Boost Your Stock IQ: The Ultimate Guide To Mastering The Stock Market

Let’s be real here—stock IQ is more than just a buzzword; it’s your golden ticket to navigating the wild world of investing. Whether you’re a rookie just dipping your toes into the stock market or a seasoned pro looking to sharpen your skills, understanding stock IQ can make all the difference. It’s not just about knowing which stocks to buy; it’s about building a mindset that helps you make smarter decisions, avoid costly mistakes, and grow your wealth over time.

Imagine this: you’re standing at the edge of a bustling marketplace, surrounded by noise, uncertainty, and opportunities. The stock market is no different. But with the right stock IQ, you can cut through the chaos and focus on what truly matters. It’s like having a map in your pocket as you navigate uncharted territory. And who doesn’t love a good map, right?

Now, before we dive headfirst into the nitty-gritty of stock IQ, let me ask you something—are you ready to take control of your financial future? Because this isn’t just another article filled with fluff. We’re going deep, breaking down complex concepts into bite-sized pieces, and giving you actionable insights that you can start using today. So, buckle up and let’s get started!

- Nikita Kinka Rising Star In The Spotlight

- Hdhub4uearth Your Ultimate Destination For Highquality Entertainment

What Exactly is Stock IQ?

First things first—what the heck is stock IQ? Think of it as your brainpower when it comes to understanding and analyzing the stock market. It’s not just about knowing how to read stock charts or crunch numbers; it’s about developing a holistic approach to investing. Your stock IQ determines how well you can assess risk, identify trends, and make informed decisions under pressure.

In simple terms, stock IQ is the combination of knowledge, experience, and intuition that helps you thrive in the stock market. And the good news? It’s not something you’re born with—it’s something you can build over time with practice, patience, and a little bit of curiosity.

Why Stock IQ Matters More Than Ever

Here’s the deal: the stock market is evolving faster than ever before. With the rise of fintech apps, AI-driven trading platforms, and a 24/7 news cycle, staying ahead of the curve has become more challenging—and more important—than ever. That’s where stock IQ comes in.

- Cheryl Casone Partner Unveiling The Dynamic Duo Behind Success

- Penelope Menchaca Onlyfans Your Ultimate Guide To Her Content Journey And Success

Having a high stock IQ means you’re not just reacting to market trends; you’re anticipating them. It means you’re not blindly following the herd; you’re making calculated moves based on data, analysis, and logic. In short, stock IQ gives you the edge you need to succeed in a world where everyone’s trying to outsmart everyone else.

How to Measure Your Stock IQ

So, how do you know if your stock IQ is up to par? Here are a few signs to look out for:

- You understand the difference between short-term trading and long-term investing.

- You can read financial statements and interpret key metrics like P/E ratios and dividend yields.

- You have a solid understanding of market trends, economic indicators, and global events that impact stocks.

- You’re comfortable using tools like stock screeners, charting software, and financial news platforms.

- You’ve developed a clear investment strategy and stick to it, even when the market gets volatile.

If you’re nodding along to most of these points, congrats—you’re already on the right track. But if you’re feeling a little unsure, don’t worry. We’ll cover all of this (and more) in the sections ahead.

Building Your Stock IQ: Where to Start

Building your stock IQ doesn’t have to be overwhelming. In fact, it can be fun—seriously! Here’s a step-by-step guide to get you started:

1. Educate Yourself

The first step to boosting your stock IQ is to become a sponge for knowledge. Read books, watch videos, listen to podcasts—whatever works for you. Some of my personal favorites include:

- The Intelligent Investor by Benjamin Graham

- Common Sense on Mutual Funds by John C. Bogle

- A Random Walk Down Wall Street by Burton G. Malkiel

And if you’re into podcasts, check out Invest Like the Best or The Investors Podcast. Trust me, your brain will thank you later.

2. Practice Makes Perfect

Nothing beats hands-on experience when it comes to building stock IQ. Start small by investing in a few stocks or ETFs that align with your goals. Use platforms like Robinhood or Webull to keep things simple and cost-effective. And don’t forget to track your progress—learning from your wins (and losses) is key to improving.

3. Stay Informed

The stock market is all about information. Stay up-to-date with the latest news and trends by following reliable sources like Bloomberg, CNBC, and The Wall Street Journal. And if you’re into tech, check out platforms like Seeking Alpha or Finviz for in-depth analysis and insights.

Common Mistakes That Kill Your Stock IQ

Let’s face it—nobody’s perfect, especially when it comes to investing. But by avoiding these common pitfalls, you can keep your stock IQ in tip-top shape:

- Emotional decision-making: Letting fear or greed drive your investment choices is a recipe for disaster. Stick to your strategy and avoid impulsive moves.

- Ignoring diversification: Putting all your eggs in one basket is risky business. Spread your investments across different asset classes to minimize risk.

- Chasing trends: Just because everyone’s talking about a particular stock doesn’t mean you should jump on the bandwagon. Do your own research and make informed decisions.

Remember, the stock market is a marathon, not a sprint. Stay patient, stay disciplined, and let your stock IQ guide you.

