Chase Mortgage Loan Statement: A Comprehensive Guide To Understanding Your Financials

Let’s face it, folks—owning a home is one of life’s biggest milestones. But with that dream comes the reality of mortgage payments, and understanding your Chase mortgage loan statement can feel like deciphering a cryptic code. If you’ve ever scratched your head wondering what all those numbers mean or how to make sense of your statement, you’re not alone. In this guide, we’re breaking it down step by step so you can take control of your finances and feel confident about your mortgage journey.

Buying a house is exciting, sure, but it’s also a financial commitment that requires attention to detail. Your Chase mortgage loan statement is more than just a piece of paper—or a digital file—it’s your roadmap to understanding how much you owe, how much you’ve paid, and where your money is going. Ignoring it won’t make it go away, trust me.

Now, before we dive deep into the nitty-gritty of your Chase mortgage loan statement, let’s address the elephant in the room: why should you even care? The answer is simple—knowledge is power. Knowing what’s on your statement can help you avoid costly mistakes, plan for the future, and make smarter financial decisions. So buckle up, because we’re about to demystify the world of mortgage statements!

- Jailyne Ojeda Nude Unveiling The Truth Behind The Controversy

- Astrella Onlyfans The Ultimate Guide To Her Content Stats And More

What Is a Chase Mortgage Loan Statement?

