Candlesticks Trade: The Ultimate Guide To Mastering Price Action

Let’s be real here, candlesticks trade isn’t just another trading concept—it’s the heart and soul of technical analysis. If you’re diving into the world of trading, you better strap in because understanding candlestick patterns could mean the difference between hitting it big or missing out on golden opportunities. Imagine this: you’re sitting in front of your trading screen, staring at those tiny little candles, wondering what they’re trying to tell you. Well, my friend, those candles aren’t just random; they’re whispering secrets about market sentiment and potential price movements. So, let’s decode these whispers together.

Candlesticks trade might sound intimidating at first, but trust me, it’s like learning a new language. Once you get the hang of it, you’ll start seeing patterns everywhere. And hey, patterns are your best friends in trading. They give you insights into buyer and seller dynamics, helping you predict where prices might go next. Whether you’re a rookie or a seasoned trader, mastering candlesticks can take your game to the next level.

Now, don’t get me wrong—candlesticks aren’t some magical crystal ball that predicts the future. But they are powerful tools when combined with other indicators and strategies. This guide is here to break it all down for you, step by step. We’ll cover everything from the basics of candlestick patterns to advanced techniques that’ll make you feel like a trading wizard. Ready to light the candle of knowledge? Let’s dive in!

Table of Contents

How to Read Candlestick Charts

- Anjali Arora Viral Video The Story Behind The Sensation

- Kyla Yesenosky Nude The Truth Behind The Clickbait And Sensationalism

Common Candlestick Patterns You Need to Know

Reversal Patterns: Spotting Market Turns

Continuation Patterns: Riding the Trend

Combining Candlestick Patterns with Other Indicators

Common Risks and Mistakes in Candlesticks Trade

Real-World Examples of Successful Candlesticks Trade

What Are Candlesticks?

Candlesticks are essentially visual representations of price movements over a specific time period. They’re like little snapshots of the market’s mood. Each candlestick shows four key pieces of information: the opening price, closing price, highest price, and lowest price within that time frame. Now, here’s the fun part—candlesticks come in different shapes and sizes, and each one tells a unique story about market sentiment.

For instance, a long green candlestick with no upper wick might indicate strong buying pressure, while a short red candlestick with long wicks could suggest indecision or potential reversal. It’s all about reading the tea leaves—or in this case, the candles.

And guess what? Candlesticks aren’t just for stocks. You can use them in forex, crypto, commodities, and basically any market where price action is king. So, no matter what you’re trading, candlesticks have got your back.

The History of Candlesticks

You know what’s wild? Candlestick charts weren’t invented by some modern-day trading guru. Nope, they’ve been around for centuries. The concept is actually attributed to Munehisa Homma, a Japanese rice trader from the 1700s. Yeah, you read that right—rice trading back in the day was a big deal, and Homma figured out how to use these charts to predict price movements. Talk about being ahead of the curve!

Fast forward to today, and candlesticks have become an essential tool for traders worldwide. They’ve stood the test of time because they work. Whether you’re dealing with ancient rice markets or cutting-edge cryptocurrencies, the principles remain the same. It’s all about understanding supply and demand through price action.

How to Read Candlestick Charts

Alright, let’s get into the nitty-gritty of reading candlestick charts. First things first, you need to know the anatomy of a candlestick. Each candlestick has a body, which represents the opening and closing prices. If the body is green (or white), it means the closing price was higher than the opening price. If it’s red (or black), it means the closing price was lower than the opening price. Simple enough, right?

Then there are the wicks, also known as shadows. The upper wick shows the highest price reached during the period, while the lower wick shows the lowest price. These wicks give you valuable insights into market volatility. For example, a long upper wick might indicate that buyers tried to push the price up but were met with strong resistance.

Now, here’s a pro tip: always look at the context. A single candlestick in isolation doesn’t tell the whole story. You need to consider the bigger picture, including the surrounding candles and overall market trends. It’s like putting together a puzzle—one piece doesn’t make the whole picture.

Why Candlestick Charts Are Better Than Bar Charts

Let’s be honest, candlestick charts are just more visually appealing than bar charts. The colors and shapes make it easier to spot patterns and trends at a glance. Plus, they’re more intuitive. You don’t need a PhD in finance to understand what a long green candlestick means—it’s pretty self-explanatory.

Bar charts, on the other hand, can feel a bit clunky. They show the same information but lack the visual flair of candlesticks. Sure, some traders still prefer bar charts, but most would agree that candlesticks are the way to go for quick and effective analysis.