Tools and Resources to Boost Your Stock IQ

Now that you know what to avoid, let’s talk about the tools and resources that can help you build your stock IQ:

1. Stock Screeners

Stock screeners are your best friend when it comes to finding investment opportunities. Platforms like Finviz and Yahoo Finance offer powerful screening tools that let you filter stocks based on specific criteria like market cap, price-to-earnings ratio, and dividend yield.

2. Charting Software

If you’re into technical analysis, charting software is a must-have. Tools like TradingView and StockCharts make it easy to analyze price patterns, identify trends, and make data-driven decisions.

3. Financial News Platforms

Staying informed is crucial, and platforms like Bloomberg, CNBC, and The Wall Street Journal provide up-to-the-minute coverage of market news and events. Plus, they offer expert analysis and insights that can help you stay ahead of the curve.

Stock IQ and Risk Management

Let’s talk about risk management, because let’s be real—investing without a solid risk management strategy is like driving without a seatbelt. Your stock IQ should include a clear understanding of how much risk you’re willing to take on and how to mitigate potential losses.

Here are a few risk management tips to keep in mind:

- Set stop-loss orders to limit your downside.

- Rebalance your portfolio regularly to maintain your desired asset allocation.

- Keep an emergency fund separate from your investment accounts.

By incorporating these strategies into your investment plan, you can protect your assets and sleep better at night.

Case Studies: Real-World Examples of High Stock IQ

Talking about stock IQ is one thing, but seeing it in action is another. Let’s take a look at a few real-world examples of investors who’ve mastered the art of stock IQ:

1. Warren Buffett

Known as the Oracle of Omaha, Warren Buffett is a master of value investing. His ability to identify undervalued companies and hold onto them for the long term has made him one of the richest people in the world. Buffett’s stock IQ is rooted in his deep understanding of business fundamentals and his willingness to think long-term.

2. Cathie Wood

Cathie Wood, founder of ARK Invest, is a pioneer in the world of thematic investing. Her focus on disruptive innovation and cutting-edge technologies has earned her a reputation as one of the most forward-thinking investors of our time. Wood’s stock IQ lies in her ability to spot trends before they become mainstream.

Future Trends in Stock IQ

So, what’s on the horizon for stock IQ? As technology continues to evolve, we’re seeing new tools and platforms emerge that are changing the way we invest. Here are a few trends to watch:

- AI-driven investing: Artificial intelligence is revolutionizing the way we analyze data and make investment decisions. Expect to see more AI-powered tools in the years to come.

- Sustainable investing: Investors are increasingly prioritizing environmental, social, and governance (ESG) factors when making investment decisions. This trend is likely to continue as more people seek to align their investments with their values.

- Decentralized finance (DeFi): The rise of blockchain technology and decentralized finance is creating new opportunities for investors. While still in its early stages, DeFi has the potential to disrupt traditional financial systems.

As these trends unfold, staying ahead of the curve will require a strong stock IQ and a willingness to adapt to change.

Conclusion: Take Your Stock IQ to the Next Level

And there you have it—the ultimate guide to boosting your stock IQ. From understanding the basics to mastering advanced strategies, the key to success lies in building a strong foundation of knowledge and experience. Remember, investing is a journey, not a destination. Keep learning, stay disciplined, and most importantly, have fun!

So, what’s next? Leave a comment below and let me know what you think. Share this article with your friends and family, and don’t forget to check out our other articles for more insights and tips. Your financial future is in your hands—now it’s time to take control!

Table of Contents

- What Exactly is Stock IQ?

