Can You Sell On Ex Dividend Date? A Comprehensive Guide For Savvy Investors

When it comes to the world of stocks and dividends, there’s a lot of jargon that can leave even the most seasoned investors scratching their heads. One of the most common questions that pops up is, "Can you sell on ex dividend date?" Well, buckle up, my friend, because we’re about to deep-dive into this topic and answer all your burning questions. Whether you're a rookie or a stock market wizard, understanding the ins and outs of the ex-dividend date is crucial for maximizing your profits.

Let’s face it, investing in the stock market is not just about buying low and selling high. It’s also about timing, strategy, and knowing the rules of the game. The ex-dividend date is one of those rules that can significantly impact your investment decisions. So, if you’re wondering whether you can sell on the ex-dividend date, you’re in the right place. We’ll break it down step by step so you can make informed choices.

Before we dive into the nitty-gritty, let me give you a heads-up: this isn’t just another boring article filled with financial jargon. We’re going to chat about the ex-dividend date like we’re sitting at a coffee shop, sipping lattes, and talking shop. Ready? Let’s go!

- Sophia Rain Xxx A Comprehensive Look At The Rising Star

- Kid And His Mom Cctv Video The Untold Story Thats Capturing Everyones Attention

Now that we’ve set the stage, let’s get into the meat of the matter. This article will cover everything you need to know about selling on the ex-dividend date, including what it means, how it works, and whether it’s a good idea. Plus, we’ll sprinkle in some expert tips and real-world examples to keep things interesting. Let’s jump into the table of contents so you can navigate through this guide easily.

Table of Contents

- What is Ex Dividend Date?

- Can You Sell on Ex Dividend Date?

- How Does Ex Dividend Date Work?

- Impact on Stock Price

- Tax Implications

- Strategies for Investors

- Common Mistakes to Avoid

- Real-World Examples

- Frequently Asked Questions

- Conclusion

What is Ex Dividend Date?

Alright, let’s start with the basics. The ex-dividend date is the date on which a stock starts trading without its upcoming dividend. Think of it as the cutoff point for receiving the dividend payout. If you buy the stock on or after this date, you won’t be eligible for the dividend. Simple, right?

But here’s the kicker: the ex-dividend date is not the same as the record date or the payment date. Confused? Don’t worry, we’ll break it down further in the next section. For now, just remember that the ex-dividend date is crucial because it determines who gets the dividend – the seller or the buyer.

- Zulma Aponte Shimkus A Rising Star In The Spotlight

- Unveiling The Power Of Mms Video Revolutionizing Mobile Communication

Let me give you a quick analogy. Imagine you’re hosting a party and you’ve sent out invitations. The ex-dividend date is like the RSVP deadline. If you respond after the deadline, you’re not on the guest list. Similarly, if you buy the stock after the ex-dividend date, you’re not on the dividend payout list.

Why is the Ex Dividend Date Important?

The ex-dividend date is more than just a calendar event. It affects stock prices, investor behavior, and even tax strategies. For instance, many investors use the ex-dividend date to time their trades and optimize their returns. Others might avoid buying on this date to avoid potential price drops. Understanding the significance of this date can help you make smarter investment decisions.

Can You Sell on Ex Dividend Date?

Now, let’s tackle the big question: can you sell on the ex-dividend date? The short answer is yes, you absolutely can. There’s no rule preventing you from selling your shares on this date. However, whether you should or not depends on your investment strategy and goals.

Selling on the ex-dividend date means you’re giving up your right to the upcoming dividend. If you’ve already held the stock for a while and don’t need the dividend, selling might make sense. On the other hand, if you’re counting on that dividend payout, you might want to hold onto your shares until after the record date.

Let me throw in a little secret here: some investors actually sell on the ex-dividend date to lock in profits. They know that the stock price might drop after the dividend is paid out, so they sell before the dip happens. It’s like selling your lemonade stand right before the rain starts – you get out while the getting’s good.

What Happens if You Sell on Ex Dividend Date?

If you sell on the ex-dividend date, you won’t be eligible for the dividend. The new owner of the shares will receive the payout instead. Additionally, the stock price might adjust downward to reflect the dividend payment. So, if you’re planning to sell, make sure you’ve factored in these potential price changes.

How Does Ex Dividend Date Work?

Now that we’ve covered the basics, let’s dive deeper into how the ex-dividend date works. When a company declares a dividend, it sets several important dates:

- Declaration Date: The date the company announces the dividend.

- Ex-Dividend Date: The date the stock starts trading without the dividend.

- Record Date: The date the company determines who gets the dividend.