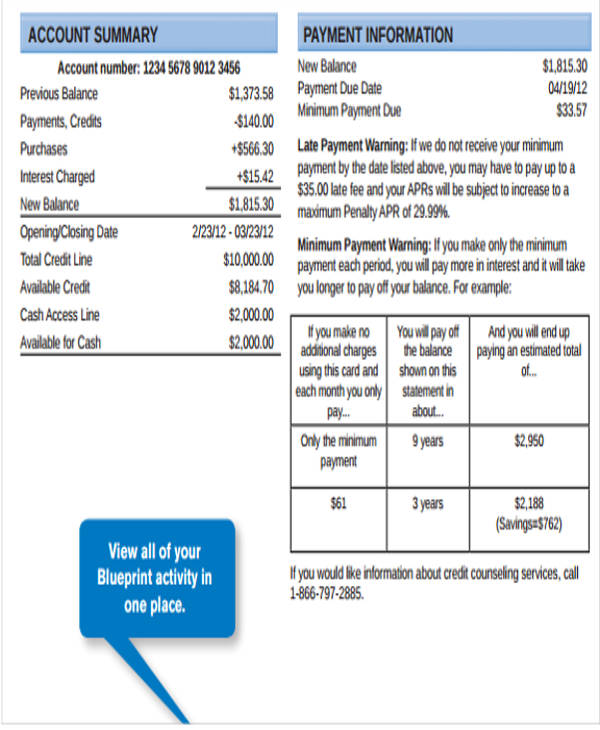

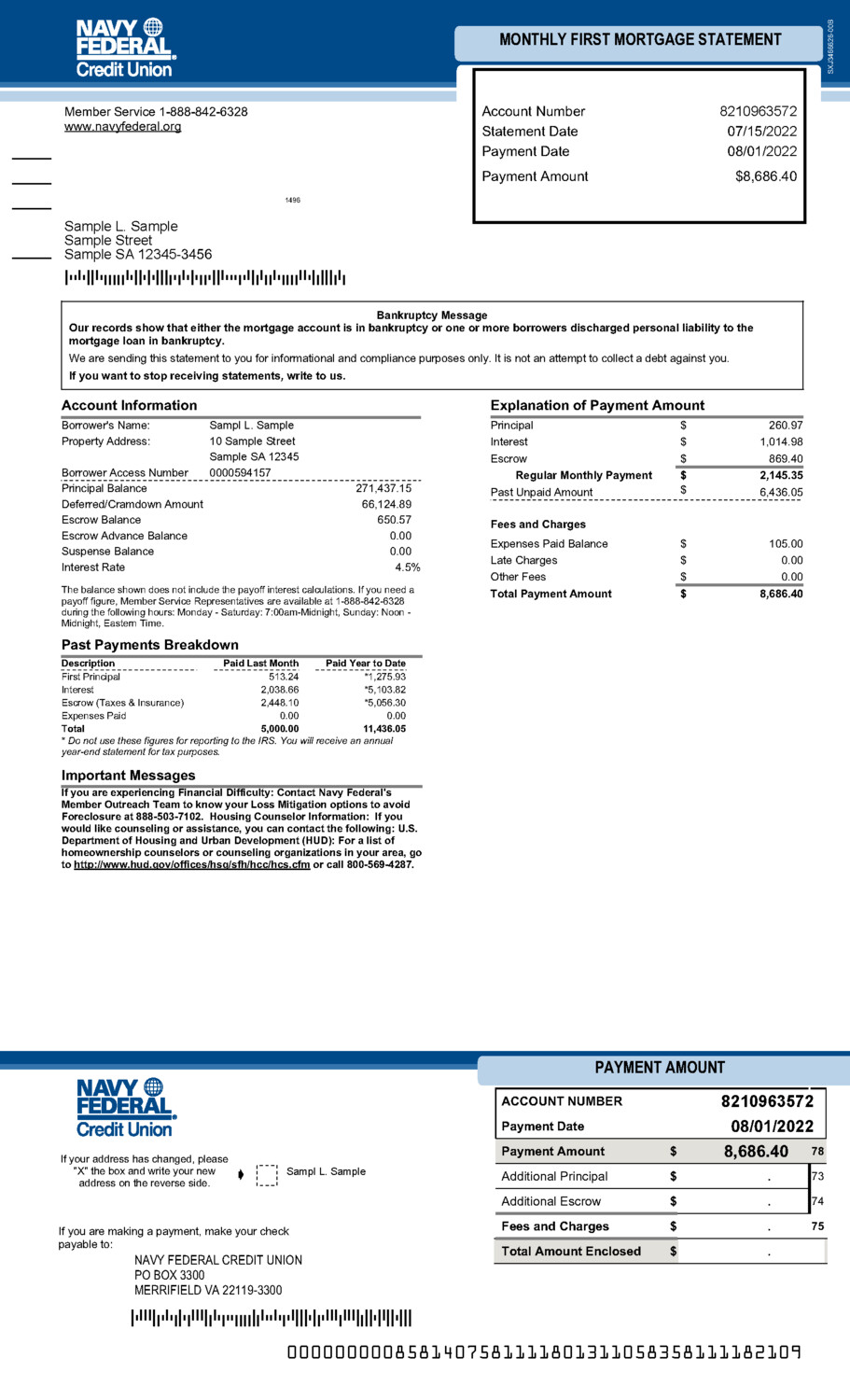

A Chase mortgage loan statement is essentially a monthly or quarterly summary of your mortgage account. Think of it as a financial snapshot that shows you the current status of your loan, including your payment history, outstanding balance, and any additional fees or charges. It’s like a report card for your mortgage, except instead of grades, you’re dealing with dollars and cents.

Here’s the deal: your statement isn’t just a bunch of random numbers. It’s packed with important details that can affect your financial health. For example, it tells you how much of your payment goes toward principal (the actual loan amount) versus interest (the cost of borrowing). It also shows you if you’re on track to pay off your loan on time—or if you’re falling behind.

Understanding your Chase mortgage loan statement is crucial because it helps you stay informed and in control. Whether you’re a first-time homeowner or a seasoned property owner, this document is your key to managing your mortgage effectively.

- Zulma Aponte Shimkus A Rising Star In The Spotlight

- Mila Ruby Onlyfans The Untold Story You Need To Know

Key Components of Your Chase Mortgage Loan Statement

Let’s break it down further. Your Chase mortgage loan statement typically includes several key components:

- Loan Balance: This is the total amount you still owe on your mortgage. It’s the number that matters most when you’re thinking about paying off your loan early or refinancing.

- Payment Due: This is the amount you’re required to pay each month to stay current on your mortgage. Missing a payment can lead to late fees and damage your credit score, so mark this date in your calendar!

- Principal and Interest: Your payment is divided into two main parts—principal (the portion that reduces your loan balance) and interest (the cost of borrowing). Over time, more of your payment goes toward principal, which is great news for your wallet.

- Escrow Account: If you have an escrow account, it’s used to pay property taxes and homeowners insurance. Your statement will show how much is being collected for these expenses and whether there’s a surplus or shortage in your account.

These components might seem overwhelming at first, but once you get the hang of them, they’ll become second nature. And don’t worry—we’ll explain each one in more detail later on.

How to Read Your Chase Mortgage Loan Statement

Reading your Chase mortgage loan statement doesn’t have to be a headache. With a little practice, you’ll be able to navigate it like a pro. Here’s how to get started:

First, locate the most important sections of your statement. Start with the loan balance—this tells you how much you owe overall. Then, check your payment due date and amount to ensure you’re on track. Next, review the breakdown of your payment to see how much is going toward principal versus interest. Finally, take a look at your escrow account to confirm that everything’s in order.

Here’s a tip: if you notice anything unusual, such as unexpected fees or discrepancies, don’t hesitate to contact Chase customer service. It’s better to address issues early than to let them snowball into bigger problems.

Tips for Interpreting Your Statement

Interpreting your Chase mortgage loan statement can be easier with these tips:

- Keep a record of your payments to compare with your statement.

- Pay attention to changes in your escrow account, especially if property taxes or insurance premiums increase.

- Look for any adjustments to your interest rate if you have an adjustable-rate mortgage (ARM).

- Check for late fees or penalties that could impact your credit score.

By staying vigilant and informed, you’ll be able to spot potential issues before they become major headaches.