Common Candlestick Patterns You Need to Know

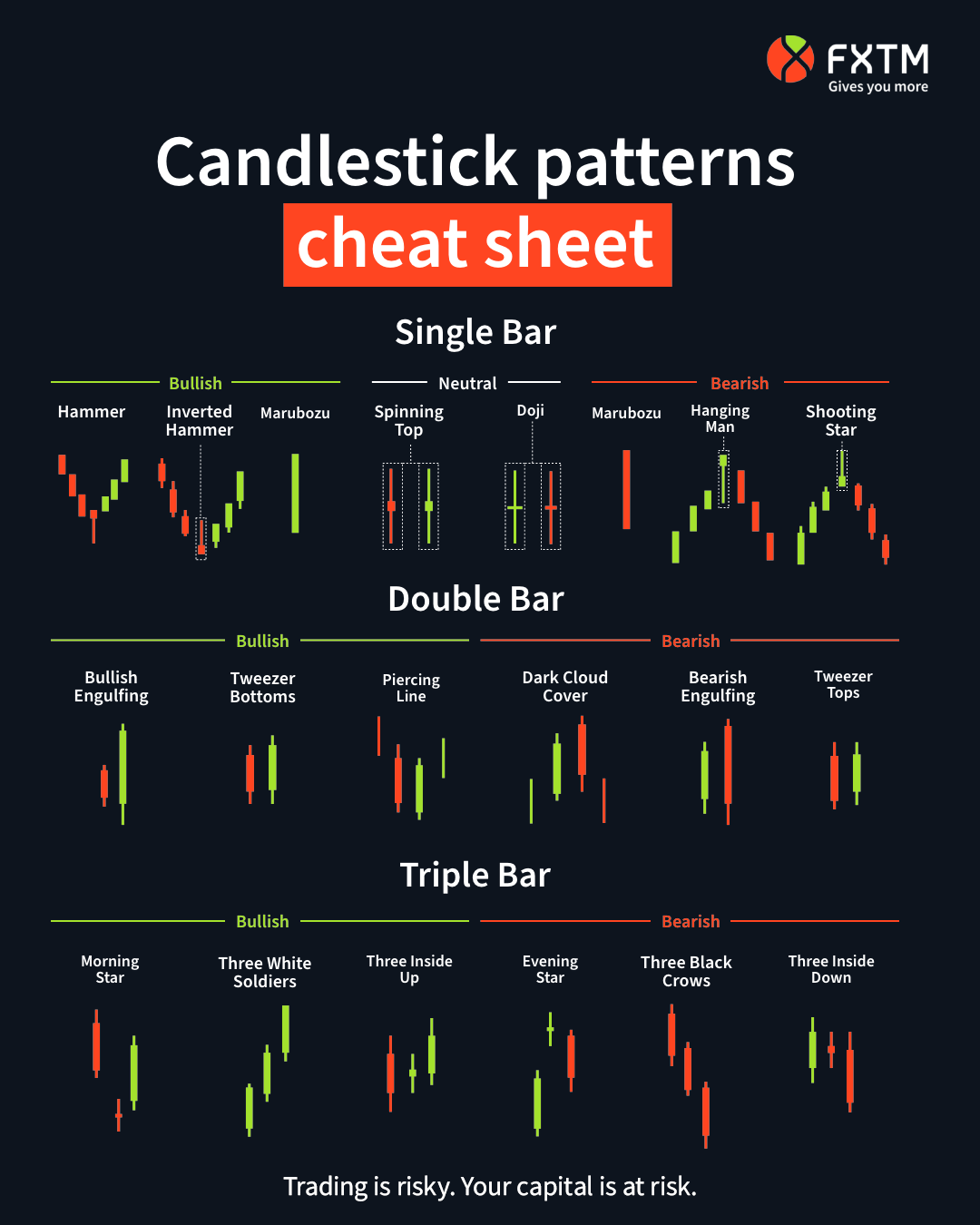

Now that you know how to read candlesticks, it’s time to learn about the most common patterns. These patterns are like the alphabet of trading—they form the building blocks of your analysis. Here are a few must-know patterns:

- Doji: A doji occurs when the opening and closing prices are almost the same, resulting in a tiny body. It often indicates indecision in the market and can signal a potential reversal.

- Hammer: A hammer has a small body at the top of a long lower wick. It’s usually seen as a bullish reversal pattern, suggesting that buyers stepped in after prices fell.

- Engulfing Pattern: This pattern consists of two candles where the second candle completely engulfs the first. A bullish engulfing pattern occurs when a green candle follows a red one, indicating strong buying pressure.

- Shooting Star: A shooting star is the opposite of a hammer, with a small body at the bottom of a long upper wick. It’s a bearish reversal pattern, suggesting that sellers took control after prices rose.

These are just a few examples, but there are dozens of candlestick patterns out there. The key is to focus on the ones that work best for your trading style.