- Why Stock IQ Matters More Than Ever

- How to Measure Your Stock IQ

- Building Your Stock IQ: Where to Start

- Common Mistakes That Kill Your Stock IQ

- Tools and Resources to Boost Your Stock IQ

- Stock IQ and Risk Management

- Case Studies: Real-World Examples of High Stock IQ

- Future Trends in Stock IQ

- Conclusion: Take Your Stock IQ to the Next Level

- Sandra Blust Erome Unveiling The Sensation Behind The Spotlight

- Kyla Yesenosky Nude The Truth Behind The Clickbait And Sensationalism

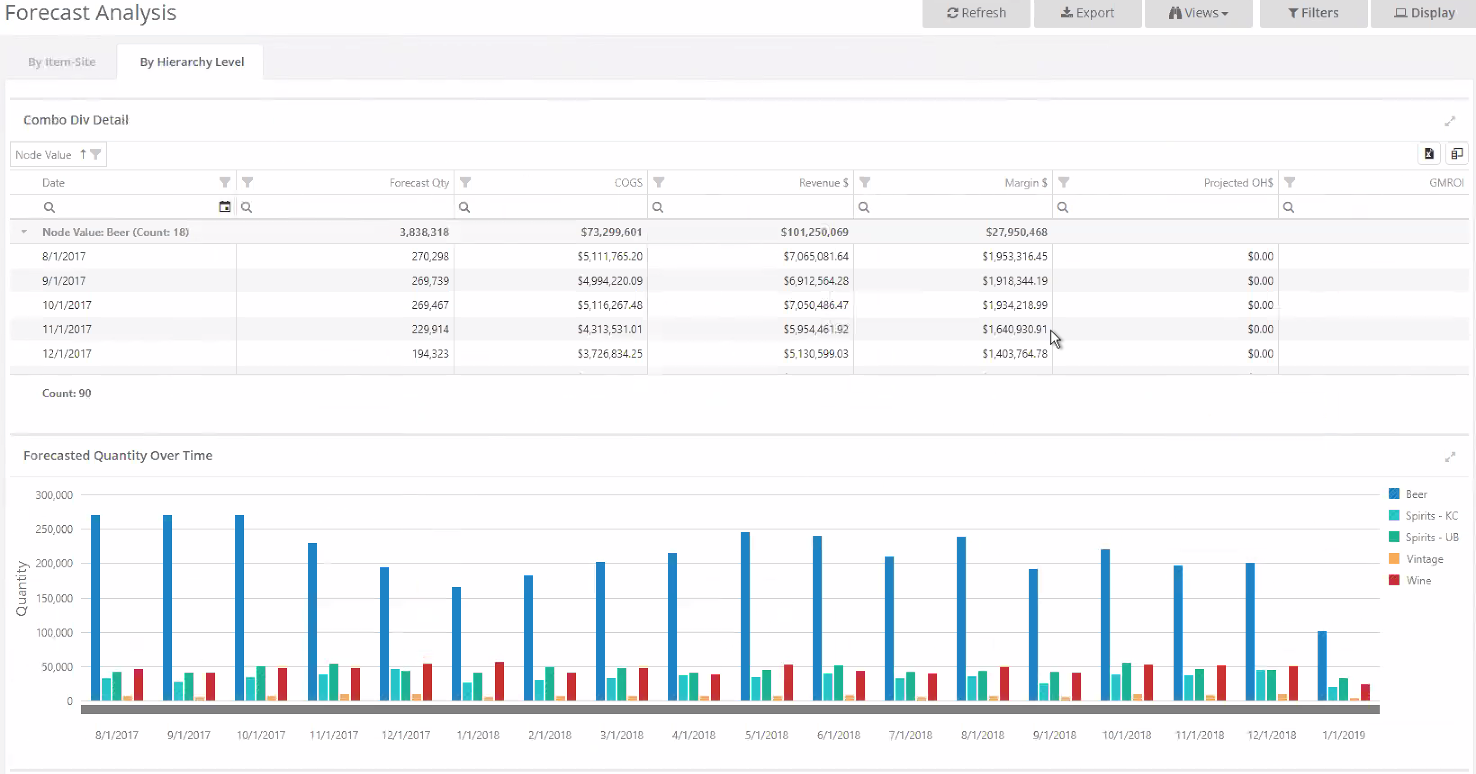

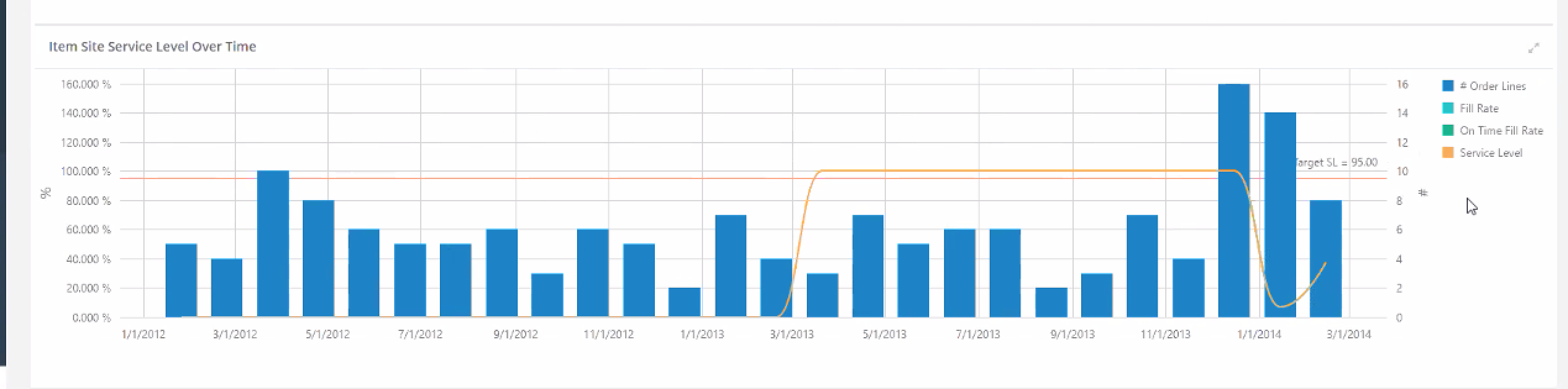

StockIQ Software Reviews, Demo & Pricing 2024

StockIQ Software Reviews, Demo & Pricing 2024

Iq eq intelligence Images, Stock Photos & Vectors Shutterstock