Why Understanding Your Chase Mortgage Loan Statement Matters

Now, you might be wondering, “Why does all this matter?” The truth is, understanding your Chase mortgage loan statement can have a huge impact on your financial well-being. Here’s why:

First, it helps you avoid surprises. If you know exactly what you owe and when payments are due, you’re less likely to miss a payment or incur unnecessary fees. Second, it empowers you to make smarter financial decisions. For example, if you see that a large portion of your payment is going toward interest, you might consider refinancing to a lower rate. Finally, it gives you peace of mind. Knowing that you’re on top of your mortgage payments can reduce stress and help you focus on other important aspects of your life.

The Impact of Ignoring Your Statement

On the flip side, ignoring your Chase mortgage loan statement can lead to serious consequences. Missed payments can result in late fees, damage your credit score, and even put your home at risk of foreclosure. Additionally, failing to monitor your escrow account could leave you short when property taxes or insurance premiums are due.

So, the bottom line is this: don’t neglect your statement. Treat it like the valuable tool it is and use it to your advantage.

Common Questions About Chase Mortgage Loan Statements

Let’s tackle some of the most common questions people have about Chase mortgage loan statements:

Q: How often do I receive my statement?

A: Chase typically sends out mortgage loan statements monthly or quarterly, depending on your account settings. You can also access your statement online anytime through your Chase account.

Q: What happens if I miss a payment?

A: Missing a payment can result in late fees and negatively affect your credit score. If you’re struggling to make your payments, contact Chase immediately to discuss options like forbearance or loan modification.

Q: Can I pay extra toward my principal?

A: Absolutely! Paying extra toward your principal can reduce your loan balance faster and save you money on interest over time. Just make sure to specify that the extra payment should go toward principal when you make it.

Q: What if I notice an error on my statement?

A: If you spot an error, don’t panic. Contact Chase customer service right away to report the issue. They’ll work with you to resolve the problem and correct your statement.

Managing Your Chase Mortgage Loan Statement Effectively

Managing your Chase mortgage loan statement doesn’t have to be a chore. With the right strategies, you can stay on top of your finances and make the most of your mortgage. Here’s how:

Start by setting up automatic payments to ensure you never miss a due date. This not only saves you time but also helps you avoid late fees. Next, consider creating a budget that includes your mortgage payment so you can plan for it each month. Finally, review your statement regularly to catch any errors or changes early on.

Tools and Resources to Help You

Chase offers several tools and resources to help you manage your mortgage loan statement more effectively:

- Online banking: Access your statement and account information anytime, anywhere.

- Mobile app: Stay connected to your mortgage account on the go.

- Customer support: Reach out to Chase’s knowledgeable team for assistance with any questions or concerns.

Take advantage of these resources to streamline your mortgage management and make your life easier.

Strategies for Paying Off Your Chase Mortgage Faster

Paying off your Chase mortgage faster can save you thousands in interest and give you peace of mind. Here are some strategies to consider:

One approach is to make bi-weekly payments instead of monthly payments. This results in one extra payment per year, which can significantly reduce your loan term. Another option is to apply windfalls, such as tax refunds or bonuses, toward your principal. Lastly, consider refinancing to a lower interest rate if it makes financial sense for you.

Benefits of Paying Off Your Mortgage Early

Paying off your mortgage early has several benefits:

- Reduced interest costs over the life of the loan.

- Increased equity in your home.

- Improved financial freedom and security.

While it might require some sacrifices in the short term, the long-term rewards are well worth it.

Final Thoughts: Take Control of Your Mortgage

In conclusion, understanding your Chase mortgage loan statement is essential for managing your finances and achieving your homeownership goals. By staying informed, proactive, and strategic, you can make the most of your mortgage and build a solid financial foundation for the future.

So, what’s next? Start by reviewing your statement regularly and familiarizing yourself with its components. Then, explore ways to optimize your payments and pay off your mortgage faster. And don’t forget to reach out to Chase if you have any questions or need assistance.

Remember, your mortgage is a significant part of your financial life, but it doesn’t have to control you. Take charge, stay informed, and watch your dreams of homeownership turn into reality.

Got questions or comments? Drop them below, and let’s chat! And while you’re at it, why not share this guide with a friend who could benefit from it? Together, we can all become mortgage masters!

Table of Contents

- What Is a Chase Mortgage Loan Statement?

- Key Components of Your Chase Mortgage Loan Statement

- How to Read Your Chase Mortgage Loan Statement

- Why Understanding Your Chase Mortgage Loan Statement Matters

- Common Questions About Chase Mortgage Loan Statements

- Managing Your Chase Mortgage Loan Statement Effectively

- Strategies for Paying Off Your Chase Mortgage Faster

- Final Thoughts: Take Control of Your Mortgage

- Pierre Poilievre Height And Weight A Closer Look At The Canadian Politician

- Aaron Pierre Wife Jessica Hardwick Love Journey And Everything Inbetween

Free Mortgage Loan Statement Templates For Google Sheets And Microsoft

9+ Chase Bank Statement Templates

Utility Bill Editable Template ConEdison Documentplug