How to Identify Patterns Quickly

Identifying patterns quickly is a skill that takes practice. Start by familiarizing yourself with the most common patterns and their meanings. Then, use charting tools that highlight patterns automatically. Some platforms even have built-in alerts for specific patterns, so you don’t miss out on opportunities.

Remember, not all patterns are created equal. Some are more reliable than others, so it’s important to test them in different market conditions. And always combine patterns with other indicators to confirm your analysis. You don’t want to rely on one single signal when the stakes are high.

Reversal Patterns: Spotting Market Turns

Reversal patterns are every trader’s dream. They help you spot potential trend changes before they happen, giving you a competitive edge. Some of the most popular reversal patterns include:

- Double Top/Double Bottom: These patterns occur when prices test a certain level twice but fail to break through, signaling a potential reversal.

- Head and Shoulders: This classic pattern consists of three peaks, with the middle peak being the highest. It often indicates a bearish reversal when completed.

- Inverted Head and Shoulders: The opposite of the head and shoulders, this pattern signals a bullish reversal.

Reversal patterns can be highly profitable if identified correctly. However, they also come with risks. Markets don’t always behave as expected, so it’s crucial to manage your risk and set proper stop-loss levels.

When to Trust Reversal Patterns

Not every reversal pattern is worth betting on. You need to look for confirmation signals, such as volume spikes or breakouts from key levels. Additionally, consider the broader market context. Is the overall trend strong enough to support a reversal? Are there any macroeconomic factors at play? These questions can help you make more informed decisions.

Continuation Patterns: Riding the Trend

While reversal patterns are exciting, continuation patterns are equally important. They help you identify when a trend is likely to continue, allowing you to ride the wave for maximum profits. Common continuation patterns include:

- Flags: These patterns resemble flags on a flagpole. They occur during strong trends and usually last for a short period before the trend resumes.

- Pennants: Similar to flags, pennants are triangular patterns that form during a pause in the trend.

- Triangles: There are three types of triangles—symmetrical, ascending, and descending. Each one provides valuable insights into market direction.

Continuation patterns are great for traders who prefer to follow trends rather than trying to pick tops and bottoms. They offer lower-risk opportunities to enter or exit trades in the direction of the trend.

How to Trade Continuation Patterns

Trading continuation patterns requires patience and discipline. Don’t jump the gun—wait for the pattern to fully form before taking action. Once the breakout occurs, enter your trade with a tight stop-loss and a clear profit target. And always respect the trend—don’t fight it unless you have a very good reason.

Combining Candlestick Patterns with Other Indicators

Candlestick patterns are powerful on their own, but they become even more effective when combined with other indicators. Some popular indicators to pair with candlesticks include:

- RSI (Relative Strength Index): RSI helps you identify overbought and oversold conditions, providing additional confirmation for your trades.

- MACD (Moving Average Convergence Divergence): MACD can help you spot trend changes and momentum shifts, complementing candlestick signals.

- Volume: Volume is a crucial factor in confirming patterns. A breakout on high volume is more reliable than one on low volume.

By combining multiple indicators, you can create a robust trading strategy that minimizes risks and maximizes rewards. Just be careful not to overcomplicate things—too many indicators can lead to analysis paralysis.

Creating a Winning Strategy

Your ultimate goal is to create a strategy that works for you. Start by testing different combinations of candlestick patterns and indicators in a demo account. Keep track of your results and adjust your approach as needed. Over time, you’ll develop a system that aligns with your trading style and risk tolerance.

Common Risks and Mistakes in Candlesticks Trade

As with any trading strategy, candlesticks come with risks. Here are some common mistakes to avoid:

- Overtrading: Don’t get carried away by seeing patterns everywhere. Stick to high-probability setups and avoid chasing every signal.

- Ignoring Context: Always consider the bigger picture. A single pattern in isolation might not be reliable without proper context.

- Failing to Manage Risk: Risk management is key to long-term success. Set stop-loss levels and stick to them, no matter how confident you are in a trade.

Trading is a marathon, not a sprint. Focus on consistency and discipline, and you’ll be well on your way to mastering candlesticks trade.

Real-World Examples of Successful Candlesticks Trade

Let’s take a look at some real-world examples of successful candlesticks trade. Imagine you’re trading a stock that forms a bullish engulfing pattern after a downtrend. You enter the trade at the breakout point and set your stop-loss below the low of the engulfing pattern. The stock rallies as expected, and you exit with

- Jameliz Benitez The Truth Behind The Controversial Search Term

- Penelope Menchaca Onlyfans The Rise Of A Digital Sensation

Strength of Candlesticks Stock trading, Trading charts, Online stock

Forex Trade Candlesticks 1782087 Vector Art at Vecteezy

Forex Candlesticks » Crypto Exchange Spy