- Payment Date: The date the dividend is actually paid out to shareholders.

Here’s a quick example to help you visualize the process. Let’s say Company XYZ declares a $1 dividend per share. The ex-dividend date is set for March 1st, the record date is March 3rd, and the payment date is March 15th. If you buy the stock on or after March 1st, you won’t be eligible for the dividend. However, if you owned the stock before March 1st, you’ll receive the payout on March 15th.

Why Do Stock Prices Drop on Ex Dividend Date?

One of the most common questions about the ex-dividend date is why stock prices often drop on this day. The reason is simple: the stock is now trading without the value of the dividend. For example, if a stock is trading at $100 and the dividend is $2, the price might drop to $98 on the ex-dividend date. This adjustment ensures that buyers aren’t getting the dividend for free.

Impact on Stock Price

The ex-dividend date can have a significant impact on stock prices. As we mentioned earlier, the price often drops to reflect the dividend payout. However, the magnitude of the drop can vary depending on market conditions and investor sentiment.

Some stocks might experience a larger drop if there’s a lot of selling pressure on the ex-dividend date. Others might stabilize quickly if buyers step in to take advantage of the lower price. It’s like a game of supply and demand – the more people want the stock, the less it will drop.

How to Predict Stock Price Movements

Predicting stock price movements on the ex-dividend date isn’t an exact science, but there are a few factors you can consider:

- Historical Data: Look at how the stock has behaved on previous ex-dividend dates.

- Market Sentiment: Check news articles and analyst reports to gauge investor sentiment.

- Company Performance: Evaluate the company’s financial health and growth prospects.

Tax Implications

Another important aspect of the ex-dividend date is its tax implications. Depending on your jurisdiction, dividends might be taxed differently than capital gains. For instance, in the U.S., qualified dividends are taxed at a lower rate than ordinary income, while non-qualified dividends are taxed at the higher rate.

If you sell on the ex-dividend date, you might trigger a capital gain or loss, depending on your purchase price. It’s always a good idea to consult with a tax professional to understand the implications of your trades.

How to Minimize Tax Liability

Here are a few tips to help you minimize your tax liability when selling on the ex-dividend date:

- Hold for the Long Term: If you’ve held the stock for more than a year, you’ll qualify for long-term capital gains tax rates.

- Use Tax-Advantaged Accounts: Consider using IRAs or other tax-advantaged accounts to shelter your gains.

- Harvest Losses: If you have losing stocks, you can sell them to offset your gains and reduce your tax bill.

Strategies for Investors

Now that you understand the mechanics of the ex-dividend date, let’s talk about some strategies you can use to maximize your returns. Whether you’re a dividend-focused investor or a short-term trader, there’s a strategy that can work for you.

Dividend Capture Strategy

The dividend capture strategy involves buying a stock just before the ex-dividend date and selling it shortly after the dividend is paid out. The idea is to capture the dividend without holding the stock for an extended period. While this strategy can be profitable, it comes with risks, such as price volatility and tax implications.

Long-Term Buy-and-Hold

If you’re a long-term investor, you might prefer the buy-and-hold strategy. This involves purchasing stocks that pay consistent dividends and holding them for years. The beauty of this strategy is that you benefit from both dividend income and potential price appreciation.

Common Mistakes to Avoid

As with any investment strategy, there are common mistakes that can trip you up. Here are a few to watch out for:

- Ignoring the Ex-Dividend Date: Failing to understand the ex-dividend date can cost you dividends or lead to unexpected price drops.

- Overtrading: Buying and selling too frequently can result in higher transaction costs and tax liabilities.

- Chasing Dividends: Buying a stock solely for its dividend can be risky if the company’s fundamentals are weak.

Real-World Examples

To help you better understand the concept, let’s look at a couple of real-world examples:

Example 1: Apple Inc.

Apple Inc. recently declared a quarterly dividend of $0.23 per share. The ex-dividend date was set for February 10th, with a payment date of February 16th. Investors who owned the stock before February 10th received the dividend, while those who bought on or after this date did not.

Example 2: Johnson & Johnson

Johnson & Johnson, a dividend aristocrat, pays a quarterly dividend of $1.01 per share. The ex-dividend date for their latest payout was January 10th, with a payment date of January 25th. Long-term investors who held the stock throughout this period benefited from both the dividend and potential price appreciation.

Frequently Asked Questions

Q: Can you sell on the ex-dividend date and still get the dividend?

No, if you sell on the ex-dividend date, you won’t be eligible for the dividend. The new owner of the shares will receive the payout instead.

Q: What happens if I buy on the ex-dividend date?

