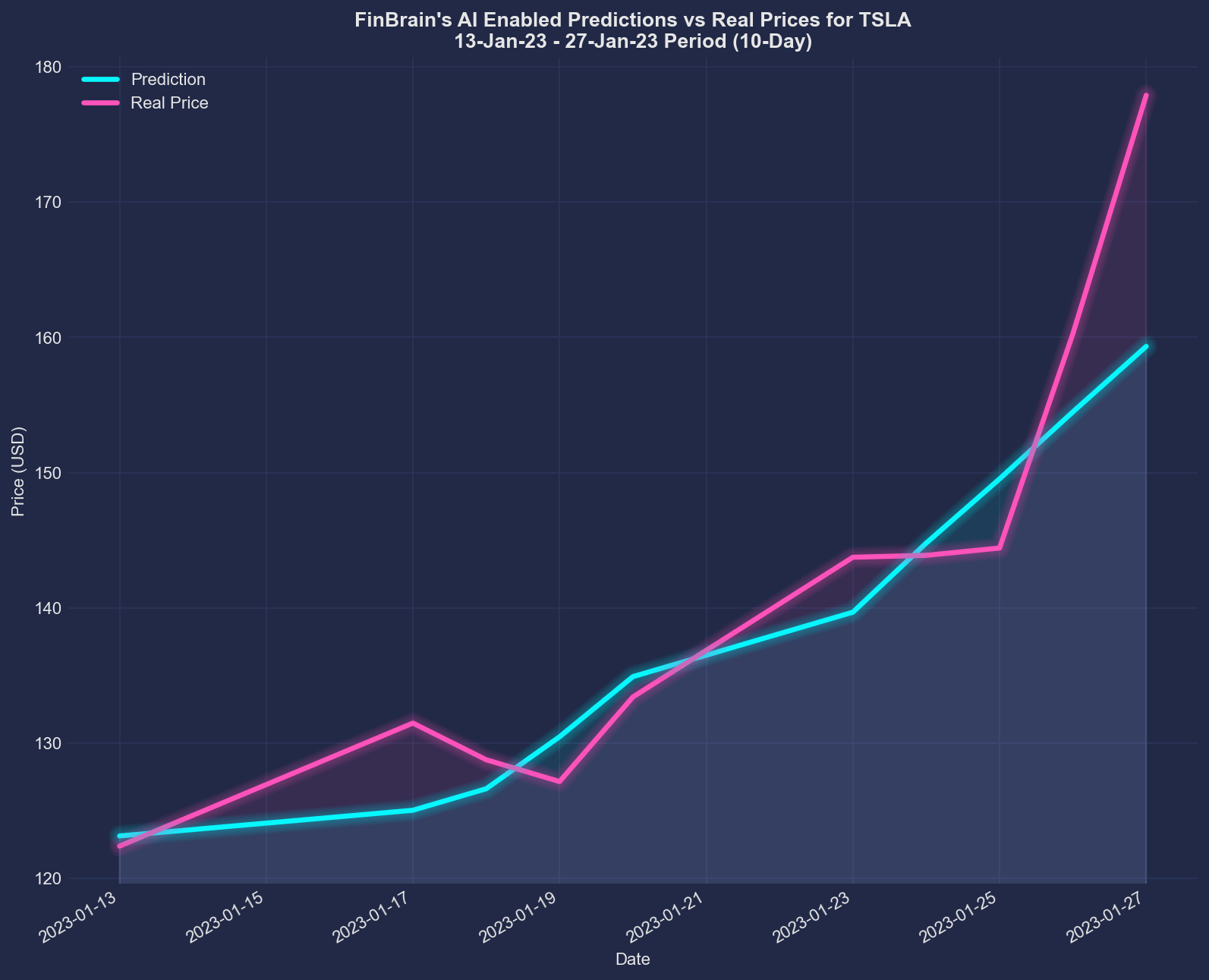

Here is how FinBrain achieved a remarkable forecast accuracy for TSLA