If you buy on the ex-dividend date, you won’t be eligible for the upcoming dividend. The seller of the shares will receive the payout instead.

Q: How do I know the ex-dividend date for a stock?

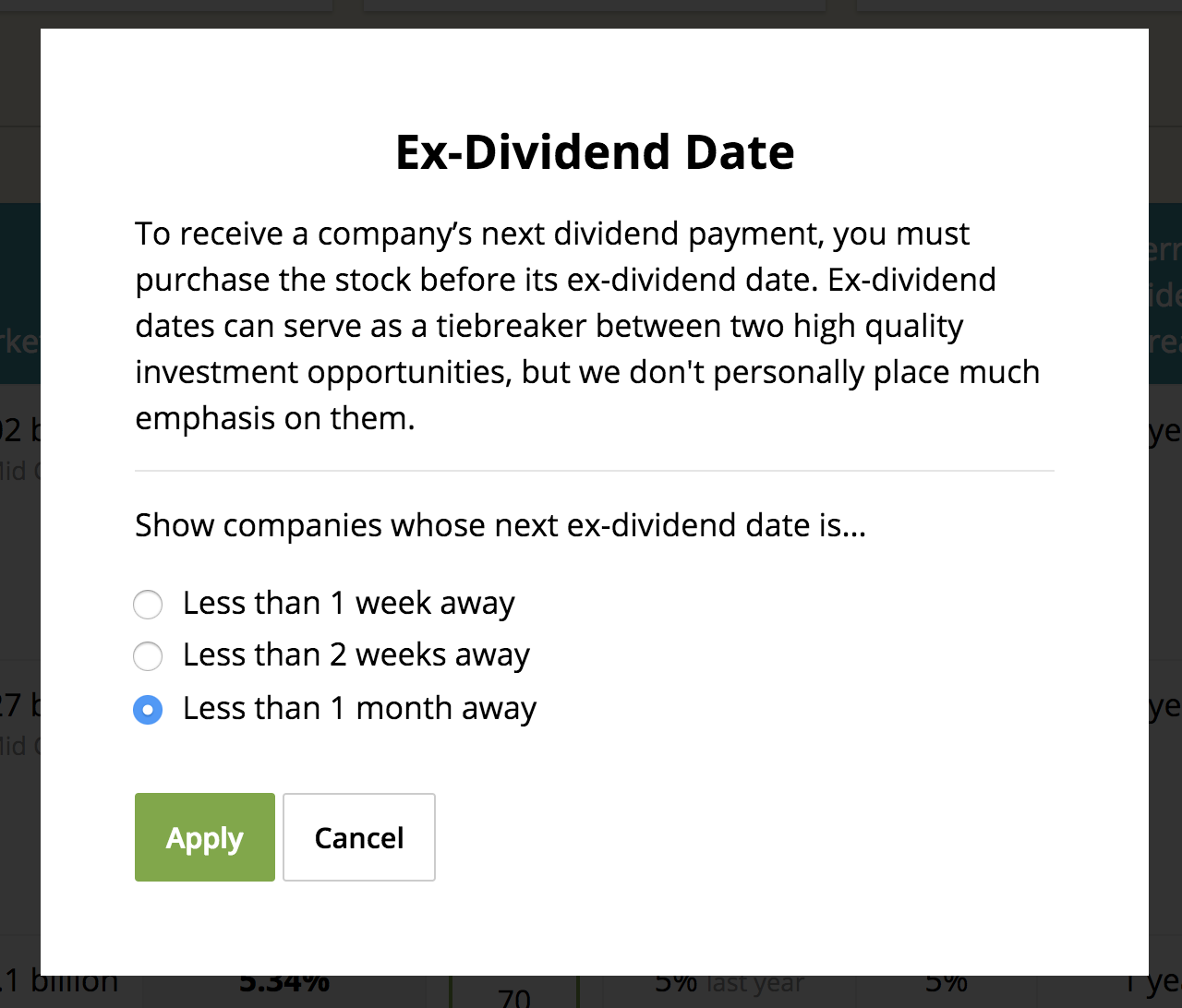

You can find the ex-dividend date on the company’s investor relations website or through your brokerage platform. Most financial news websites also provide this information.

Conclusion

So, can you sell on the ex-dividend date? Absolutely,

- Sundra Blustleaks The Untold Story Behind The Viral Sensation

- Edward Sharpe And The Magnetic Zeros Jade Drugs Unveiled

ExDividend Date EExample and Importance of ExDividend Date

Iep Ex Dividend Date 2025 Layla Ruby

Vlo Ex Dividend Date 2025 Sana Calvin